- United States

- /

- Banks

- /

- NYSE:FBP

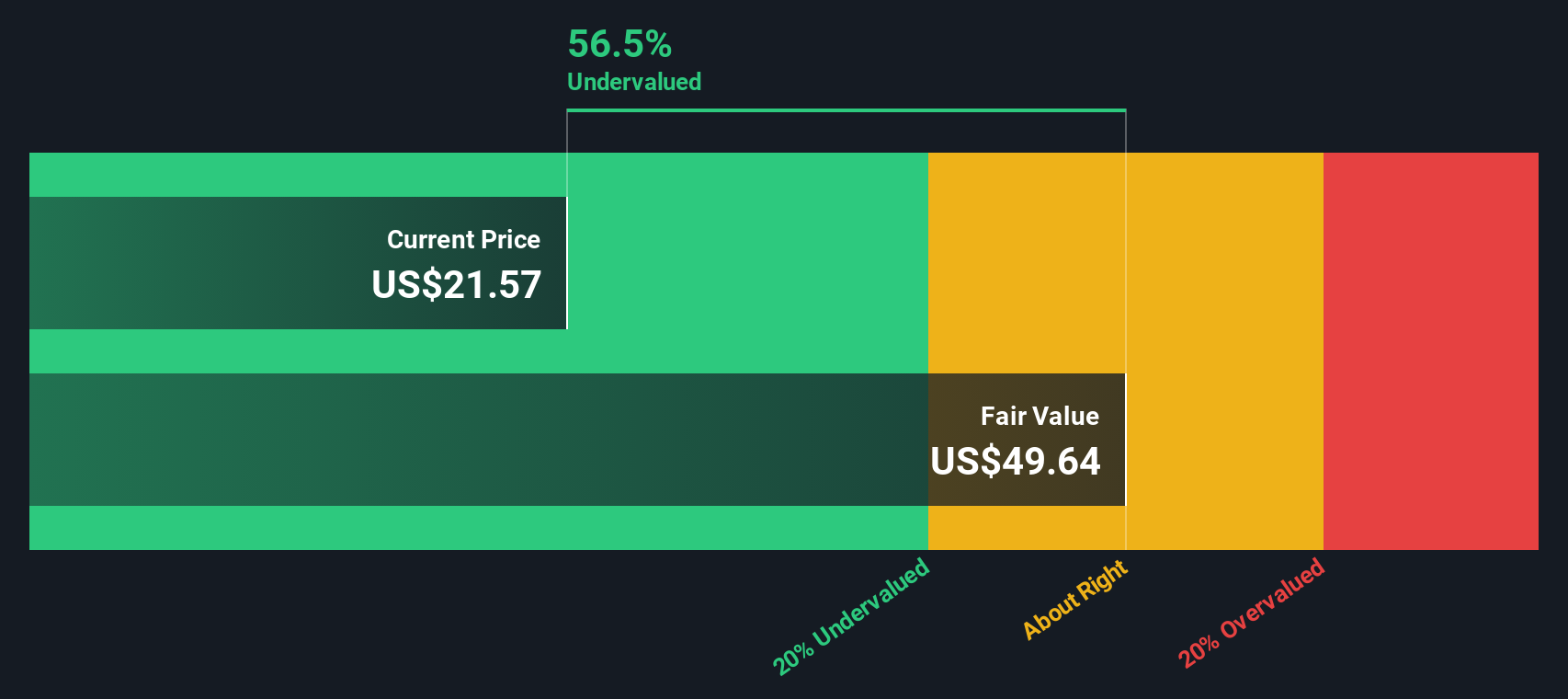

A Look at First BanCorp (FBP) Valuation After Boosting Its Dividend Yield Above Sector and S&P 500 Averages

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 11.7% Undervalued

According to the most popular narrative, First BanCorp appears to be undervalued by a significant margin based on analysts’ growth and profitability projections. This bullish view reflects optimism around the bank’s evolving fundamentals and the economic backdrop.

Favorable labor market conditions and improving consumer health are reducing credit losses, as seen in lower net charge-offs and stable or improving asset quality metrics. These trends could support more stable and higher earnings in the future.

Want to know what’s fueling this upbeat valuation? There is a surprising set of numbers analysts are banking on, especially regarding how much profit and revenue could accelerate in the coming years. Which financial levers matter most for that double-digit price target gap, and what assumptions are built into their calculations? Discover the unique growth drivers and forecast shifts powering this bold narrative.

Result: Fair Value of $25.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent demographic stagnation or a lack of geographic diversification could quickly undermine optimism. This could expose First BanCorp to more volatile returns and growth.

Find out about the key risks to this First BanCorp narrative.Another View: Discounted Cash Flow Model

Taking a step back from market multiples, the SWS DCF model offers a different perspective. This method also signals undervaluation, but it relies on future cash flow projections that can change quickly. Which approach do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First BanCorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First BanCorp Narrative

If you have a different perspective or want to dive into the details yourself, it's simple to build your own take on First BanCorp in just a few minutes. Do it your way

A great starting point for your First BanCorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't wait on just one stock when you can amplify your portfolio with other high-potential ideas. Uncover unique growth stories and targeted opportunities. All are just a click away.

- Tap into future-defining breakthroughs as you check out companies pushing the boundaries in artificial intelligence with AI penny stocks.

- Get ahead of the market by spotting resilient, undervalued stocks with solid cash flow foundations using our handpicked list of undervalued stocks based on cash flows.

- Capture income potential and stability by browsing businesses known for consistent, above-average yields through our curated collection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBP

First BanCorp

Operates as the bank holding company for FirstBank Puerto Rico that provides financial products and services to consumers and commercial customers.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives