- United States

- /

- Banks

- /

- NYSE:C

Assessing Citigroup’s 40% Surge in 2025: Are Shares Trading Below Fair Value?

Reviewed by Bailey Pemberton

If you have been keeping an eye on Citigroup lately and find yourself wondering whether it is the right time to buy, sell, or simply hold steady, you are not alone. The bank’s stock, which closed at $98.25 most recently, has certainly made some waves, giving investors a lot to think about. While it has slipped a bit over the last month, down about 4.3%, the longer-term performance shows serious momentum. Citigroup is up an impressive 40.5% year-to-date and has delivered a staggering 59.3% jump over the past year. Taking a step back even further, the five-year return is sitting at 182.3%, which is nothing to sneeze at.

What is driving these moves? Recent headlines suggest renewed optimism in the banking sector as regulatory updates and shifting interest rates play their part. Citigroup’s strategic shifts, including a focus on streamlining global operations and bolstering its digital banking footprint, have captured investor attention. This renewed focus has also meant changes in risk perception, with optimism gradually building among both retail and institutional investors.

But let’s get down to brass tacks: valuation. Citigroup currently scores a 3 out of 6 on the value scale, meaning the market recognizes strengths in a few key areas, but is not ready to declare it a screaming bargain just yet. Still, that score tells only part of the story. Let’s take a closer look at the different valuation approaches analysts use, and stick around because there may be an even better way to assess Citigroup’s value by the end of this article.

Approach 1: Citigroup Excess Returns Analysis

The Excess Returns valuation model is designed to assess how effectively a company produces profits over and above its cost of equity. In simple terms, it looks at whether Citigroup is putting shareholders’ funds to work efficiently enough to generate value beyond the minimum return required by investors.

For Citigroup, analysts estimate a Book Value of $108.41 per share and a stable Earnings per Share (EPS) of $10.20. Both figures are based on forward-looking estimates from multiple analysts. The cost of equity stands at $9.78 per share. This means Citigroup’s returns are only slightly above what market participants expect as compensation for risk, with an excess return of $0.42 per share. The average Return on Equity (ROE) is forecast at 8.57 percent, while the stable Book Value is expected to grow to $119.05 per share in the coming years.

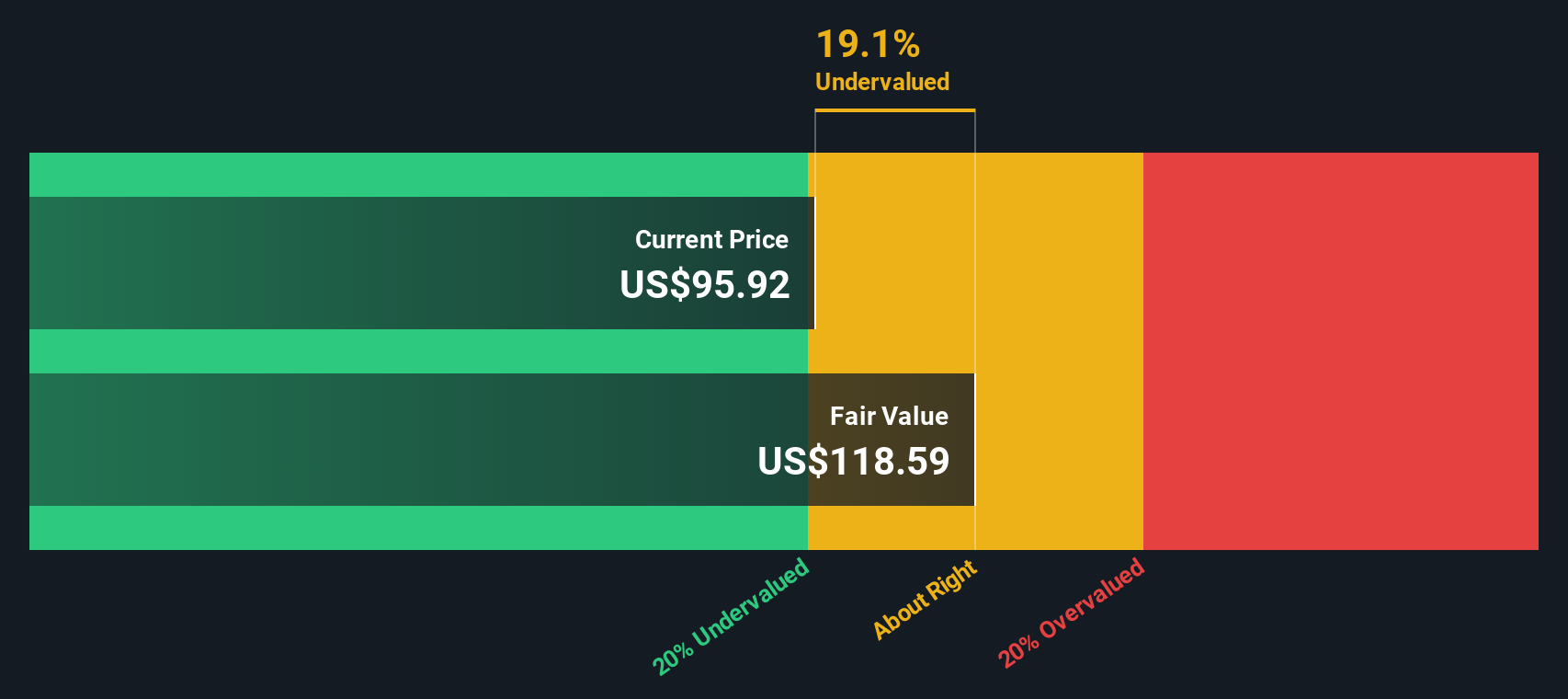

Taken together, these figures generate an intrinsic value estimate of $127.26 per share according to the Excess Returns model. This is 22.8 percent above the current share price of $98.25, indicating the stock is significantly undervalued at present levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citigroup is undervalued by 22.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Citigroup Price vs Earnings

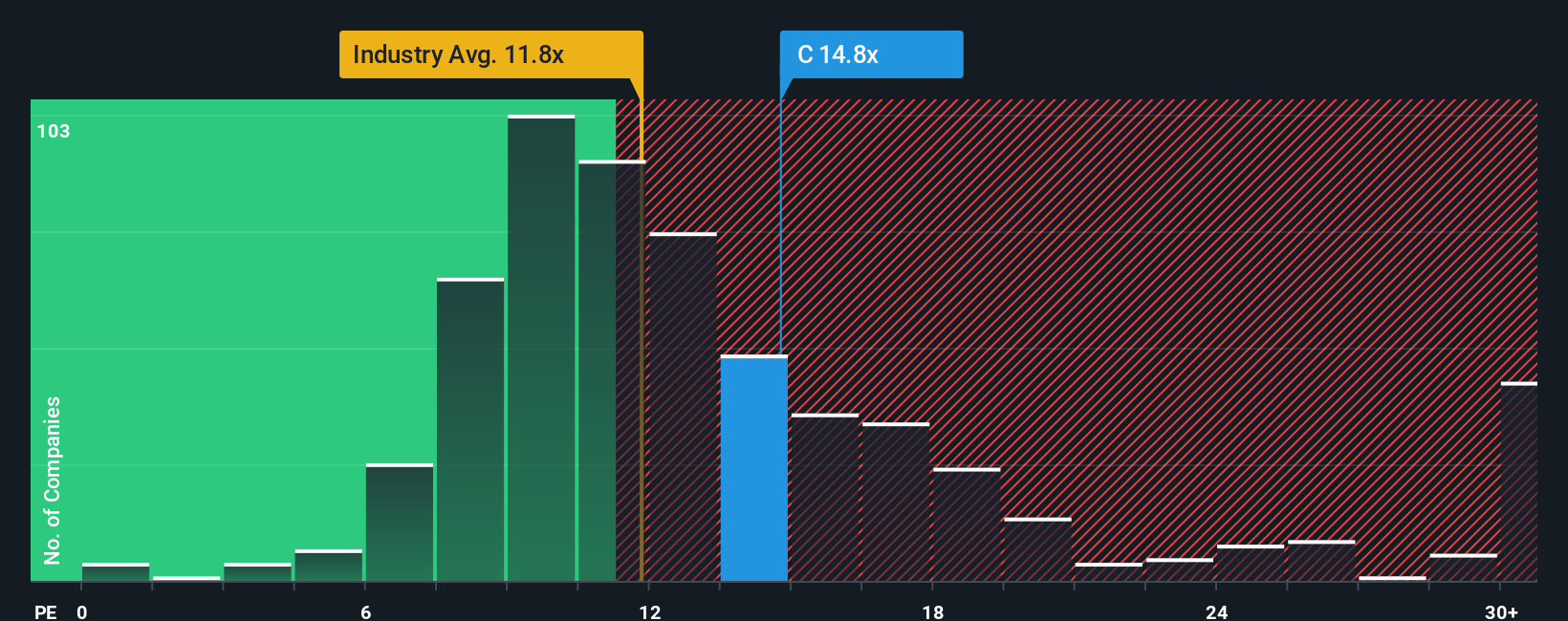

The Price-to-Earnings (PE) ratio is often the preferred valuation metric for profitable companies like Citigroup because it shows how much investors are willing to pay today for each dollar of current earnings. It is especially useful when a company is generating consistent profits, as it ties the stock price directly to the business’s bottom line.

The level at which a PE ratio is considered “normal” or “fair” is not set in stone. It depends on expectations for future growth and the risks associated with the business or sector. Higher expected growth and lower risk tend to justify a higher PE multiple, while more mature or riskier companies generally command lower multiples.

Citigroup is currently trading at a PE ratio of 13.1x. This is modestly above the average PE for its banking peers at 12.3x, and higher than the industry average of 11.2x. However, Simply Wall St’s proprietary “Fair Ratio” for Citigroup is calculated at 17.5x. The Fair Ratio goes beyond simple peer or industry comparisons by adjusting for differences in earnings growth, risk levels, profit margins, industry dynamics, and market capitalization. This makes it a more holistic gauge of valuation.

Comparing Citigroup’s current 13.1x PE against its Fair Ratio of 17.5x, the stock appears undervalued by this assessment. There is a substantial gap between what the market is paying today and what would be justified factoring in the company's fundamentals and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Citigroup Narrative

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives: a new, interactive approach that empowers you to attach your own story and perspective to Citigroup, linking the company’s outlook with financial forecasts and Fair Value estimates.

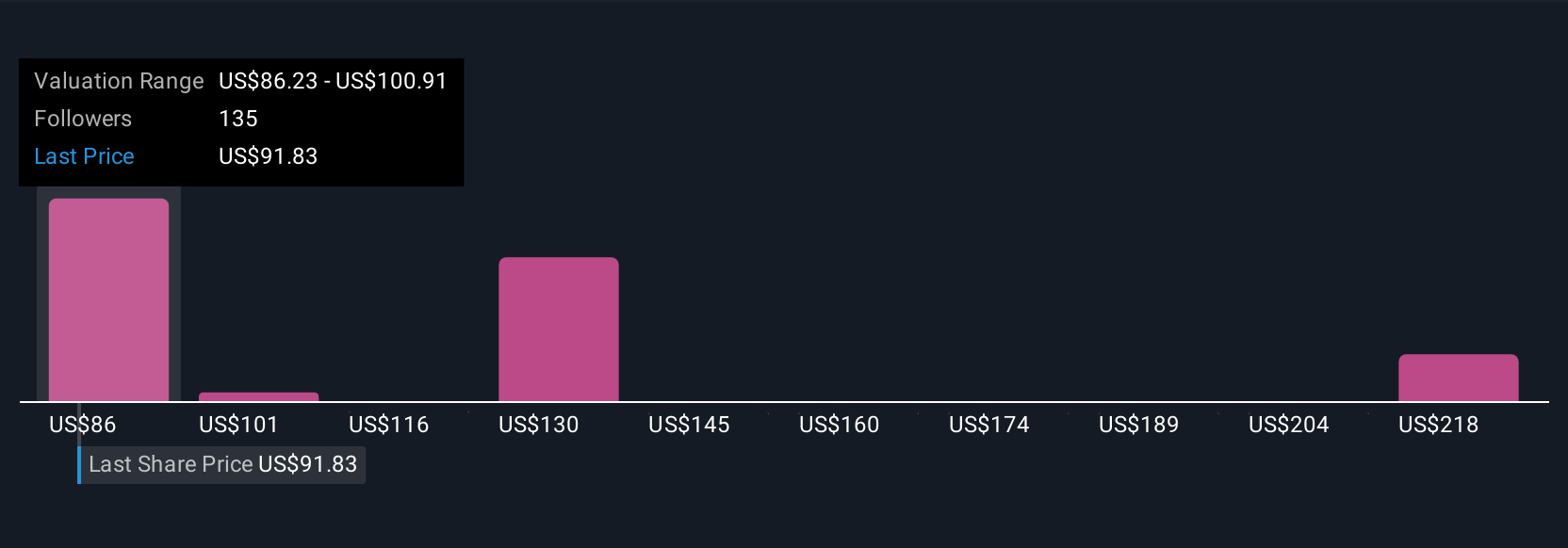

A Narrative is simply your view of Citigroup’s future. It is how you see the business, its opportunities, and the numbers that will drive results like revenue, earnings, and profit margins. In other words, it connects the story you believe in with the numbers you expect, and then calculates what you think Citigroup is actually worth.

On Simply Wall St’s Community page (used by millions of investors worldwide), Narratives make it easy for anyone to map their thinking, compare Fair Value with today’s price, and quickly decide if it is time to buy, sell, or hold. They're automatically updated anytime news or results change the outlook.

For example, some Citigroup Narratives project a Fair Value of $233, reflecting major optimism on its growth and digital assets strategy. Others see Fair Value as low as $77, signaling caution about future risks and competition.

Do you think there's more to the story for Citigroup? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives