- United States

- /

- Banks

- /

- NYSE:CADE

What Cadence Bank (CADE)'s Dividend Declaration and Q3 Results Mean for Shareholders

Reviewed by Sasha Jovanovic

- Cadence Bank recently declared quarterly cash dividends on both its common and Series A Preferred stock, while reporting third-quarter results highlighted by net interest income of US$423.73 million and net income of US$129.85 million.

- Analysts point to the bank’s improved net interest margin, well-executed acquisitions in Texas and Georgia, and ongoing expansion as material factors shaping its outlook within high-growth regions.

- We'll explore how successful acquisition integrations and healthy net interest income reported this quarter may influence Cadence Bank’s investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cadence Bank Investment Narrative Recap

To be a shareholder in Cadence Bank, you need to believe in its ability to profit from expansion in high-growth southern markets and integrate acquisitions effectively. The newly declared dividends and stable net charge-offs indicate no material change to the short-term catalyst, which remains the successful integration of recent acquisitions, while the main risk continues to be operational execution in these new markets. Among the recent announcements, the board's reaffirmation of dividends for both common and Series A Preferred shares stands out, signaling continued confidence in the bank’s capital position and its strategy to maintain shareholder returns. This consistency aligns with the ongoing catalyst of ensuring strong profitability and efficient growth as the new acquisitions settle into Cadence’s broader operations. However, investors should also keep in mind that, unlike the steady dividend announcements, the real test may come from...

Read the full narrative on Cadence Bank (it's free!)

Cadence Bank's narrative projects $2.5 billion in revenue and $810.9 million in earnings by 2028. This requires 12.4% yearly revenue growth and a $285.7 million increase in earnings from the current $525.2 million.

Uncover how Cadence Bank's forecasts yield a $42.27 fair value, a 16% upside to its current price.

Exploring Other Perspectives

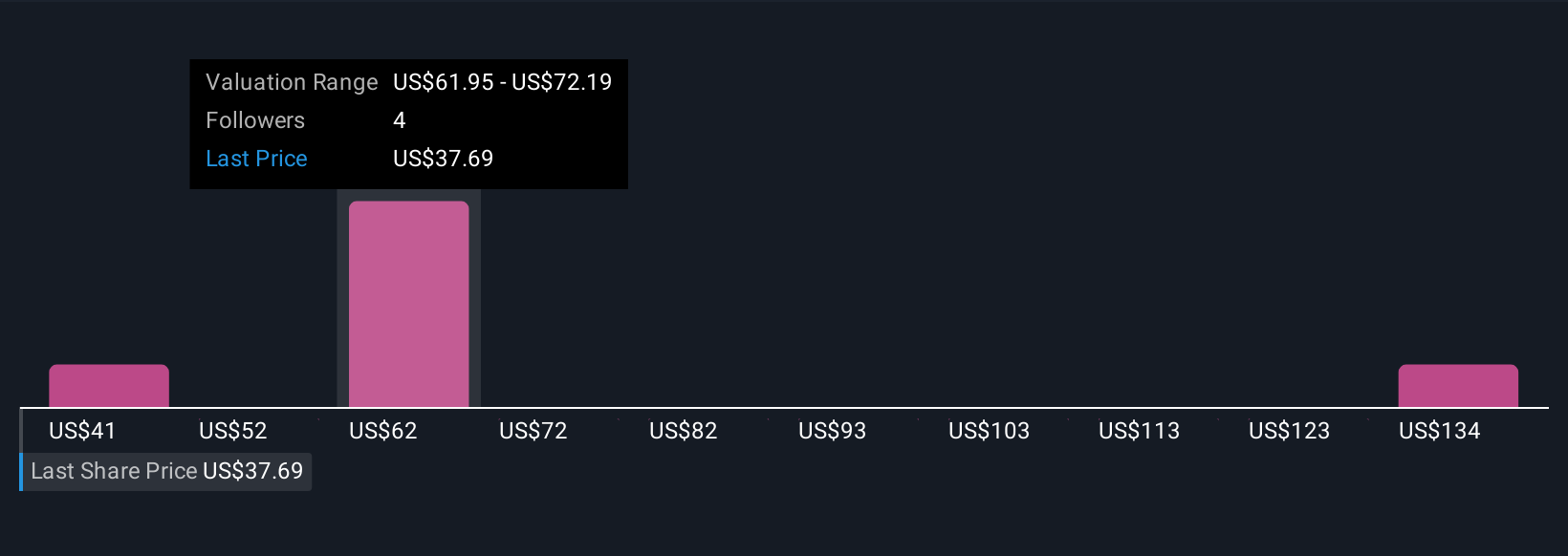

Fair value estimates in the Simply Wall St Community range from US$42.27 to US$143.92 based on three different analyses. While some see strong upside, the risk of integration difficulties in recently acquired loan portfolios is an issue you cannot ignore when considering the broader performance outlook.

Explore 3 other fair value estimates on Cadence Bank - why the stock might be worth just $42.27!

Build Your Own Cadence Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cadence Bank research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cadence Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cadence Bank's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion