- United States

- /

- Banks

- /

- NYSE:CFR

Cullen/Frost Bankers (CFR): A Fresh Review of Valuation and Long-Term Opportunity

Reviewed by Simply Wall St

Cullen/Frost Bankers (CFR) has seen some movement in its stock lately, catching investor attention. While the company’s recent returns have been mixed over the past month and three months, its longer-term performance reflects both challenges and recovery phases for the Texas-based bank.

See our latest analysis for Cullen/Frost Bankers.

Looking at the bigger picture, Cullen/Frost Bankers’ share price has taken a breather so far this year, reflecting a modest drop, but the bank’s five-year total shareholder return still sits comfortably higher. This indicates that long-term holders have seen positive gains even through recent volatility. While momentum has softened a bit lately, the company’s broad recovery highlights underlying resilience and potential for renewed growth as market sentiment shifts.

If watching bank stocks settle has you thinking about new opportunities, now could be the moment to expand your search and discover fast growing stocks with high insider ownership

So as shares hover below analyst targets and current valuation metrics suggest a potential margin of safety, investors face a timely question: is there real upside left for Cullen/Frost Bankers, or is all future growth already baked in?

Most Popular Narrative: 9.4% Undervalued

With a fair value estimate of $137.60 compared to the recent close at $124.64, the most widely followed narrative contends that the share price currently leaves potential on the table. Market watchers are focused on whether improved operating leverage and projected growth could drive the stock higher in the near-to-medium term.

The full payoff from the branch expansion strategy is approaching, with maturing branches in high-growth markets shifting from breakeven to accretive by 2026. This shift is expected to unlock operating leverage and drive faster bottom-line growth relative to the past three years.

What’s fueling this upside? It is not just branch growth. This narrative hinges on the interplay of ambitious financial forecasts, a surprising profit multiple, and key assumptions about Texas’ economic forces. Wondering how much these factors impact fair value? Go deeper and see the hidden levers behind this pricing outlook.

Result: Fair Value of $137.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as rising funding costs and a branch-centric strategy could pressure margins and slow the anticipated benefits of expansion.

Find out about the key risks to this Cullen/Frost Bankers narrative.

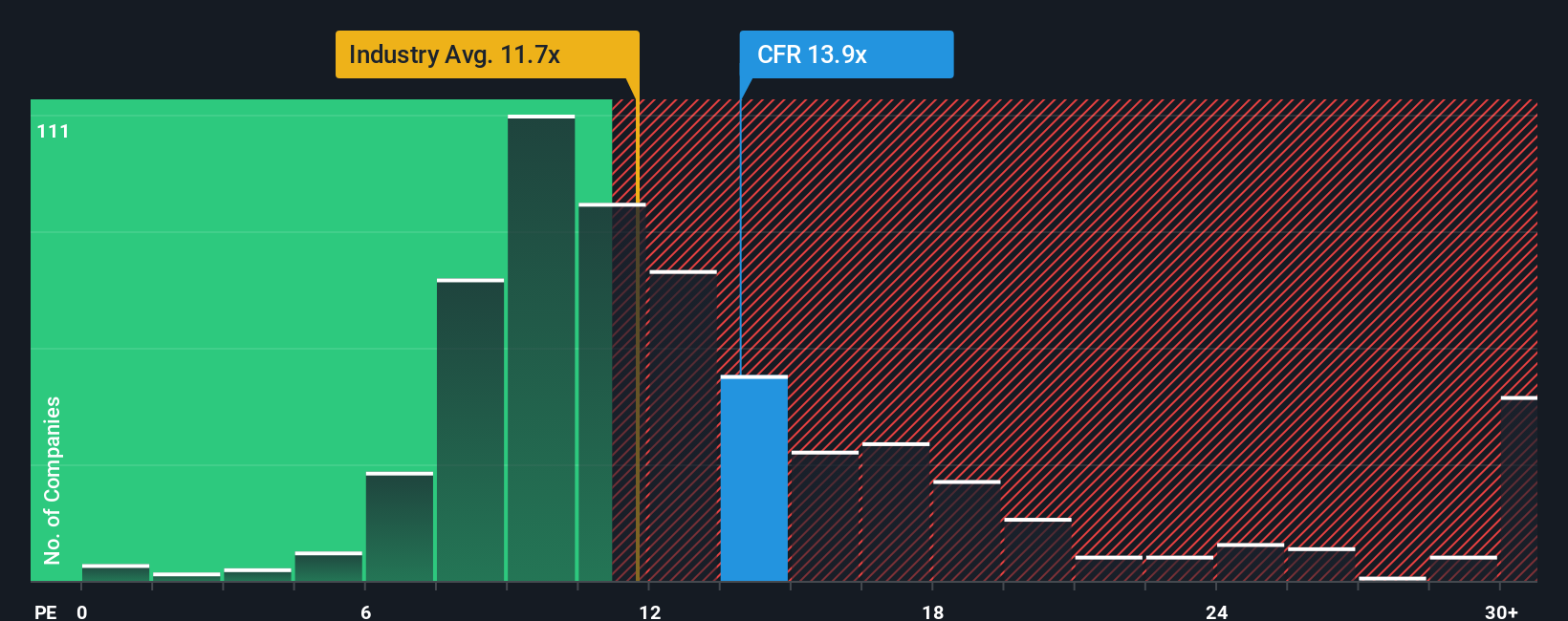

Another View: Looking at Earnings Multiples

While our fair value calculation suggests upside, a look at the price-to-earnings ratio offers a different perspective. Cullen/Frost Bankers currently trades at 12.8x earnings, which is higher than both the US Banks industry average of 11.4x and its peer average of 12.2x. It is also above its estimated fair ratio of 10.4x. This higher valuation multiple may indicate that some optimism is already reflected in the current price, which could increase the importance of future results. Do investors have room to expect more, or is caution warranted in this situation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cullen/Frost Bankers Narrative

Feel free to dig into the numbers, question the assumptions, and build your own perspective. Forming your own Cullen/Frost story takes just a few minutes. Do it your way

A great starting point for your Cullen/Frost Bankers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more ways to invest with confidence?

Don’t stop at Cullen/Frost Bankers. Smart investors always keep an eye out for the next standout opportunity. Check out these handpicked ideas now and get ahead of the curve before others catch on.

- Uncover high-potential opportunities by scanning these 3578 penny stocks with strong financials with strong fundamentals and the power to surprise the market.

- Boost your portfolio’s income with these 15 dividend stocks with yields > 3% that deliver reliable cash flow through healthy yields over 3%.

- Tap into the future of computing and innovation by backing these 27 quantum computing stocks set to transform entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFR

Cullen/Frost Bankers

Operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success