- United States

- /

- Banks

- /

- NYSE:BANC

Is Banc of California Still a Good Value After Recent 28% One Year Share Price Jump?

Reviewed by Bailey Pemberton

Trying to decide what to do with Banc of California stock right now? You’re not alone. With the shares closing at $17.10 and turning in a strong 12.1% year-to-date return, capped with a one-year gain of 28.6%, investors are asking whether this regional bank still offers good value or if most of the upside has already been captured. The stock’s recent uptick, including a steady 2.6% gain over the past week, seems to reflect shifting sentiment as markets react to evolving banking sector dynamics nationwide. Even so, the underlying picture remains nuanced. By our numbers, Banc of California earns a valuation score of just 1 out of 6, telling us it appears undervalued on only one check out of six.

So, what does that mean for your investment strategy? Let’s break down how Banc of California stacks up against standard valuation approaches and why a better way to understand value could make all the difference at the end of the day.

Banc of California scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Banc of California Excess Returns Analysis

The Excess Returns model estimates company value by focusing on how effectively a business generates returns above its cost of equity. Rather than simply looking at profits, this approach weighs how much value Banc of California creates for shareholders through its core operations.

For Banc of California, the average return on equity stands at 7.25%, with a stable earnings per share estimate of $1.50 and a book value of $18.59 per share. Analysts project a stable book value of $20.71 per share, based on consensus from 8 analysts. The cost of equity is calculated at $1.61 per share, resulting in a negative excess return of $-0.11 per share. This suggests that, at present, the company is returning slightly less than its cost of equity, which may limit value creation over the long term.

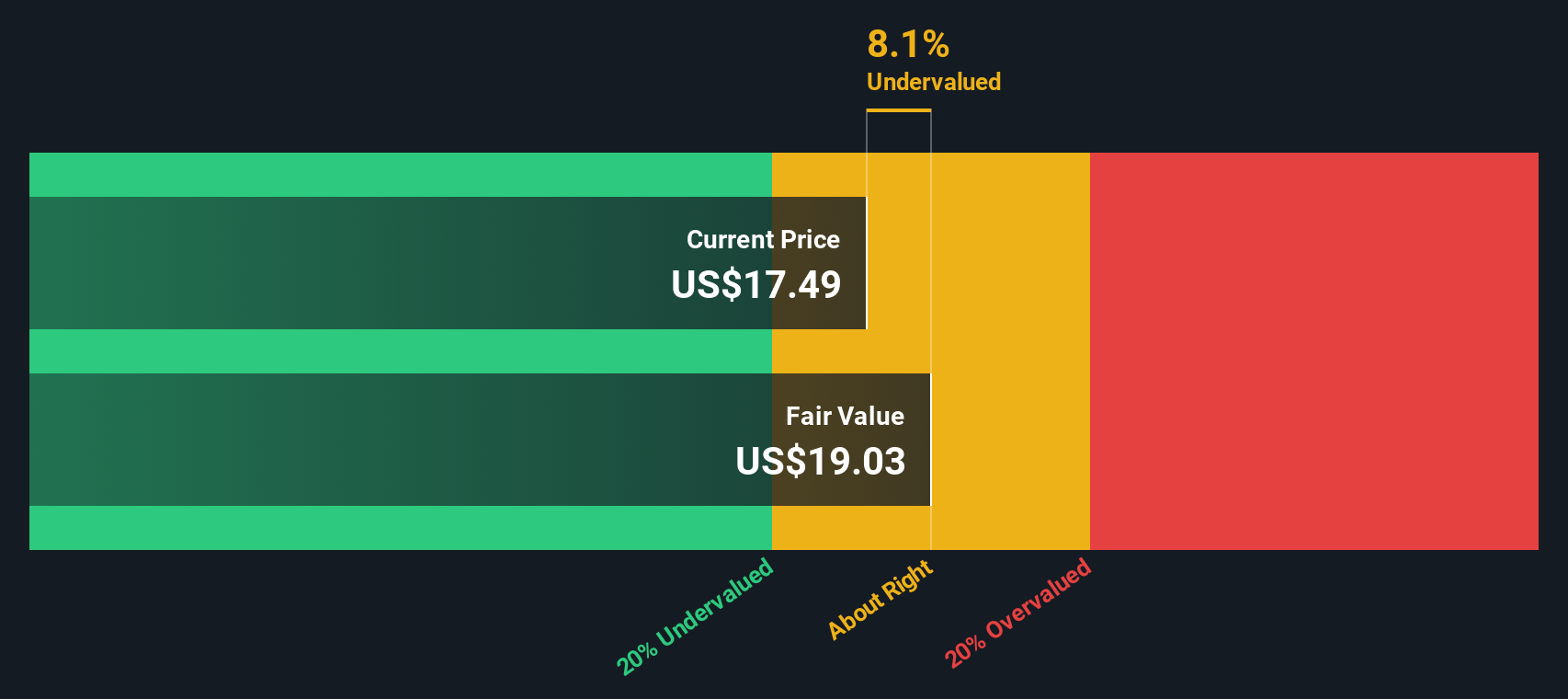

Despite these modest numbers, the Excess Returns approach calculates an intrinsic value for Banc of California stock at $18.46. This figure is about 7.4% above the current trading price of $17.10. The stock therefore appears roughly fairly valued relative to its fundamentals, with only a small margin indicating room for upside.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Banc of California's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Banc of California Price vs Earnings

For profitable companies like Banc of California, the Price-to-Earnings (PE) ratio is often the go-to metric for gauging valuation. This measure takes the current share price and divides it by the company’s earnings per share, offering investors a snapshot of how much they are paying for each dollar of profit. It is particularly useful because it directly reflects whether the market expects high or low future growth, and it also adjusts for the risk profile of each business.

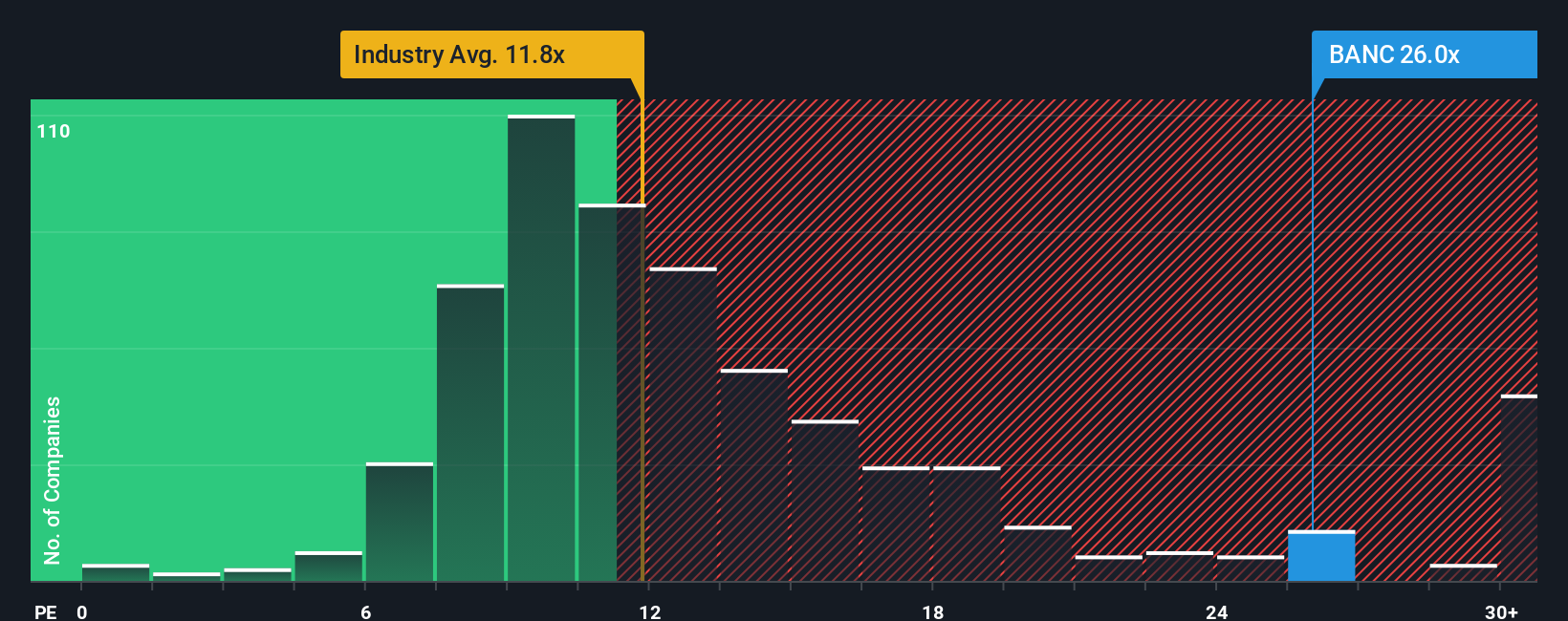

Banc of California currently trades at a PE ratio of 25x. This puts it well above the industry average for banks, which stands at 11.8x, and even higher than the average among direct peers at 20.5x. While at first glance this might suggest the shares are expensive, it is important to remember that a “normal” or “fair” PE ratio can be much higher than the industry average if a company offers better growth prospects, stronger profitability, or lower risk. Market expectations and risk appetite can therefore drive significant variation in what is considered fair value.

This brings us to Simply Wall St’s proprietary “Fair Ratio.” Unlike a simple comparison to industry or peers, the Fair Ratio incorporates more nuanced factors, including Banc of California’s expected growth, profit margins, relative risk, and its position within the industry and market cap ranges. For Banc of California, the Fair Ratio is 19.4x. The actual PE ratio is 25x, not far off, but since the gap is more than 0.10, it appears the market is paying a slight premium over what may be justified by fundamentals. This suggests the valuation is marginally high based on this measure, but not egregiously so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banc of California Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you put your story to work by connecting your view of Banc of California’s future, such as expected revenue, earnings, and profit margins, to a clear fair value estimate based on your unique assumptions. This approach goes beyond ratios or models, making it possible to ground your investment decision in both a company’s numbers and its real-world context.

On Simply Wall St’s Community page, Narratives are a fast, intuitive tool used by millions of investors to turn outlooks into actionable signals, helping you compare your Fair Value with today’s price to see when it might be time to buy or sell.

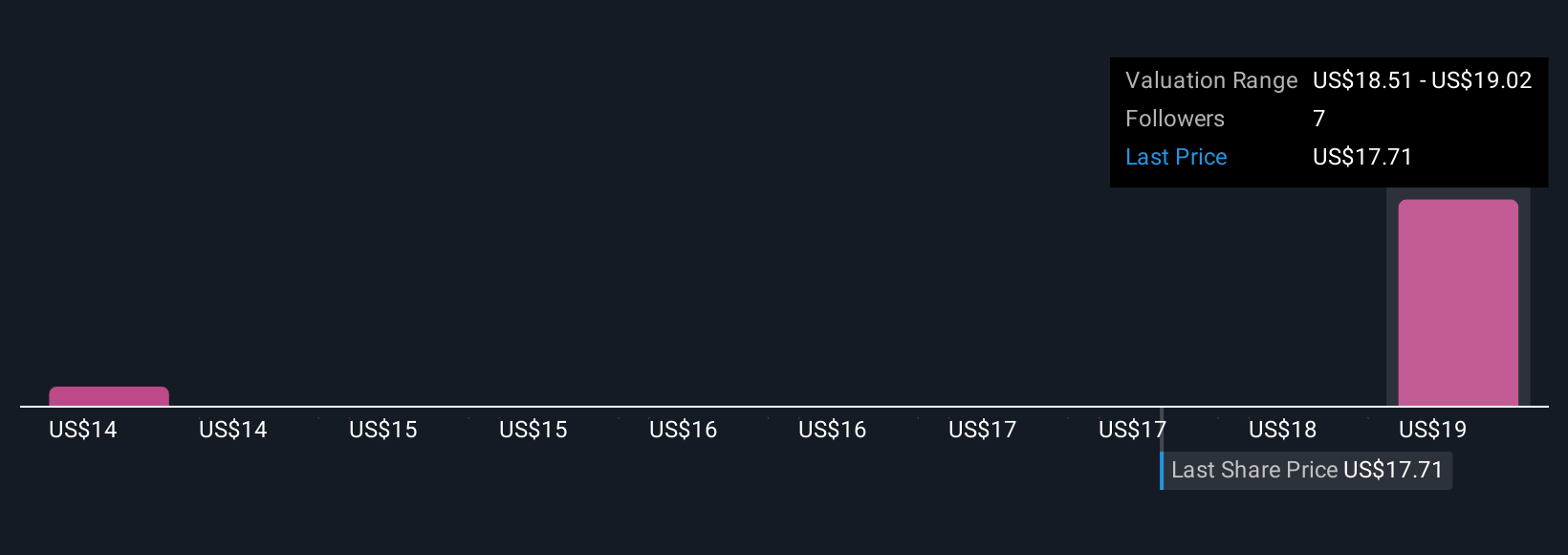

Because Narratives update dynamically as new news and earnings emerge, your perspective remains current. For example, some Banc of California Narratives reflect a bullish outlook with a fair value estimate as high as $21.00, anticipating strong digital transformation and merger synergies. The most cautious project fair value as low as $15.00, focusing on risks around real estate exposure and rising deposit costs. With Narratives, you can see and act on what matters most to you as an investor, not just what the market implies.

Do you think there's more to the story for Banc of California? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives