- United States

- /

- Banks

- /

- NYSE:CUBI

Did Reassuring Regional Bank Updates Just Shift Customers Bancorp’s (CUBI) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, reassuring commentary from regional bank leaders, including updates on loan portfolio health, has calmed earlier investor concerns about a potential credit crisis in the sector. This shift in sentiment follows a period of turmoil reminiscent of 2023, highlighting the influence of clear communication from regional banks on market confidence.

- Market analysis now suggests these credit concerns were likely isolated cases, as regional bank CEOs emphasized broadly healthy loan portfolios to ease investor jitters.

- We'll explore how renewed confidence in regional banks, driven by reassuring management updates, shapes the current investment narrative for Customers Bancorp.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Customers Bancorp Investment Narrative Recap

To be a shareholder in Customers Bancorp, you need confidence in its ability to harness digital innovation and capture deposit growth from emerging sectors, while managing the earnings volatility that comes with heavy digital asset exposure. The recent round of reassuring commentary from regional banks helps support near-term confidence in portfolio health but does not materially diminish the main risk: deposit concentration tied to digital asset markets, which can amplify the impact of shifting sector sentiment or regulatory change.

A key recent development was Customers Bancorp’s inclusion in the S&P Banks Select Industry Index, signaling elevated sector credibility and potential for increased institutional ownership. This announcement, in light of more stable investor sentiment following management reassurances, underscores the role of strong market perception as a short-term catalyst, especially as the company seeks to compete for share in high-growth digital verticals.

However, investors should also be aware that, despite the positive momentum, the concentration of digital asset-related deposits could still...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's outlook anticipates $977.5 million in revenue and $424.9 million in earnings by 2028. This is based on a projected annual revenue growth rate of 17.9% and an earnings increase of $293.3 million from current earnings of $131.6 million.

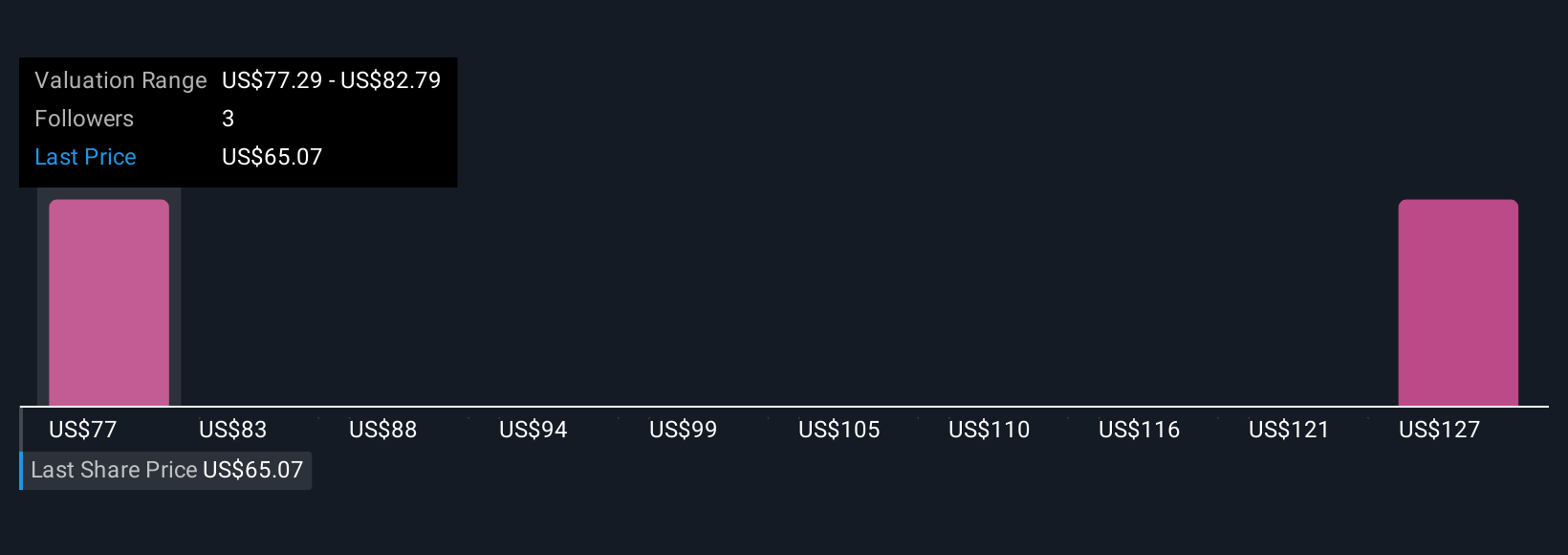

Uncover how Customers Bancorp's forecasts yield a $77.29 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared fair value estimates for Customers Bancorp ranging from US$77.29 to US$132.82, based on two distinct perspectives. With ongoing regulatory uncertainty around digital assets shaping future outcomes, consider how these varied viewpoints could reflect the very real earnings and liquidity risks faced by the company.

Explore 2 other fair value estimates on Customers Bancorp - why the stock might be worth just $77.29!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives