- United States

- /

- Banks

- /

- NYSE:BANC

Banc of California (BANC): Revisiting Valuation After Buybacks and a New Quarterly Dividend Signal Confidence

Reviewed by Simply Wall St

Management moves signal confidence

Banc of California (BANC) just paired ongoing share buybacks with a fresh quarterly dividend on both common and preferred stock. This is a clear signal that leadership sees the bank’s balance sheet and outlook as solid.

See our latest analysis for Banc of California.

Those moves come as Banc of California trades near a recent 52 week high of 18.97 dollars, with a solid year to date share price return of about 22.7 percent and a 1 year total shareholder return of roughly 13.2 percent. This suggests momentum is building as investors reassess its risk and growth profile.

If this kind of bank story has you thinking bigger, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

Yet with the stock near its 52 week high, trading at a modest discount to analyst targets and intrinsic value estimates, investors must decide: Is Banc of California still undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 7.5% Undervalued

With the narrative fair value sitting around 20.23 dollars versus a last close of 18.71 dollars, the core debate centers on how sustainable its growth really is.

The successful merger integration with Pacific Western Bank is unlocking cost synergies, revenue cross sell opportunities, and scale benefits, which are already contributing to tangible book value expansion and margin improvement and are likely to further boost future profitability.

Want to see what is driving that optimism under the hood? The narrative leans on aggressive revenue gains, surging margins, and a future earnings multiple that looks unusually restrained. Curious which moving parts matter most to this fair value call and how they fit together over time? Read on to unpack the full storyline behind the numbers.

Result: Fair Value of $20.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on successful Pacific Western integration and stable Southern California commercial real estate conditions. Any stumble could quickly pressure margins and asset quality.

Find out about the key risks to this Banc of California narrative.

Another Angle on Valuation

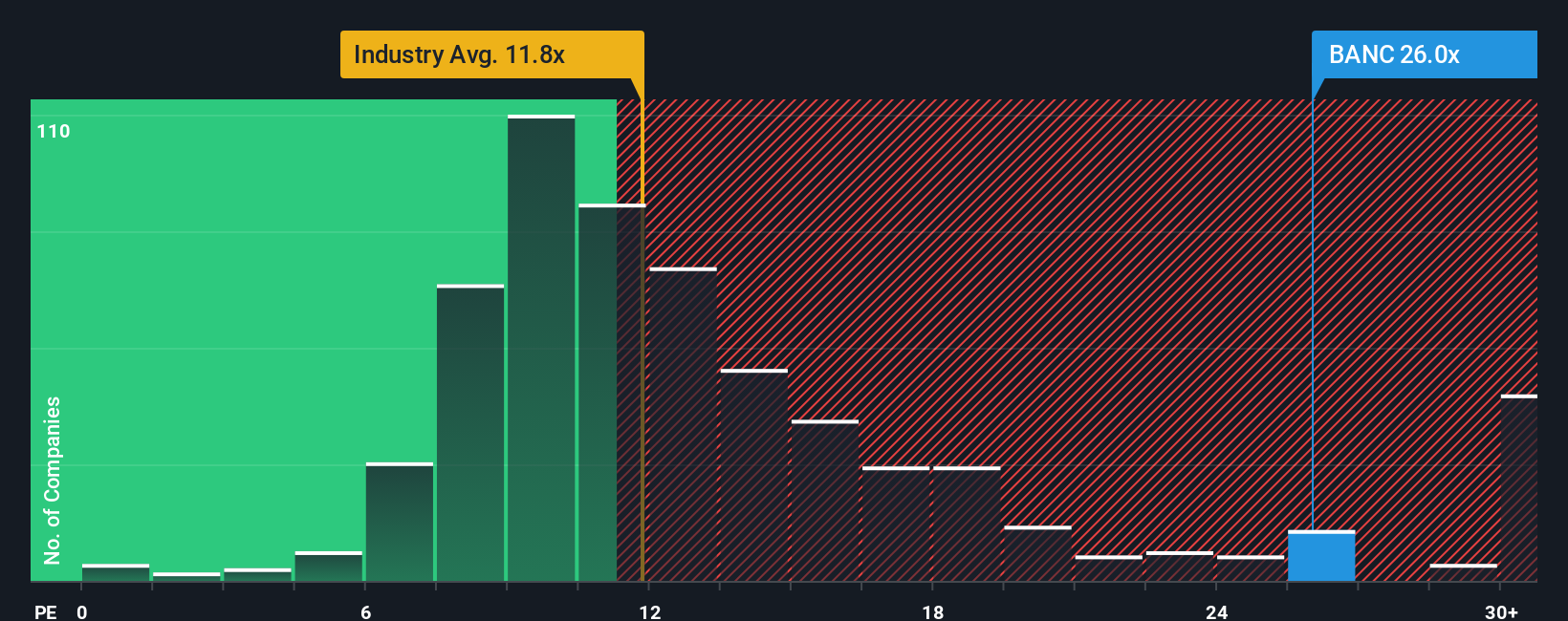

While the narrative fair value points to upside, the earnings ratio paints a more demanding picture. Banc of California trades at about 17.2 times earnings, versus a fair ratio of 16.6 times and an industry average near 11.5 times, so the margin for error looks thin rather than generous.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banc of California Narrative

If this storyline does not quite match your view, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment angles?

Before you move on, consider using the Simply Wall Street Screener to explore additional focused ideas beyond Banc of California today.

- Target cash rich opportunities by scanning these 925 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Explore potential trends by reviewing these 24 AI penny stocks related to developments in artificial intelligence.

- Strengthen your income strategy by focusing on these 14 dividend stocks with yields > 3% that can help support a long term income approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026