- United States

- /

- Banks

- /

- NYSE:FBK

A Look at FB Financial’s Valuation Following New $111 Million Equity Offering

Reviewed by Simply Wall St

FB Financial (FBK) announced a follow-on equity offering of around $111 million, issuing over 2 million shares of common stock at $51.50 each. This move is drawing attention, as such offerings often signal strategic intentions for growth or balance sheet repositioning.

See our latest analysis for FB Financial.

This fresh capital raise follows FB Financial’s recent shelf registration in mid-November, reinforcing the sense that management is positioning for future growth or strategic moves. While the 1-year total shareholder return is a slight -1.7%, multi-year investors remain solidly ahead. The 3-year total return stands at 29.7% and the 5-year at 65.4%, suggesting the bank’s long-term narrative is very much intact, even as short-term momentum fluctuates.

If news like this has you thinking more broadly, consider expanding your investment radar and discover fast growing stocks with high insider ownership.

This steady performance sets the stage for a crucial question for investors: Is FB Financial currently undervalued amid its robust growth, or has the market already factored in its next chapter, leaving little room for upside?

Most Popular Narrative: 18.8% Undervalued

FB Financial’s most widely followed narrative sets its fair value far above the latest close, making $52.89 per share look like a potential bargain. The narrative emphasizes rapid growth and margin improvements as key elements.

The planned merger with Southern States Bank could boost revenue and margins through market expansion and stabilization. Strategic growth in commercial loans and hiring aims to enhance revenue, leverage, and potential EPS through efficient capital use.

Curious what assumptions deliver such a steep discount? The fair value calculation depends on significant increases in top-line growth, major profit margin gains, and a lower future earnings multiple. What’s the real story behind these bold forecasts? Tap to unpack where analysts see the biggest leaps and a few surprises hidden in the math.

Result: Fair Value of $65.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration risks from the Southern States Bank merger and ongoing pressure on net interest margins could quickly shift FB Financial’s long-term outlook.

Find out about the key risks to this FB Financial narrative.

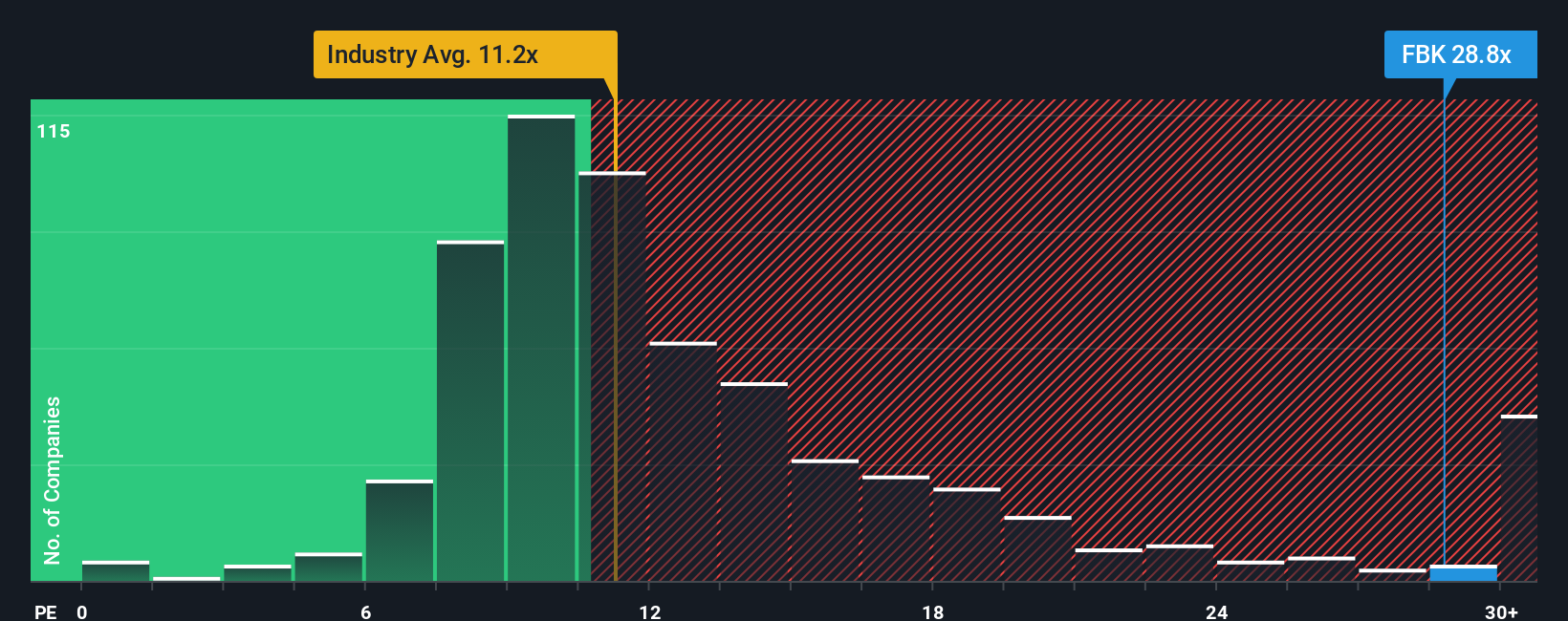

Another View: What Does the P/E Ratio Reveal?

Looking at market multiples offers a very different perspective. FB Financial currently trades at a price-to-earnings ratio of 27.3x, which is much higher than the US Banks industry average of 10.9x and a fair ratio of 19.3x. This big gap could signal that investors risk overpaying if earnings do not accelerate as fast as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FB Financial Narrative

If you see things differently or want to dig into the details yourself, you’re free to examine the numbers and build your own view in just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FB Financial.

Looking for More Compelling Investment Ideas?

Don’t miss the opportunities that could transform your portfolio. Take the next step and uncover new stocks with breakthrough potential right now.

- Capture the yield advantage by identifying income opportunities with these 18 dividend stocks with yields > 3% focused on reliable payouts above 3%.

- Tap into innovation by targeting these 27 AI penny stocks at the forefront of artificial intelligence breakthroughs reshaping entire industries.

- Strengthen your portfolio’s potential with these 906 undervalued stocks based on cash flows uniquely positioned based on their attractive cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives