- United States

- /

- Banks

- /

- NYSE:FBP

First BanCorp (FBP) Is Up 5.2% After Fed Rate Cut Hints Boost Regional Bank Optimism – Has The Bull Case Changed?

Reviewed by Simply Wall St

- Following recent dovish remarks by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, regional bank stocks, including First BanCorp, experienced a rise in investor optimism due to indications of potential interest rate cuts and moderating inflation risks.

- This shift in monetary policy outlook has heightened attention on the banking sector’s sensitivity to interest rate expectations, underscoring how quickly central bank commentary can influence investor sentiment.

- We will explore how the Fed’s signals of possible rate cuts could shape First BanCorp’s investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

First BanCorp Investment Narrative Recap

To be a shareholder in First BanCorp, one typically needs confidence in Puerto Rico’s economic recovery and robust commercial loan demand, while remaining aware of the bank’s exposure to interest rate shifts and local economic events. The recent dovish commentary from the Federal Reserve has softened immediate concerns about prolonged high rates, making interest margin pressures less severe in the short term. While this news lifts a key headwind, geographic concentration and demographic risks remain central risks to monitor.

The completion of First BanCorp’s latest buyback tranche, with over 3.8 million shares repurchased since July 2024, highlights the bank’s ongoing capital return commitment. This action aligns with the positive momentum from favorable rate expectations, potentially supporting earnings per share and investor confidence as interest rate cuts are anticipated. The interplay between capital returns and economic factors will remain crucial for near-term performance.

However, contrasting with buoyant sentiment around rate policy, it’s important for investors to be aware of the outsized impact local economic shocks could have on...

Read the full narrative on First BanCorp (it's free!)

First BanCorp's outlook sees revenues reaching $1.2 billion and earnings rising to $349.9 million by 2028. This projection is based on annual revenue growth of 10.2% and an earnings increase of $43.2 million from the current earnings of $306.7 million.

Uncover how First BanCorp's forecasts yield a $25.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

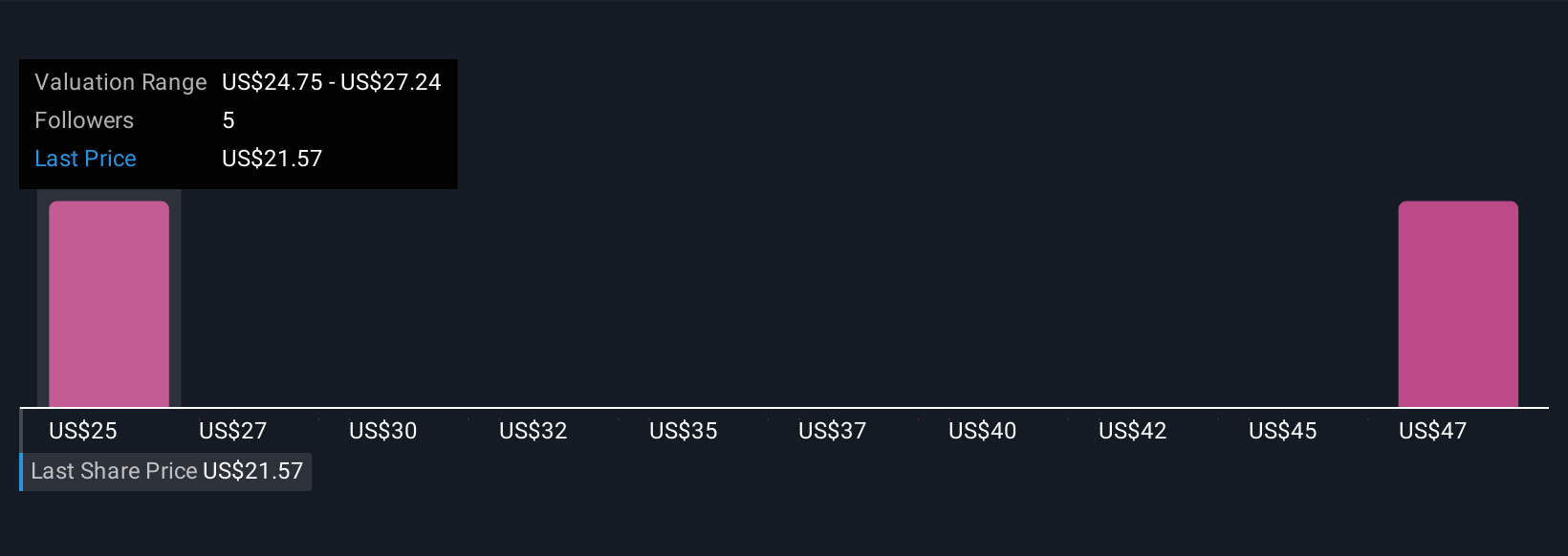

You can find two fair value estimates for First BanCorp from the Simply Wall St Community, spanning US$25.00 to US$49.64. Against this spectrum of views, heightened focus on interest rate sensitivity highlights why gauging the impact of Fed policy shifts is vital for anyone considering the stock.

Explore 2 other fair value estimates on First BanCorp - why the stock might be worth over 2x more than the current price!

Build Your Own First BanCorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First BanCorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First BanCorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First BanCorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBP

First BanCorp

Operates as the bank holding company for FirstBank Puerto Rico that provides financial products and services to consumers and commercial customers.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026