- United States

- /

- Banks

- /

- NYSE:FBP

First BanCorp (FBP) Profit Margin Decline Tests Bullish Value Narrative

Reviewed by Simply Wall St

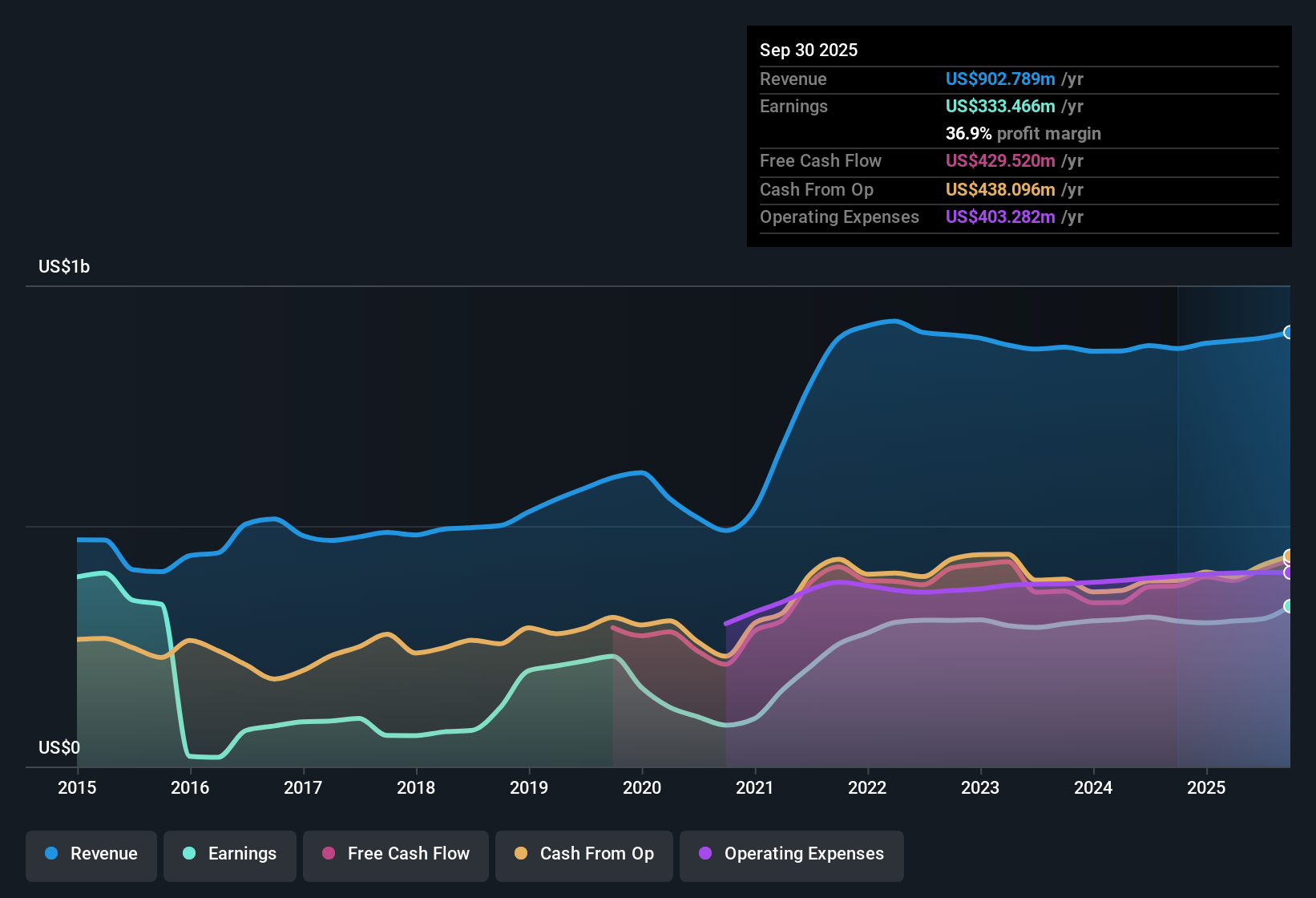

First BanCorp (FBP) reported average annual earnings growth of 13.3% over the past five years, though the latest results reveal net profit margins have slipped to 34.4% from last year’s 35.5%. EPS and revenue are forecast to grow at 4.4% and 4.9% per year, but those rates trail expectations for the broader US market. While investors have enjoyed favorable value signals and consistently high earnings quality, the recent pause in earnings momentum and a slight margin dip add a note of caution to the otherwise solid long-term story.

See our full analysis for First BanCorp.With the headline numbers in focus, the next section will examine how First BanCorp’s results align with the dominant narratives shaping the stock’s outlook. This analysis will highlight which stories remain valid and which may require further consideration.

See what the community is saying about First BanCorp

Share Price Trades at 21% Discount to Consensus Target

- With a current share price of $19.98, First BanCorp trades roughly 21% below the analyst consensus target of $25.33. This suggests the market is less optimistic than the average Wall Street estimate.

- Analysts' consensus view sees steady improvement in core banking operations but warns that projected profit margins could shrink from 34.4% today to 29.3% in three years.

- The forecast for annual revenue growth of 10.2% over the next three years supports an upside case for the price target.

- This optimism is checked by expectations that, to reach the target, First BanCorp must lift its price-to-earnings multiple from 10.4x to 13.0x, a premium to the US banks industry average, which is currently 11.9x.

Profit Margins Remain High, but Future Compression Expected

- Current net profit margins stand at a strong 34.4%, although projections indicate these could decline to 29.3% by 2028 as modeled by analysts.

- Analysts' consensus view highlights that while robust loan growth and reinvestment strategies are boosting earnings today, heavy reliance on limited markets and rising regulatory costs may erode profits in future years.

- This warning draws on the fact that limited geographic diversification could leave First BanCorp exposed to localized economic shocks or regulatory changes.

- Mounting technology investments and regulatory compliance requirements are expected to strain efficiency and put further pressure on margins if digital adoption lags larger competitors.

Strong Value Signals vs. Subdued Growth Outlook

- The company’s price-to-earnings ratio of 10.4x is appealing compared with both its US banks industry peer average of 11.9x and analysts’ consensus target. This reinforces First BanCorp’s undervalued look on paper.

- Analysts' consensus view suggests that while favorable valuation and quality metrics are a clear positive, slower expected growth and margin compression provide a natural ceiling for upside unless underlying trends improve.

- The decline in expected profit margins is a key headwind, with analysts modeling earnings rising from $306.7 million today to $349.9 million by 2028, but at a slower pace than peers.

- Consensus positions First BanCorp as a solid value candidate as long as investors are comfortable with slower near-term growth and the regional risks that come with it.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First BanCorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on the numbers? Put your perspective into action and share your narrative in just minutes. Do it your way

A great starting point for your First BanCorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite First BanCorp’s appealing valuation, the company faces a subdued growth outlook with expected margin compression. Its earnings increases also trail behind industry peers.

If you want to focus on companies that consistently deliver reliable results across market cycles, use our stable growth stocks screener (2090 results) to find those with steadier revenue and earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBP

First BanCorp

Operates as the bank holding company for FirstBank Puerto Rico that provides financial products and services to consumers and commercial customers.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion