- United States

- /

- Banks

- /

- NYSE:C

Is Citi's 46.6% Rally Justified After Management Shake-Up and Restructuring?

Reviewed by Bailey Pemberton

- Wondering whether Citigroup is a hidden gem or an overhyped pick? You are not alone. Let's get to the bottom of what the numbers say about the stock's true value.

- The share price has seen a strong run lately, up 3.9% in the past week and showing a 46.6% return year-to-date.

- Citigroup has been in the headlines for its ongoing restructuring and strategic investments, which have energized some investors and cast new light on its long-term prospects. Recent management shake-ups and a renewed focus on efficiency have also fueled discussions about its future direction.

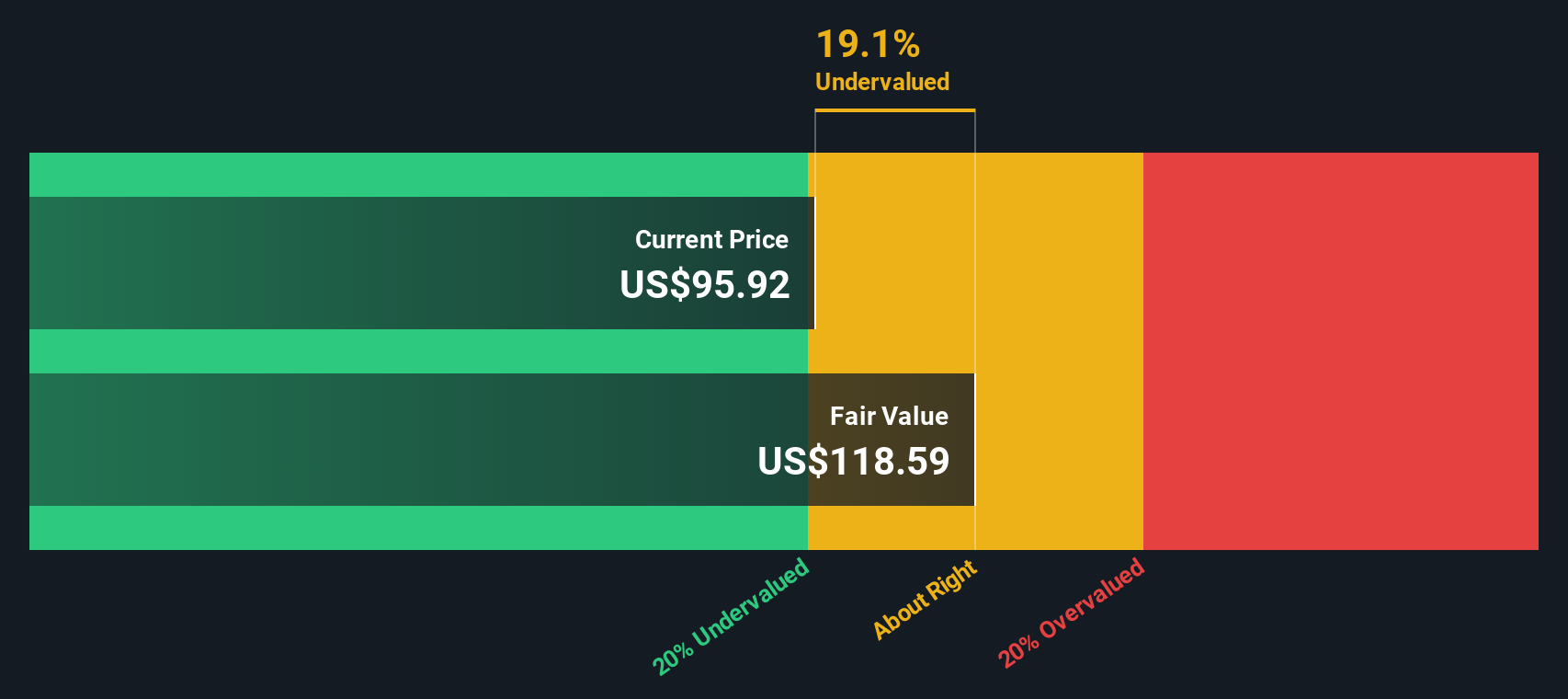

- On our valuation checks, Citigroup scores 3 out of 6 for being undervalued. Up next, we will break down various approaches to valuing the stock, including one that brings all the pieces together at the end of this article.

Approach 1: Citigroup Excess Returns Analysis

The Excess Returns model assesses whether a bank like Citigroup creates value above its cost of equity by looking at the profits it generates from shareholders' invested capital. In short, it measures if management is delivering a sustainable edge, beyond just keeping pace with the cost of money.

For Citigroup, the key figures stand out: its Book Value per share is $108.41, and its projected stable Earnings Per Share (EPS) is $10.27, as estimated from the consensus of 14 analysts. The company has an average Return on Equity (ROE) of 8.63%, while its Cost of Equity sits at $9.75 per share. This leads to an Excess Return of $0.51 per share, which is a modest cushion that signals profitability above the bare minimum expected by investors. Additionally, analysts see the Stable Book Value growing to $118.91 per share, based on forward-looking estimates from 11 analysts.

Based on this analysis, the estimated intrinsic value for Citigroup is $129.27 per share, which is 20.7% above the current market price. This indicates that the stock is notably undervalued relative to the sustainable long-term returns it is expected to generate.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citigroup is undervalued by 20.7%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

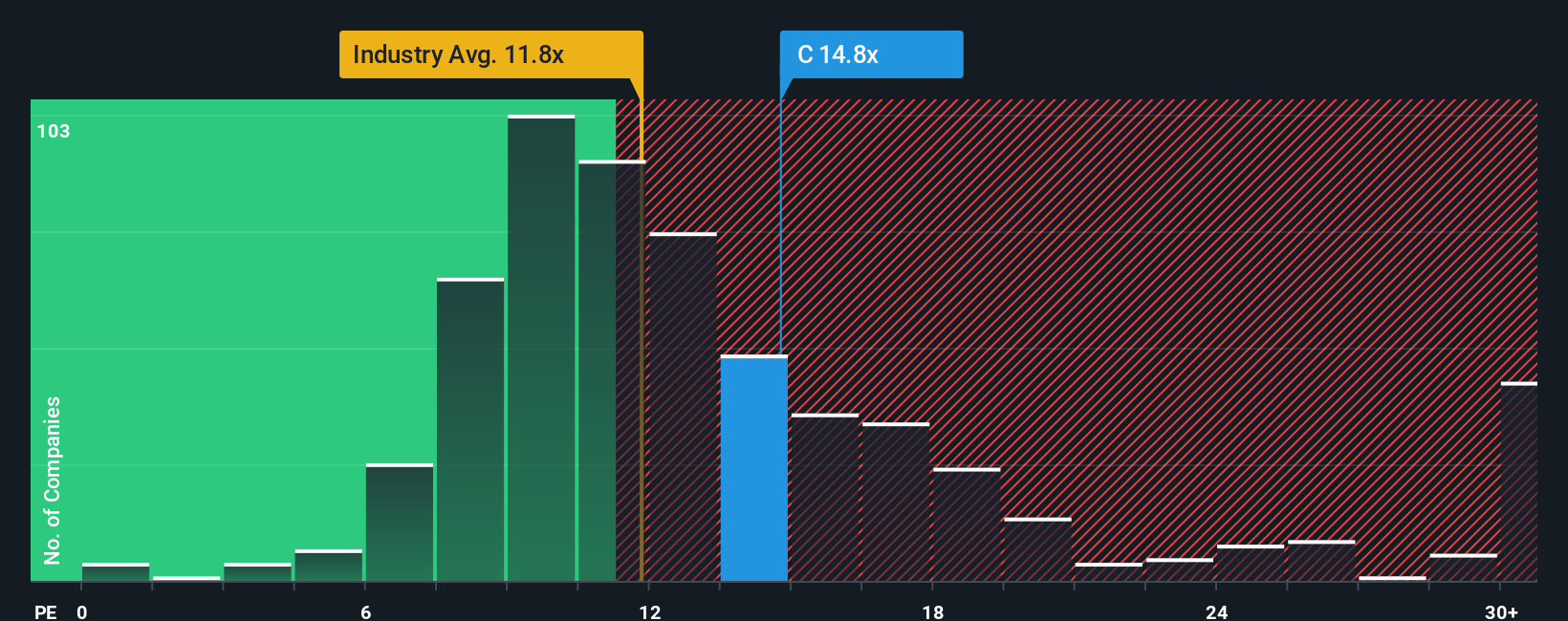

Approach 2: Citigroup Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation method for profitable companies like Citigroup because it helps investors gauge how much they are paying for each dollar of the company’s earnings. It is particularly useful when a business has consistent and positive profits, as it connects the share price directly to underlying performance.

When evaluating what a "normal" or "fair" PE ratio should be, factors like a company’s expected earnings growth and its risk relative to the market are important. A higher growth outlook or lower risk profile often justifies a higher PE multiple. Companies with slower growth or higher risk tend to trade at lower multiples.

At present, Citigroup trades at a PE ratio of 13.6x. This is above the Banks industry average of 11.4x and slightly above the peer average of 12.6x. Simply Wall St’s proprietary Fair Ratio for Citigroup is 15.2x, factoring in the company’s growth prospects, profit margin, industry characteristics, market cap, and risk profile. The Fair Ratio offers a more holistic assessment that reflects attributes unique to Citigroup, moving beyond basic comparisons with peers or the industry.

Since Citigroup’s current PE is not far from its Fair Ratio and is just below by a modest margin, the stock appears slightly undervalued but well within a reasonable range for long-term investors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

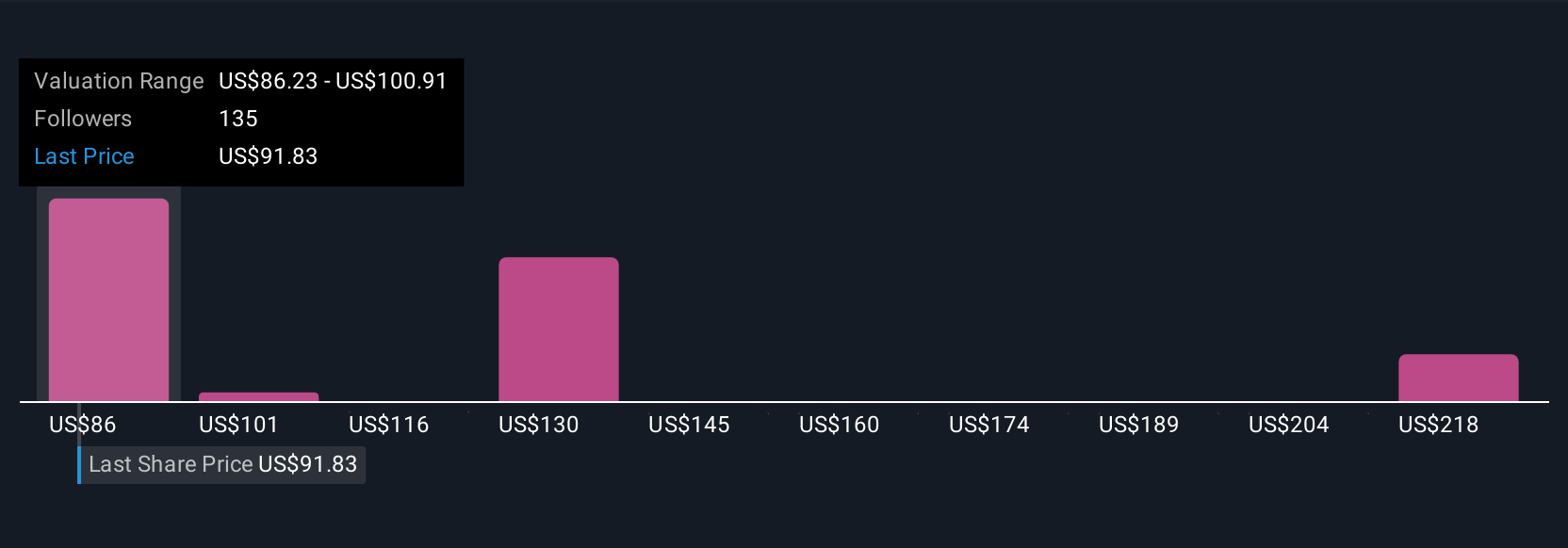

Upgrade Your Decision Making: Choose your Citigroup Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple, powerful way to tie Citigroup’s story—your perspective as an investor—to the financial numbers that drive fair value estimates.

A Narrative is your own forecast for a company's future, connecting how you see Citigroup’s strategy, revenue growth, and margins to a fair value that evolves over time. With Narratives, available on Simply Wall St’s Community page, millions of investors are able to anchor their buy and sell decisions to what they believe about a business, rather than just relying on a spreadsheet or consensus target.

This approach is incredibly accessible. You describe the story you believe in, fill in your financial assumptions, and see if your fair value is above or below the current price. Narratives also update whenever new news or earnings data comes in, so your investment case remains current and robust.

For example, the most optimistic Citigroup Narrative recently published leads to a fair value of $233, while the most conservative puts it at $77. This illustrates how different views and assumptions about Citigroup’s future create a wide range of fair values and actionable investing ideas.

Do you think there's more to the story for Citigroup? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.