- United States

- /

- Banks

- /

- NYSE:C

Will Citigroup's (C) AI Success and Digital Asset Push Change Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Citigroup recently reported third-quarter earnings that exceeded analysts' estimates, driven by strong results across all major business segments and marked progress in its ongoing transformation initiatives.

- The company's accelerated adoption of artificial intelligence and plans to roll out digital asset custody services signal a push towards innovation and adaptability in the evolving financial landscape.

- We'll now explore how Citigroup's earnings momentum and push into digital assets could reshape its forward-looking investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Citigroup Investment Narrative Recap

To be a Citigroup shareholder today, you need to believe the bank’s global footprint, digital transformation, and drive for operational efficiency can outpace rising costs and regulatory hurdles. The recent management announcement in Malaysia is unlikely to be a material short-term catalyst or risk for Citigroup’s broader business; key drivers remain the pace of its tech-enabled transformation and progress on the Banamex IPO, while the most significant risks continue to stem from regulatory costs and competition from fintechs.

Among all recent news, Citi’s accelerating digital asset custody initiative is most relevant for its innovation narrative. Plans to launch crypto custody services in 2026 highlight how the bank aims to keep its transaction and payments franchise competitive. As digital assets reshape financial services, Citi’s success in this new area could reinforce, or challenge, progress on the catalysts investors care most about.

Yet, on the flip side, investors should not overlook ongoing regulatory scrutiny and escalating costs that…

Read the full narrative on Citigroup (it's free!)

Citigroup's outlook anticipates $88.8 billion in revenue and $17.2 billion in earnings by 2028. This scenario is based on 6.8% annual revenue growth and an increase in earnings of $4.3 billion from the current $12.9 billion.

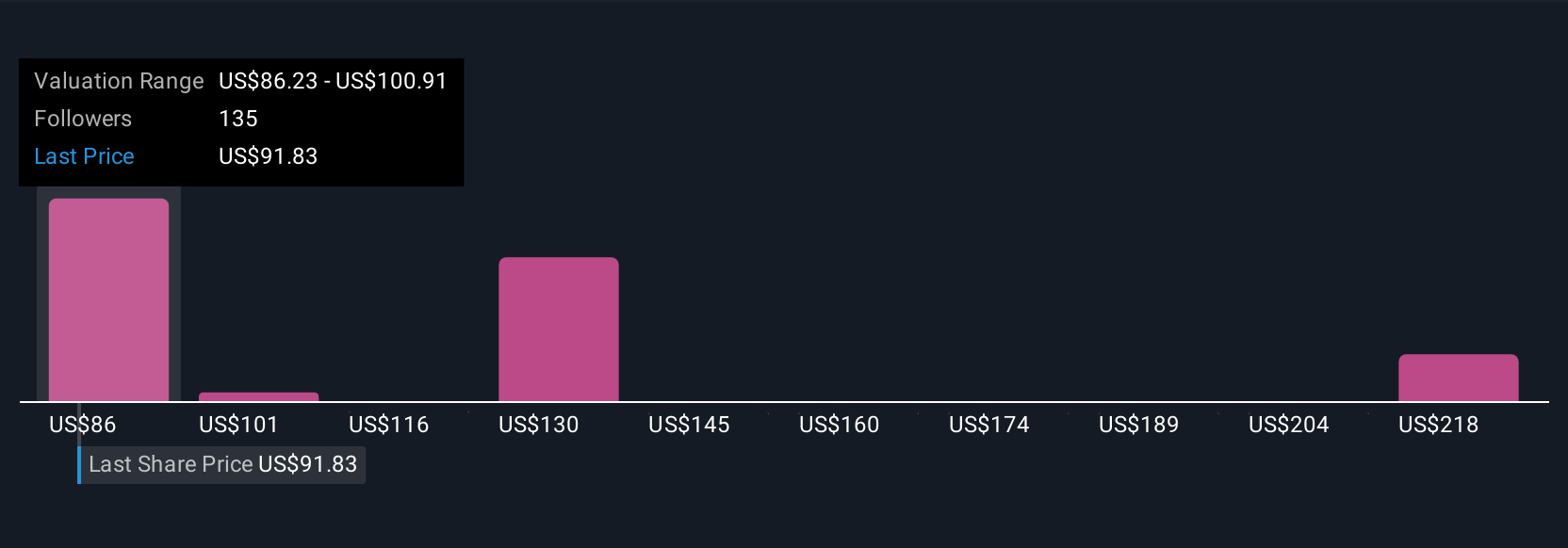

Uncover how Citigroup's forecasts yield a $108.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

If you’re inclined toward the most optimistic analyst expectations, consider that they projected annual revenues reaching US$91.3 billion and earnings of US$20.0 billion by 2028. These bullish views focus on the benefits of robust AI investments and efficiency gains, assuming fewer operational setbacks than others might. Keep in mind opinions can differ widely, with the latest news, it’s worth asking whether those forecasts might shift.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth 21% less than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives