- United States

- /

- Banks

- /

- NYSE:BANC

Banc of California (BANC): Revisiting Valuation After Analyst Upgrades and Share Repurchases Drive Renewed Optimism

Reviewed by Kshitija Bhandaru

Several leading brokerage firms have boosted their outlook on Banc of California (BANC), with upgrades and more positive forecasts highlighting the company’s recent share repurchases as well as ongoing improvements in earnings and financial strategy.

See our latest analysis for Banc of California.

Banc of California has been drawing attention lately, not just for its bold share repurchase activity and upbeat analyst sentiment, but also for its strong price action. The stock’s latest share price return is up 17.6% over the past three months, capping off a one-year total shareholder return of 29.0%. Momentum is clearly building as the bank continues to execute on its growth and financial initiatives, with recent milestones such as a 52-week high and new loan programs reinforcing its presence in the market.

If this kind of turnaround story has you thinking bigger, now is the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With analyst upgrades, strong recent returns, and improving fundamentals, is Banc of California’s momentum signaling an undervalued opportunity, or is the stock starting to reflect all of its future growth potential?

Most Popular Narrative: 6.5% Undervalued

With the narrative fair value for Banc of California set at $18.82, analysts see meaningful upside compared to the last close of $17.60. This optimism is rooted in tangible business shifts and presumed synergies that are poised to impact future performance.

"The successful merger integration with Pacific Western Bank is unlocking cost synergies, revenue cross-sell opportunities, and scale benefits. These factors are already contributing to tangible book value expansion and margin improvement, and are likely to further boost future profitability."

Want to know what’s powering this premium price? One key assumption is a dramatic shift in profit margins and future earnings, all tied to strategic growth bets. Get the numbers and see which bold projections make this valuation stand out from the crowd.

Result: Fair Value of $18.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration risks from recent mergers and intense deposit competition could still challenge Banc of California’s growth trajectory and future profitability.

Find out about the key risks to this Banc of California narrative.

Another View: Multiples Raise Caution

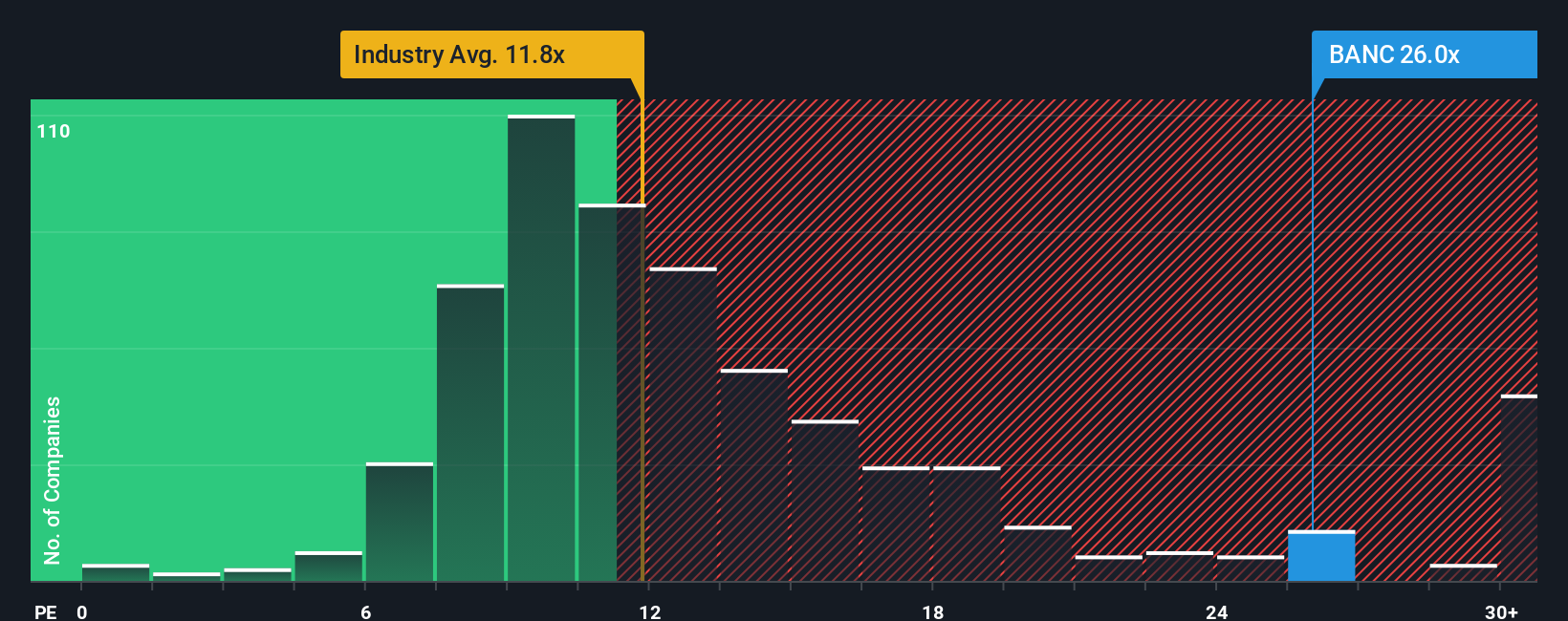

While the narrative fair value looks promising, a different lens suggests caution. Banc of California trades at a price-to-earnings ratio of 25.7x, which is notably higher than its peers at 20.4x and well above the US Banks industry average of 11.7x. Even the ratio’s fair level is estimated at just 19.2x. This marks a sizable gap that signals valuation risk if growth slows. Could recent optimism be pushing prices too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banc of California Narrative

If you see things differently or want to dig into the details yourself, you can quickly shape your own perspective and narrative in just a few minutes. Do it your way

A great starting point for your Banc of California research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Let Simply Wall Street’s powerful Screener guide you to other fast-moving stocks and themes you might otherwise miss.

- Uncover steady income opportunities by checking out these 18 dividend stocks with yields > 3%, featuring companies with robust yields and strong financial track records.

- Jump ahead of the curve with these 26 quantum computing stocks, a tool to find businesses leading in quantum computing innovation and advanced tech breakthroughs.

- Tap into the future of healthcare by exploring these 32 healthcare AI stocks, where AI is transforming patient care and sector growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banc of California might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BANC

Banc of California

Operates as the bank holding company for Banc of California that provides various banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives