- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank (CADE): Evaluating Valuation After Q3 Expansion and Acquisition Integration Boosts Growth Outlook

Reviewed by Simply Wall St

Cadence Bank (CADE) reported strong third-quarter results, with management highlighting the integration of Industry Bank Shares and First Chatham. This move has driven substantial loan growth and expanded the bank’s reach in Central Texas and Georgia.

See our latest analysis for Cadence Bank.

Shares of Cadence Bank have quietly gained momentum over the past year, with a 13.91% one-year total shareholder return and year-to-date share price gains of 8.28%, outpacing many regional peers. While the valuation remains reasonable, the market’s positive reaction reflects renewed optimism as the bank continues to deliver growth through acquisitions and solid execution.

If you are on the lookout for other opportunities benefiting from operational growth and stable management, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After such robust gains and expansion, is Cadence Bank’s current share price still offering investors an attractive entry point? Or has the market already factored in all of its future growth potential?

Most Popular Narrative: 13.7% Undervalued

With Cadence Bank trading at $36.49, the leading narrative sees fair value at $42.27, which suggests the upside remains ahead. The gap between analyst expectations and the current market price sets the stakes for the coming quarters.

The ongoing expansion in high-growth Sunbelt markets, particularly Texas and Georgia, continues to drive robust organic loan and deposit growth, supported by population inflows and business activity. This should underpin sustained revenue and net interest income expansion.

Curious how analysts reach this punchy valuation? Their outlook hinges on ambitious top-line growth and strong profit trajectories driven by expansion, digital investments, and operational leverage. Uncover the numbers propelling this narrative and see what could turn the tide next.

Result: Fair Value of $42.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a regional slowdown in Texas or unexpected cost pressures from rapid acquisitions could quickly challenge Cadence Bank’s optimistic growth outlook.

Find out about the key risks to this Cadence Bank narrative.

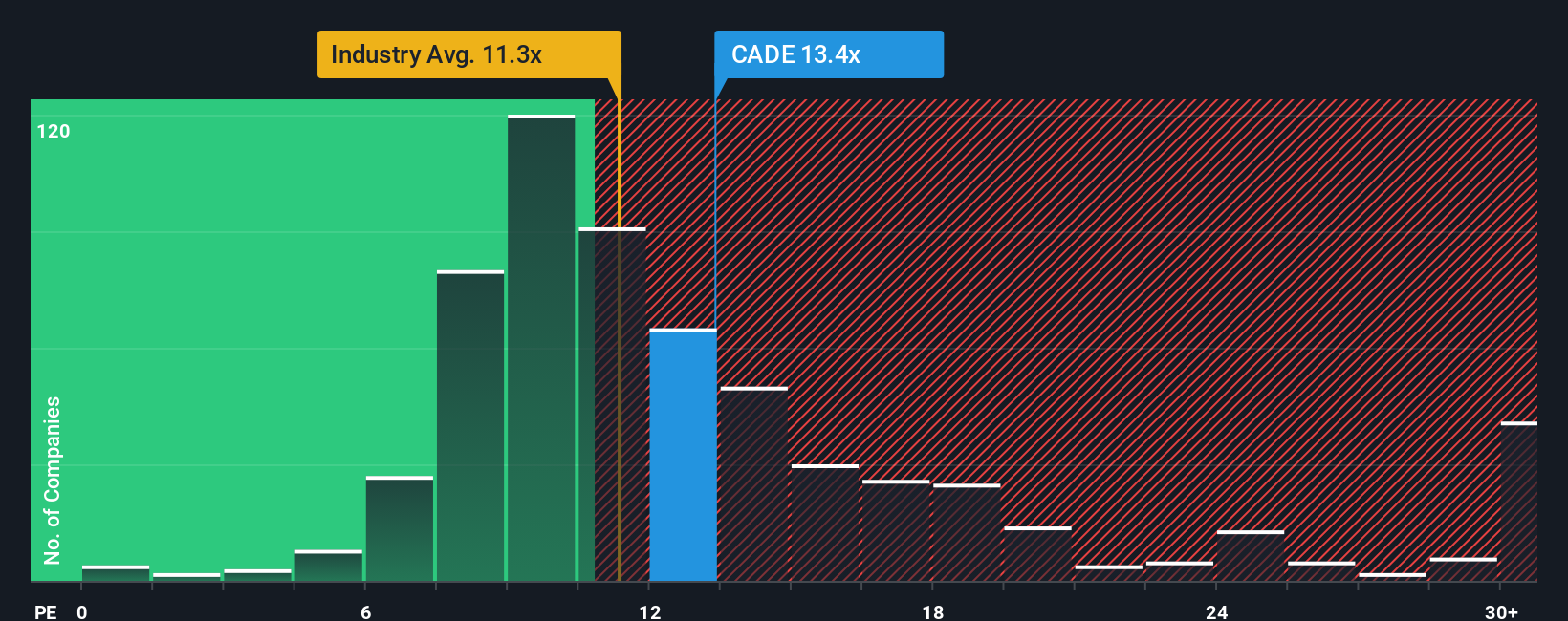

Another View: Looking Through the Lens of Earnings Multiples

While analysts see upside based on future growth, Cadence Bank's current price-to-earnings ratio of 13.1x is higher than both the US Banks industry average of 11.2x and the peer average of 12x. However, it still trades below its fair ratio estimate of 14.4x. This mix of numbers suggests Cadence might be reasonably valued by some measures. Investors should weigh whether the current premium is justified or sets up risk if growth slows. Which side of the line do you land on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Bank Narrative

If you see the numbers differently, or want to follow your own insights, you can craft a Cadence Bank story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cadence Bank.

Ready for More Investment Ideas?

If you want a real edge, handpick your next winners using the Simply Wall St Screener’s top lists. Don’t let opportunity pass you by.

- Tap into the massive potential of digital health by checking out these 33 healthcare AI stocks as these are reshaping patient care, technology, and AI-driven diagnostics.

- Boost your portfolio’s passive income by choosing from these 17 dividend stocks with yields > 3%, giving you access to companies with strong yields and reliable payout histories.

- Take advantage of rapidly evolving blockchain and finance sectors with these 80 cryptocurrency and blockchain stocks at the forefront of secure digital payment innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives