- United States

- /

- Banks

- /

- NYSE:CADE

Rate Cut Hopes and Lower Short Interest Could Be a Game Changer for Cadence Bank (CADE)

Reviewed by Sasha Jovanovic

- Following comments from New York Federal Reserve President John Williams suggesting the potential for a near-term rate cut, investor sentiment in regional banks, including Cadence Bank, improved sharply despite ongoing concerns about loan quality in the sector.

- An interesting insight is that Cadence Bank's short interest recently decreased and now sits below the peer average, signaling comparatively lower bearish positioning among investors.

- We'll explore how the surge in rate cut optimism and falling short interest could influence Cadence Bank's earnings outlook and risk profile.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cadence Bank Investment Narrative Recap

To own Cadence Bank stock, an investor typically needs confidence in the sustained economic resilience of the Sunbelt region and the company's ability to manage risks tied to concentration in Texas and recent acquisitions. The improving outlook for interest rate cuts and the marked decline in short interest are positive for market sentiment, but the most significant near-term catalyst remains the pending merger with Huntington National Bank, while ongoing concerns about loan quality and economic concentration still represent material risks to earnings stability.

The announced $7.6 billion all-stock acquisition of Cadence by Huntington National Bank in late October 2025 is central to the current investment story. This transaction, if approved and completed as expected in early 2026, is likely to reshape the short-term earnings outlook and address questions around scale and geographic diversification, which were key market catalysts prior to recent news flows.

Yet, even with optimism building, it's important for investors to be aware of the elevated risk linked to Cadence Bank's concentrated exposure to economic conditions in Texas...

Read the full narrative on Cadence Bank (it's free!)

Cadence Bank's narrative projects $2.5 billion in revenue and $810.9 million in earnings by 2028. This requires 12.4% yearly revenue growth and a $285.7 million earnings increase from the current $525.2 million.

Uncover how Cadence Bank's forecasts yield a $42.70 fair value, a 10% upside to its current price.

Exploring Other Perspectives

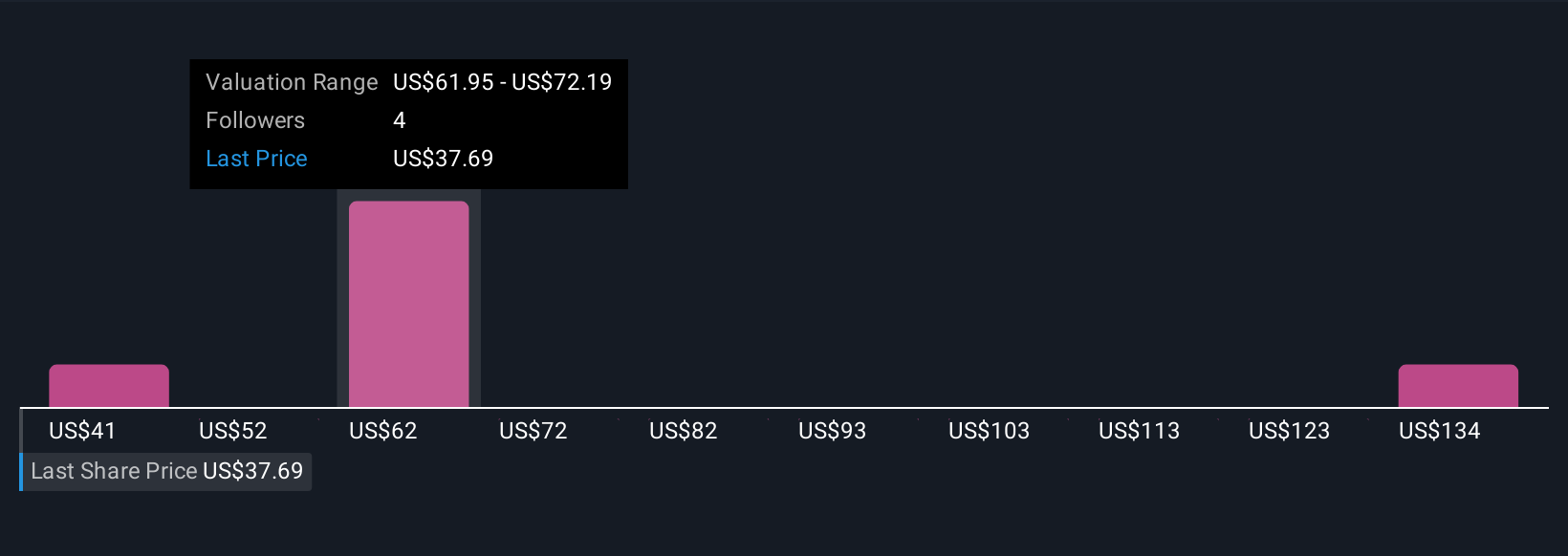

Three Simply Wall St Community fair value estimates for Cadence Bank range from US$42.70 to US$143.92 per share, highlighting diverse expectations. Shifting market sentiment on interest rates could affect these views and influence the company's performance over the coming quarters.

Explore 3 other fair value estimates on Cadence Bank - why the stock might be worth over 3x more than the current price!

Build Your Own Cadence Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cadence Bank research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cadence Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cadence Bank's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives