- United States

- /

- Banks

- /

- NYSE:CUBI

Earnings Beat, Digital Growth and Insider Selling Might Change The Case For Investing In Customers Bancorp (CUBI)

Reviewed by Sasha Jovanovic

- In recent months, Customers Bancorp reported a year-on-year revenue increase of 38.9%, beating net interest income estimates and highlighting robust deposit and loan growth alongside improved efficiency.

- At the same time, Wall Street analysts have maintained a “Moderate Buy” consensus with no sell ratings, even as Chairman & CEO Jay Sidhu sold 128,185 shares, underscoring confidence in the bank’s digitally focused commercial and consumer banking model.

- With strong earnings and analyst optimism now on the table, we’ll examine how this earnings beat reshapes Customers Bancorp’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Customers Bancorp Investment Narrative Recap

To own Customers Bancorp, you need to believe its digital-first commercial banking model can keep converting tech-focused deposits into profitable, resilient earnings. The latest earnings beat and analyst “Moderate Buy” stance reinforce that story in the near term, while concentration in digital asset deposits and rising competition in that niche remain the most immediate risks. Insider selling by the CEO does not appear to materially alter those core drivers right now.

The recent 38.9% year-on-year revenue increase and outperformance on net interest income are most relevant here, because they speak directly to the bank’s ability to grow deposits and loans efficiently on its cubiX and digital platforms. That operating momentum supports the key short term catalyst of scaling digital payments and deposits, but it also raises the stakes if digital asset related funding were to reverse quickly.

Yet behind the strong earnings story, there is a concentration risk in digital asset deposits that investors should be aware of...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's narrative projects $977.5 million revenue and $424.9 million earnings by 2028. This requires 17.9% yearly revenue growth and a roughly $293 million earnings increase from $131.6 million today.

Uncover how Customers Bancorp's forecasts yield a $84.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

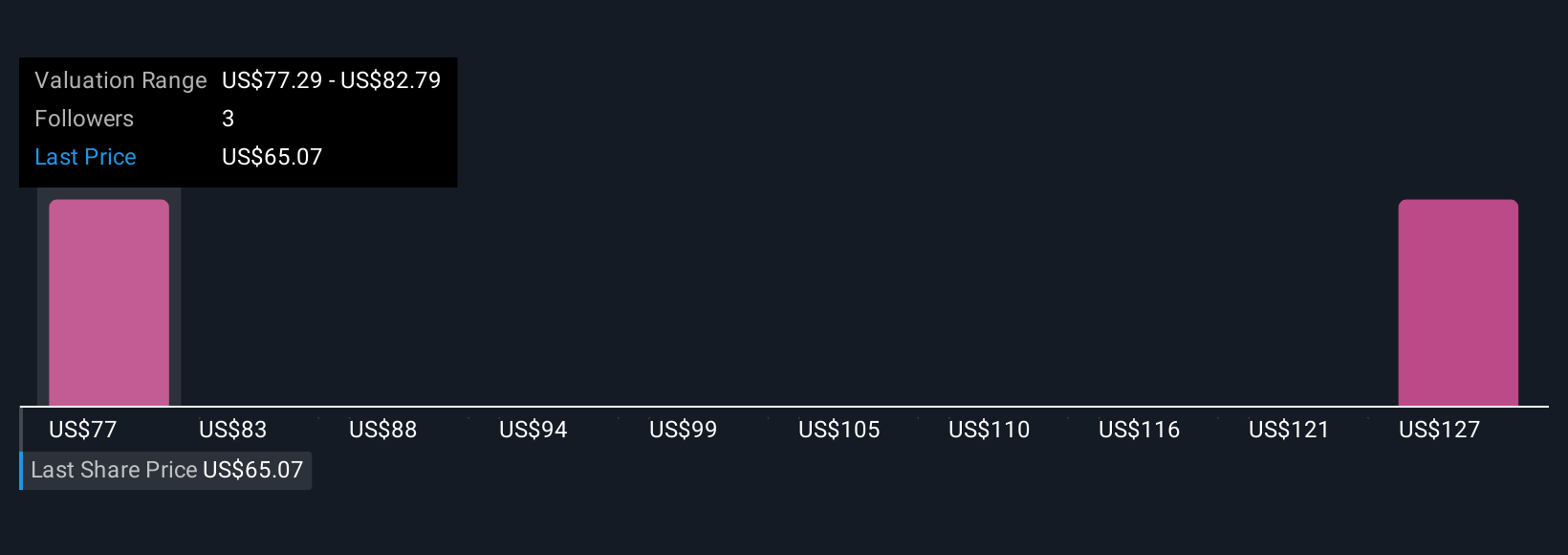

Three members of the Simply Wall St Community currently value Customers Bancorp between US$82 and about US$155.88 per share, highlighting very different expectations. As you weigh those views against the bank’s growing reliance on cubiX and digital asset related income, it is worth considering how regulatory or market shocks in that area could influence future performance and exploring several alternative viewpoints.

Explore 3 other fair value estimates on Customers Bancorp - why the stock might be worth just $82.00!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026