- United States

- /

- Banks

- /

- NYSE:C

Citigroup (C): Exploring Valuation as Shares Build Momentum and Long-Term Gains Accelerate

Reviewed by Kshitija Bhandaru

See our latest analysis for Citigroup.

Citigroup’s share price has been steady for the past year, ticking up modestly with positive momentum building in recent months. While the 3-month share price return of nearly 10% hints at strengthening sentiment, the 1-year total shareholder return of 64% shows that longer-term investors have also seen meaningful gains.

If you’re interested in discovering more opportunities with upside potential, now is a great moment to check out fast growing stocks with high insider ownership.

With recent gains and robust long-term returns, is Citigroup trading at an attractive discount, or has the market already factored in its expected growth? Could this be a genuine buying opportunity, or is all the optimism already priced in?

Most Popular Narrative: 58% Undervalued

Citigroup’s most widely followed valuation thesis puts the company’s fair value at $230, which is more than double its last close near $97. This bold price target reflects a thesis that is both ambitious and transformative, shaped by major shifts in the industry and the company’s evolving strategy.

Citi Token Services lets Citi position itself as the "killer app" for institutional cross-border payments, absorbing complexities and offering instant, cost-effective solutions. Core business is firing on all cylinders, with record performances in Markets and Wealth, significant share gains in Investment Banking (especially M&A, LevFin, and sponsors), and robust growth in Services and U.S. Personal Banking, all contributing to strong revenue momentum.

Want to know what’s fueling this sky-high price forecast? The narrative hinges on bold growth drivers across digital assets, major market share wins, and a profit outlook that rivals industry heavyweights. Click through to uncover the specific projections and see how this value was built from the ground up.

Result: Fair Value of $230 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting macroeconomic conditions or unexpected regulatory changes could quickly undermine Citigroup’s upbeat outlook and challenge its ambitious growth projections.

Find out about the key risks to this Citigroup narrative.

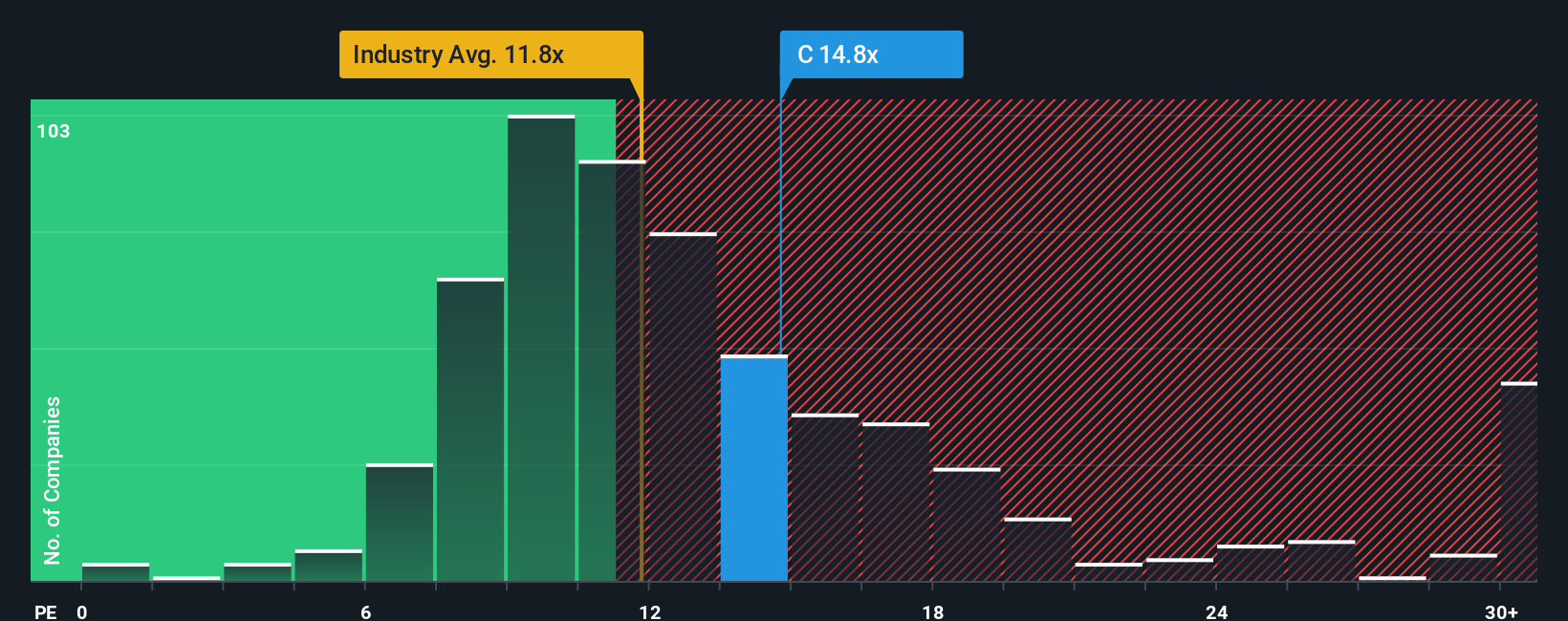

Another View: Multiples Tell a Different Story

While the primary valuation sees Citigroup as significantly undervalued, a look through the lens of typical price-to-earnings ratios paints a more cautious picture. Citigroup’s current ratio stands at 13.9x, which is higher than both its peer average (13x) and the broader US Banks industry (11.7x). Despite this, the fair ratio is estimated at 16.4x, so the question remains whether the market might eventually price Citigroup higher or if the current gap reflects justified caution. Could this premium signal real opportunity, or is it a risk that investors should weigh carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citigroup Narrative

If you see things differently or want your own perspective, you can dive into the numbers and build your own analysis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citigroup.

Looking for More Investment Ideas?

Power up your portfolio by taking action on smart ideas other investors might overlook. Don’t miss your chance to get ahead of the crowd. Move first and see what others may only realize later.

- Boost your passive income with these 19 dividend stocks with yields > 3% offering consistently high yields and reliable payouts that can make a real difference in your returns.

- Tap into tomorrow’s tech breakthroughs with these 24 AI penny stocks harnessing the power of artificial intelligence to reshape entire industries and generate outstanding growth.

- Grab opportunities the market has missed. Find undervalued stocks ready for a turnaround inside these 910 undervalued stocks based on cash flows and spot value before it becomes the next headline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives