- United States

- /

- Banks

- /

- NYSE:COSO

3 Undiscovered Gems In The US Market With Potential

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches an all-time high amid a flurry of robust earnings reports, the broader U.S. market is experiencing a wave of optimism despite ongoing economic challenges such as the government shutdown. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially as investors look beyond well-known names to uncover hidden opportunities within the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

IBEX (IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-driven customer lifecycle experience solutions both in the United States and internationally, with a market capitalization of approximately $492.66 million.

Operations: The company generates revenue primarily through its Business Process Outsourcing segment, which accounted for $558.27 million. The financial performance includes a market capitalization of approximately $492.66 million.

IBEX, a nimble player in the Professional Services sector, shows promise with its earnings growing 34.4% annually over the past five years. Despite recent insider selling and a volatile share price, it remains debt-free, having improved from a debt-to-equity ratio of 196.8% five years ago. The company recently repurchased shares worth US$1.68 million and trades at 35.9% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. With new leadership focusing on AI solutions and expanding into government sectors, IBEX is positioning itself for future growth amidst industry challenges.

- Unlock comprehensive insights into our analysis of IBEX stock in this health report.

Assess IBEX's past performance with our detailed historical performance reports.

Diamond Hill Investment Group (DHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diamond Hill Investment Group, Inc., operating through its subsidiary Diamond Hill Capital Management, Inc., offers investment advisory and fund administration services in the United States, with a market capitalization of $373.32 million.

Operations: Diamond Hill generates revenue primarily from investment advisory and fund administration services, totaling $151.28 million.

Diamond Hill Investment Group stands out with its robust financial health, being debt-free for five years and trading at 23.3% below estimated fair value. Despite a 3.2% annual decline in earnings over the past five years, recent performance is promising with a 16.3% growth in earnings last year, surpassing industry growth of 15.2%. The company reported net income of US$15.57 million for Q2 2025, up from US$8.13 million the previous year, alongside basic earnings per share rising to US$5.73 from US$2.93 last year. Additionally, it completed a share repurchase program worth $20.52 million this year.

- Click here and access our complete health analysis report to understand the dynamics of Diamond Hill Investment Group.

Gain insights into Diamond Hill Investment Group's past trends and performance with our Past report.

CoastalSouth Bancshares (COSO)

Simply Wall St Value Rating: ★★★★★★

Overview: CoastalSouth Bancshares, Inc. is the bank holding company for Coastal States Bank, offering a range of banking products and services to retail and commercial customers, with a market cap of $250.34 million.

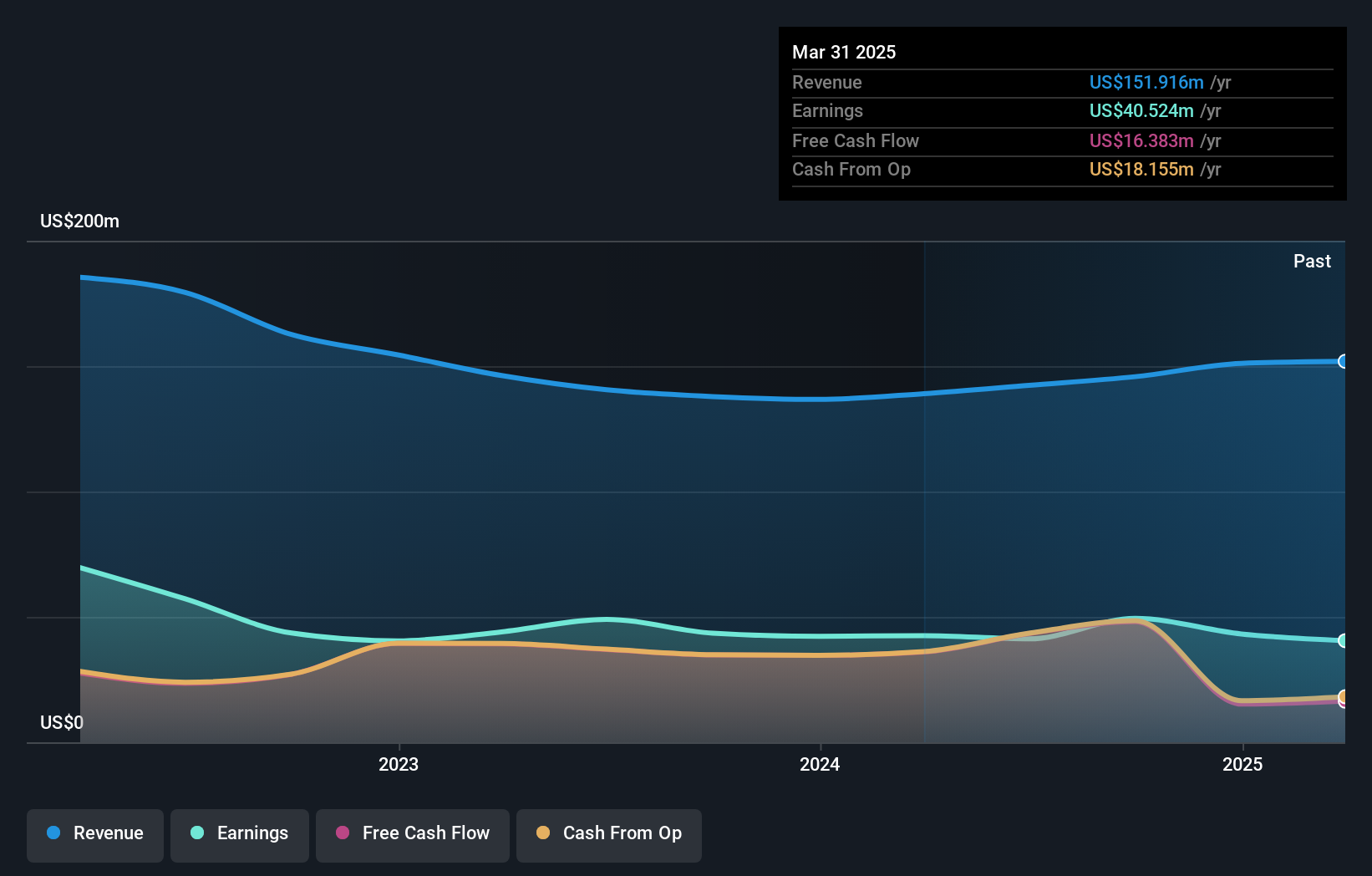

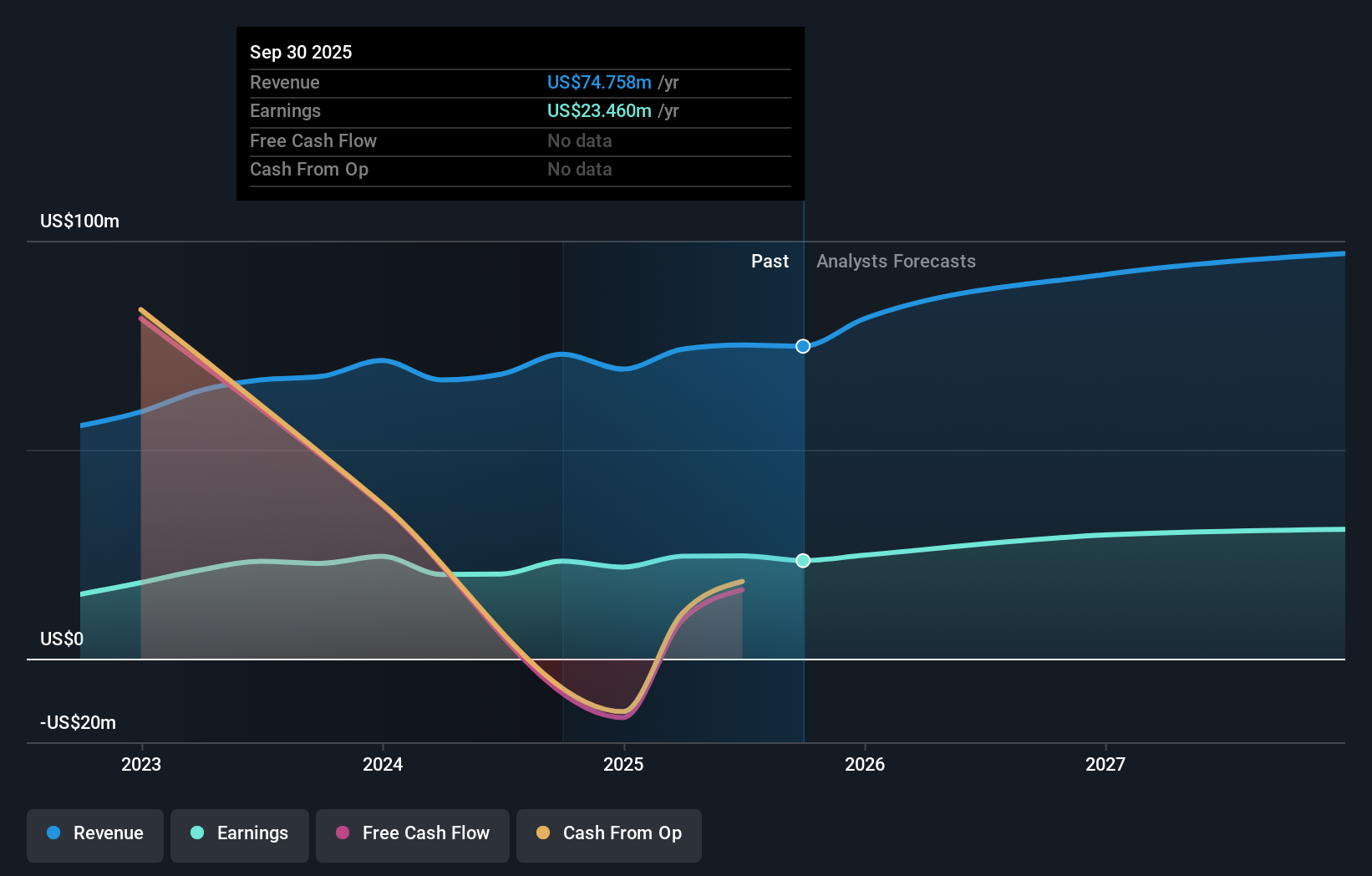

Operations: CoastalSouth Bancshares generates revenue primarily from its community banking segment, amounting to $75.07 million.

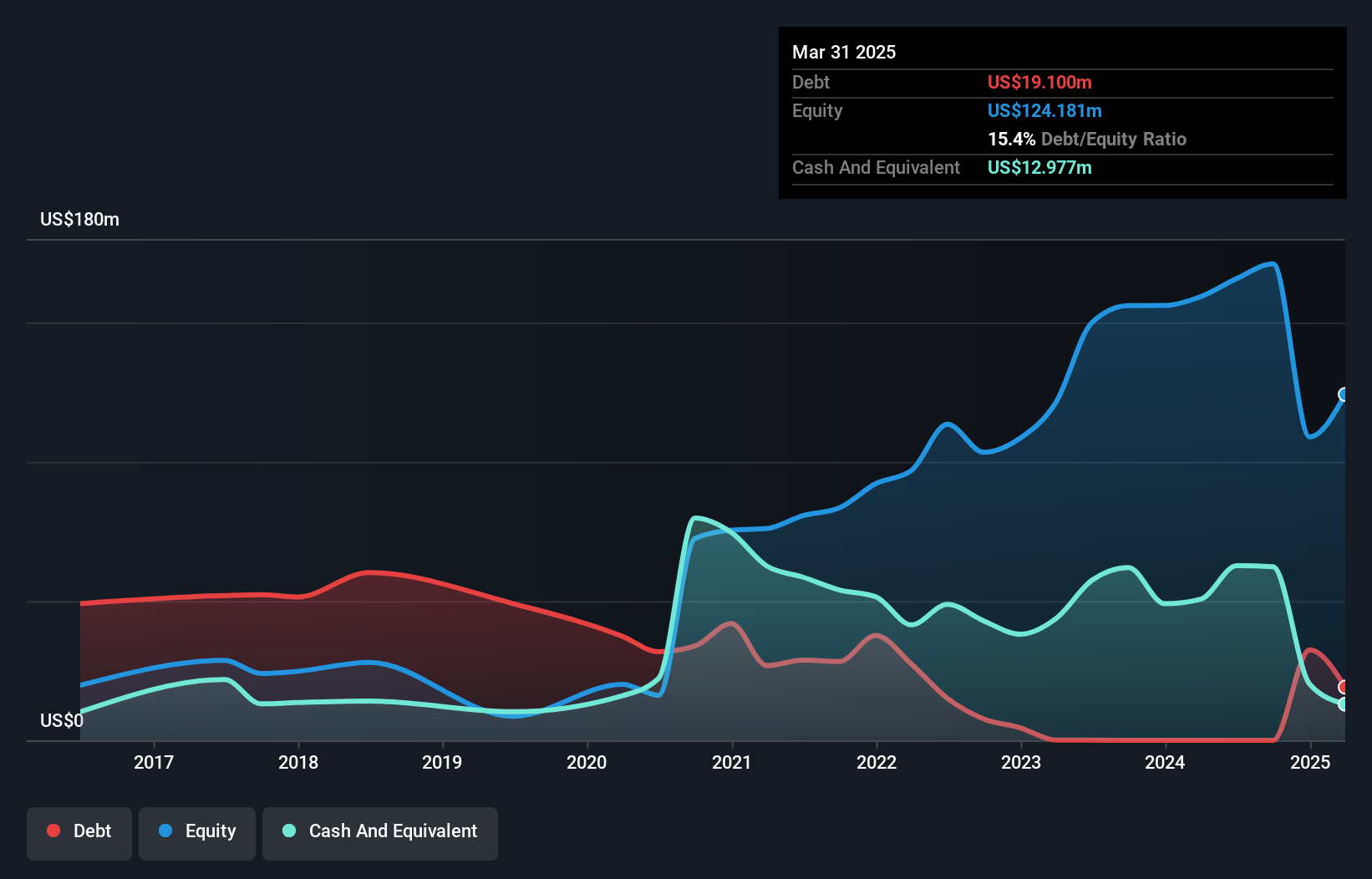

With total assets of US$2.2 billion and equity of US$209.4 million, CoastalSouth Bancshares stands out for its robust financial health. The bank's funding is 98% derived from low-risk customer deposits, reducing reliance on external borrowing. Its allowance for bad loans is a solid 119%, with non-performing loans at just 1%. Over the past year, earnings grew by 21.5%, outpacing the industry average of 13.7%. Recently added to multiple indices like Russell and S&P TMI, CoastalSouth seems well-positioned for visibility in the market despite recent net charge-offs totaling US$125 million this quarter compared to US$86 million last year.

- Delve into the full analysis health report here for a deeper understanding of CoastalSouth Bancshares.

Explore historical data to track CoastalSouth Bancshares' performance over time in our Past section.

Where To Now?

- Investigate our full lineup of 290 US Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COSO

CoastalSouth Bancshares

Operates as the bank holding company for Coastal States Bank that provides various banking products and services to retail and commercial customers.

Flawless balance sheet and good value.

Market Insights

Community Narratives