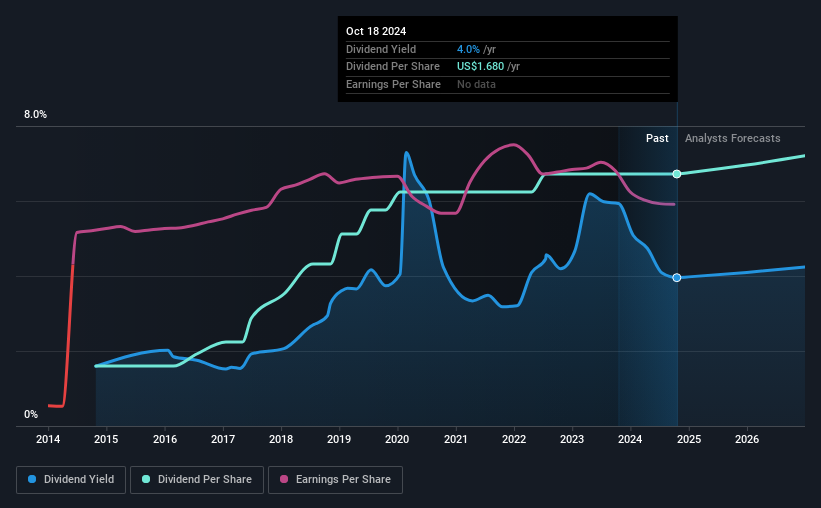

The board of Citizens Financial Group, Inc. (NYSE:CFG) has announced that it will pay a dividend on the 13th of November, with investors receiving $0.42 per share. This means the annual payment is 4.0% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Citizens Financial Group

Citizens Financial Group's Payment Expected To Have Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

Having distributed dividends for at least 10 years, Citizens Financial Group has a long history of paying out a part of its earnings to shareholders. While past data isn't a guarantee for the future, Citizens Financial Group's latest earnings report puts its payout ratio at 16%, showing that the company can pay out its dividends comfortably.

Looking forward, EPS is forecast to rise by 139.9% over the next 3 years. Analysts estimate the future payout ratio will be 30% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Citizens Financial Group Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.40 in 2014 to the most recent total annual payment of $1.68. This works out to be a compound annual growth rate (CAGR) of approximately 15% a year over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

Dividend Growth Is Doubtful

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Over the past five years, it looks as though Citizens Financial Group's EPS has declined at around 7.0% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

Overall, a consistent dividend is a good thing, and we think that Citizens Financial Group has the ability to continue this into the future. While the payments look sustainable for now, earnings have been shrinking so the dividend could come under pressure in the future. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Citizens Financial Group that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives