- United States

- /

- Banks

- /

- NYSE:FBP

Is Rising Revenue Guidance Shifting Long-Term Risk and Reward for First BanCorp (FBP)?

Reviewed by Sasha Jovanovic

- First BanCorp, the Puerto Rican financial institution, recently reported its latest quarterly earnings, with analysts forecasting a 7.4% year-on-year revenue increase following a 2% rise last year.

- Market attention has intensified given the company's uneven track record with Wall Street revenue estimates and mixed performance among other regional banks.

- We'll explore how heightened expectations for revenue growth could influence First BanCorp's long-term investment outlook and risk profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

First BanCorp Investment Narrative Recap

To be a shareholder in First BanCorp, you need confidence in Puerto Rico’s economic recovery driving commercial loan growth, alongside effective execution on digital transformation. The recent quarterly earnings forecast suggests continued momentum in revenue generation, which could bolster investor sentiment in the short term. However, the company's history of missing analyst revenue targets and the ongoing challenge of geographic concentration remain the biggest risks, and this news does not materially impact those underlying concerns.

Among recent announcements, the company’s ongoing share repurchase program stands out. Since April, First BanCorp has bought back over 2.6 million shares, reinforcing its focus on capital returns while potentially enhancing earnings per share, a relevant move as the company looks to sustain investor interest amid heightened expectations for revenue growth.

Yet, despite strong buybacks, investors should be aware that heavy reliance on Puerto Rico’s local economy remains a key risk if...

Read the full narrative on First BanCorp (it's free!)

First BanCorp's narrative projects $1.2 billion revenue and $349.9 million earnings by 2028. This requires 10.2% yearly revenue growth and a $43.2 million earnings increase from $306.7 million today.

Uncover how First BanCorp's forecasts yield a $25.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

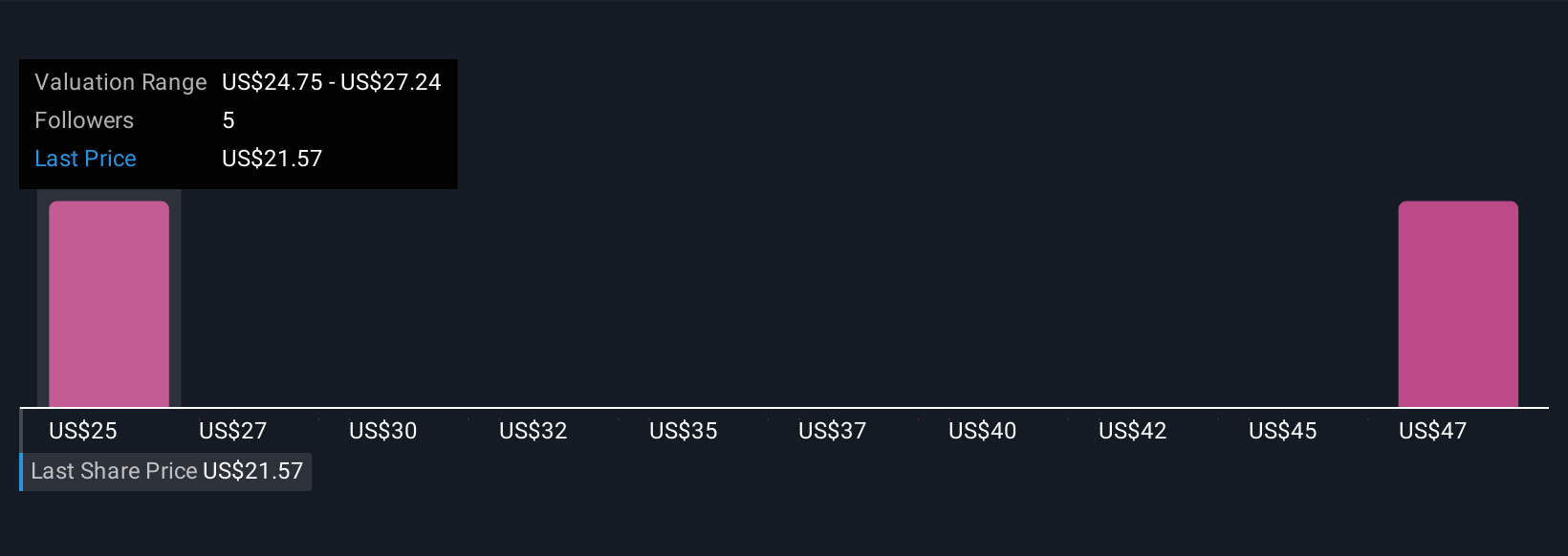

Fair value estimates from three Simply Wall St Community members range widely from US$24.75 to US$49.33. With revenue growth relying on Puerto Rico’s recovery, these views show how market participants can see the company’s outlook quite differently, consider checking several opinions before deciding where you stand.

Explore 3 other fair value estimates on First BanCorp - why the stock might be worth over 2x more than the current price!

Build Your Own First BanCorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First BanCorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First BanCorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First BanCorp's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBP

First BanCorp

Operates as the bank holding company for FirstBank Puerto Rico that provides financial products and services to consumers and commercial customers.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives