- United States

- /

- Banks

- /

- NYSE:CFG

Citizens Financial Group (CFG): Valuation in Focus After Strong Earnings, Dividend Hike, and Buyback Update

Reviewed by Simply Wall St

Citizens Financial Group (CFG) just released third quarter results that showed higher net interest income and net earnings compared to last year. In addition, management rolled out upbeat guidance for the next quarter and a larger dividend, catching investors’ attention.

See our latest analysis for Citizens Financial Group.

Citizens Financial Group shares have gained momentum this year, with the latest results and stronger dividend pushing the current share price to $52.18. Over the past year, investors have enjoyed a 26.9% total shareholder return. The five-year total return is 128%. With upbeat forward guidance and a recently completed buyback also in the mix, market optimism appears to be building for the long term.

If you’re looking to widen your search beyond banks and tap into other promising opportunities, now is a good time to discover fast growing stocks with high insider ownership

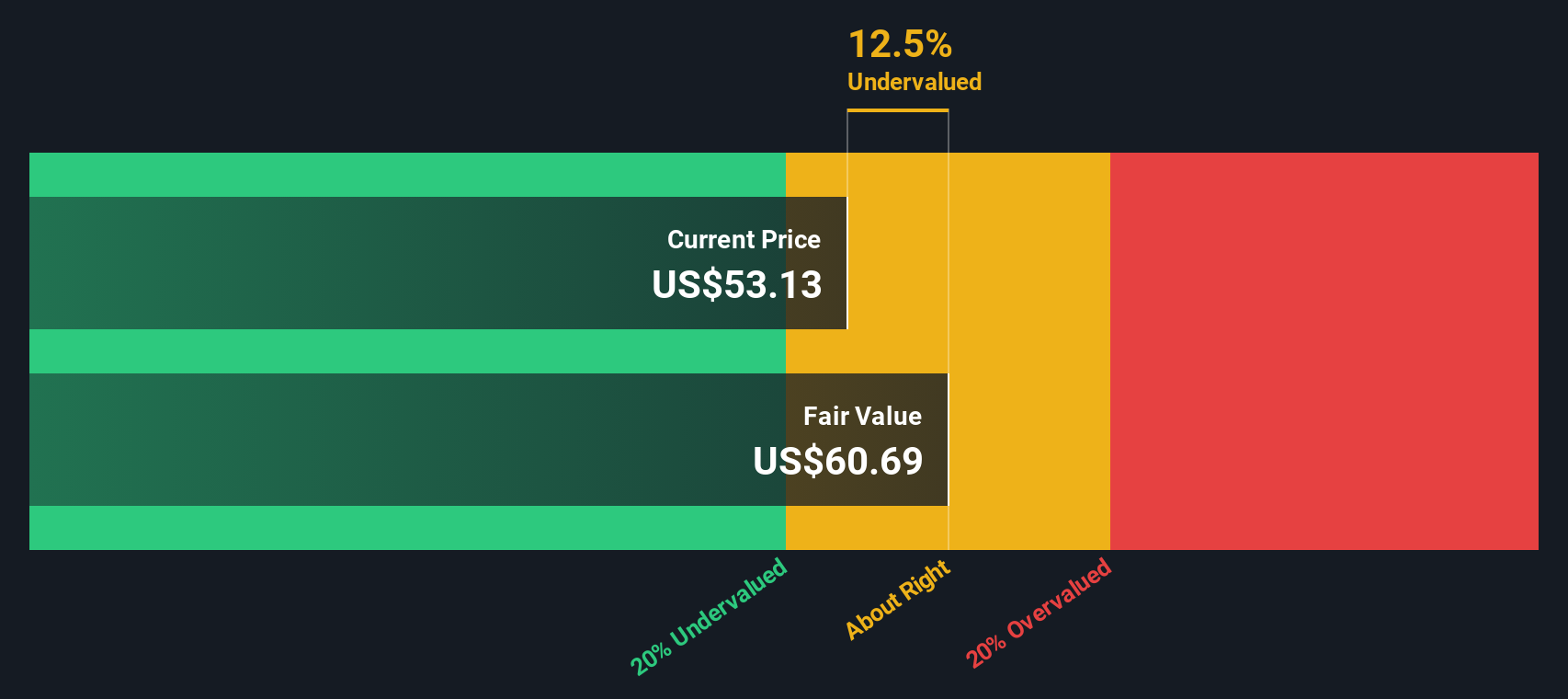

With solid earnings growth, a bigger dividend, and shares still trading at an 18% discount to analyst targets, the big question is whether Citizens Financial Group remains undervalued or if the market is already pricing in future gains.

Most Popular Narrative: 15.1% Undervalued

According to the most widely followed narrative, Citizens Financial Group’s fair value is estimated at $61.48, compared to the recent close of $52.18. This substantial valuation gap is based on strong profitability improvements and constructive industry trends that may continue to drive future performance.

Profitability improvement is a central theme, with projections of the bank’s return on tangible common equity rising meaningfully over the next few years. This narrows the gap with peers and moves closer to long-term targets.

Want to know what’s fueling analysts’ bullish conviction? One core ingredient of this fair value is future earnings projected to surge well beyond today’s levels. Eager to see which ambitious financial goals back this target? Read on to unlock the detailed assumptions and see the numbers that could surprise you.

Result: Fair Value of $61.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant exposure to commercial real estate and the rapid pace of technological change could quickly challenge Citizens Financial Group’s bullish outlook.

Find out about the key risks to this Citizens Financial Group narrative.

Another View: What About the SWS DCF Model?

Looking at Citizens Financial Group through the lens of our DCF model, the story gets interesting. The DCF approach places fair value closer to $81.56, which means shares are trading at a hefty 36% discount. That is a much deeper gap than what analyst multiples suggest. Is the market being too cautious, or is this a rare opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Citizens Financial Group Narrative

If you see things differently or enjoy digging into the numbers yourself, it takes just a few minutes to build your own perspective in your own way. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citizens Financial Group.

Looking for more investment ideas?

Smart investors always stay ahead of the curve by searching for new trends and compelling opportunities. If you want to uncover stocks that could shape your next winning move, don’t miss out on these standout ideas below. There’s real potential waiting to be seized.

- Unlock cutting-edge opportunities in medical innovation by checking out these 33 healthcare AI stocks, where healthcare breakthroughs and AI intersect to transform patient care and diagnostics.

- Tap into rapid growth potential and strong yields by searching among these 17 dividend stocks with yields > 3%, offering a selection of robust businesses with attractive dividend payouts.

- Gain first-mover advantage in disruptive technology by reviewing these 27 AI penny stocks, featuring trailblazers driving advancements in machine learning, automation, and the future of AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives