- United States

- /

- Banks

- /

- NYSE:BAC

How Bank of America’s Bid for Fannie Mae IPO Spot Impacts Its 2025 Valuation

Reviewed by Bailey Pemberton

Thinking about making a move on Bank of America stock, or just keeping a watchful eye on what’s next? You’re in good company. There has been plenty of buzz in the financial world lately, especially with big banks competing for high-profile deals such as the potential Fannie Mae and Freddie Mac IPOs. Despite all the chatter and those headline-grabbing announcements, including Bank of America’s role in major overseas investments and the steady hand at the top with CEO Brian Moynihan, the stock itself has been on a bit of a rollercoaster.

Over the last year, Bank of America shares have powered ahead by 18.7%, and if you zoom out even further, the five-year return clocks in at a notable 126.7%. Yet, more recently, there has been some cooling off, with a 3.9% drop over the past week and a 3.0% dip in the last 30 days. Even with these shorter-term slides, 2025’s story for the stock is still positive, boasting a 9.8% return year-to-date. That mix of long-term gains and short-term volatility brings up the perennial question: is Bank of America undervalued or are the risks starting to outweigh the rewards?

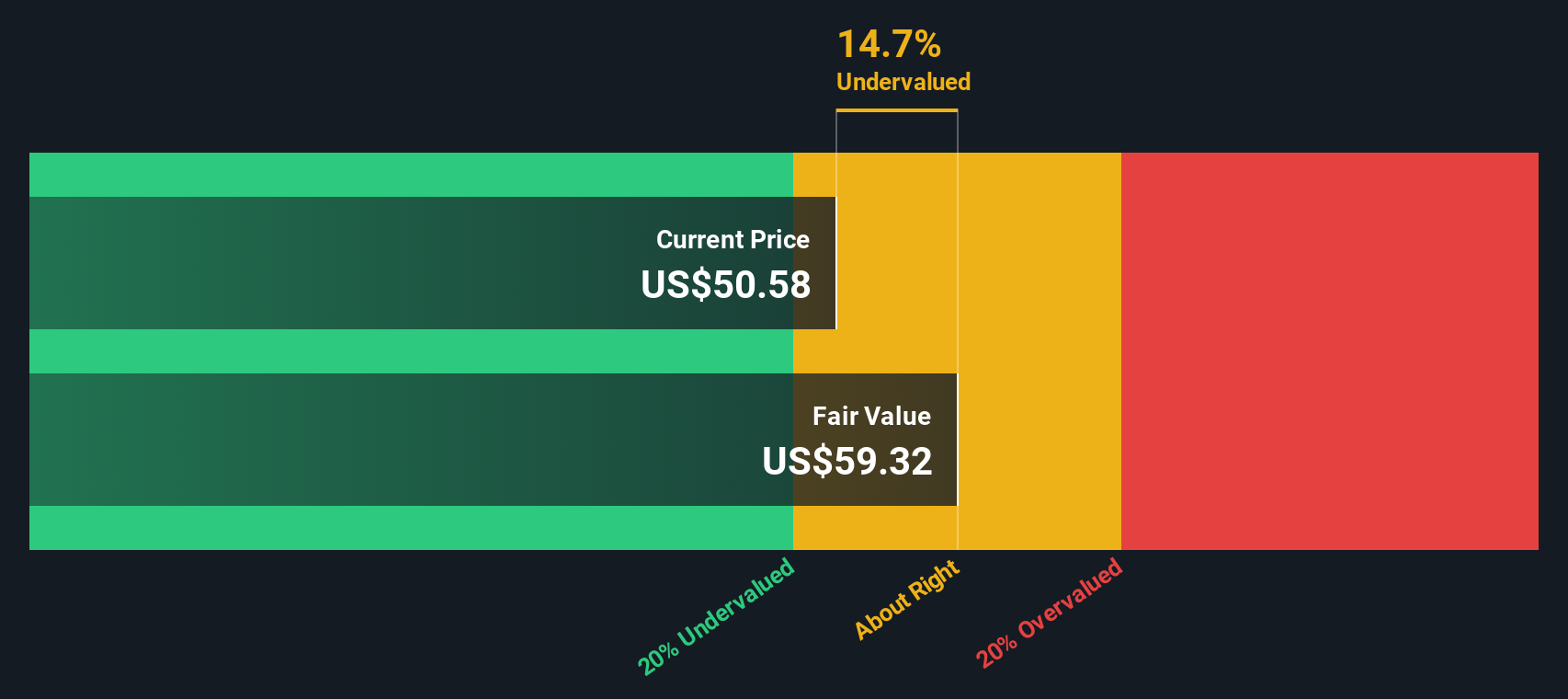

If you’re looking for clear signals, here is a quick valuation snapshot. Bank of America scores a 3 out of 6 on our undervaluation checklist. That suggests there may be some opportunity left, though not a screaming bargain. But what do those numbers actually mean? Let’s break down the different ways analysts value this blue-chip bank, and I’ll share one often-overlooked method for understanding company worth before we’re done.

Why Bank of America is lagging behind its peers

Approach 1: Bank of America Excess Returns Analysis

The Excess Returns model provides a snapshot of how much profit Bank of America is generating above its cost of equity. Effectively, it examines whether the bank’s investments are creating real value for shareholders. This approach focuses on the relationship between earnings, book value, and the required return demanded by investors, offering a more straightforward perspective compared to cash flow models.

Bank of America’s book value currently stands at $37.13 per share, while estimates suggest a stable earnings per share (EPS) of $4.39, based on the consensus of 11 analysts. The cost of equity, or the return required by shareholders, is $3.33 per share. That gives the company an excess return of $1.06 per share, meaning for every share, Bank of America is comfortably earning more than what its investors require. The average future return on equity is projected at 10.81 percent and the stable book value is set to grow towards $40.57 per share, indicating healthy and sustainable profitability.

With this approach, the estimated intrinsic value per share comes in at $61.24. Compared to the current price, this implies Bank of America is about 20.6 percent undervalued according to the Excess Returns model, which may be of interest to value-oriented investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Bank of America is undervalued by 20.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bank of America Price vs Earnings

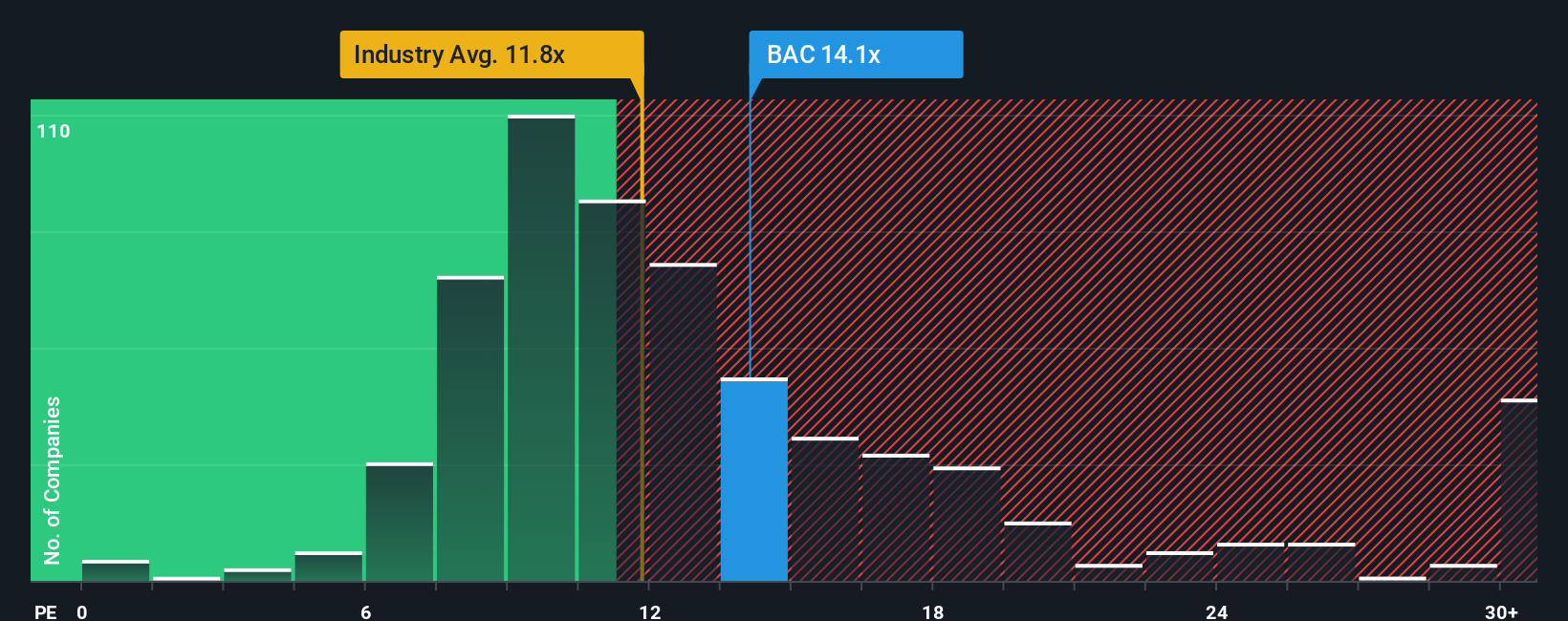

The Price-to-Earnings (PE) ratio is a classic valuation gauge, ideal for profitable companies like Bank of America because it compares the current share price to earnings. This provides a clear lens on what investors are willing to pay for each dollar of profit. The "right" PE is not fixed; it fluctuates based on how quickly a company is expected to grow, how risky its earnings are, and the overall market sentiment. All these factors help define what is reasonable for any given stock.

Currently, Bank of America trades at a PE of 13.5x. For perspective, this is slightly above the average for similar peers at 13.4x, and noticeably higher than the industry-wide banking average of 11.3x. These simple comparisons can be helpful, but they do not fully account for the company’s specific strengths or potential growth drivers.

This is where Simply Wall St’s “Fair Ratio” comes in. It is a proprietary metric designed to factor in not just Bank of America’s earnings growth, but also its profit margins, market cap, industry nuances, and overall risk profile. For Bank of America, the Fair Ratio stands at 16.0x, which is higher than both its actual PE and those broader averages. Because this personalized benchmark weighs more relevant specifics, it is a more powerful tool than simply comparing numbers for the sector or a handful of competitors.

With a Fair Ratio of 16.0x and the actual PE sitting at 13.5x, Bank of America appears to be undervalued on this analysis. This suggests the stock could have room to run if growth expectations play out as anticipated.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bank of America Narrative

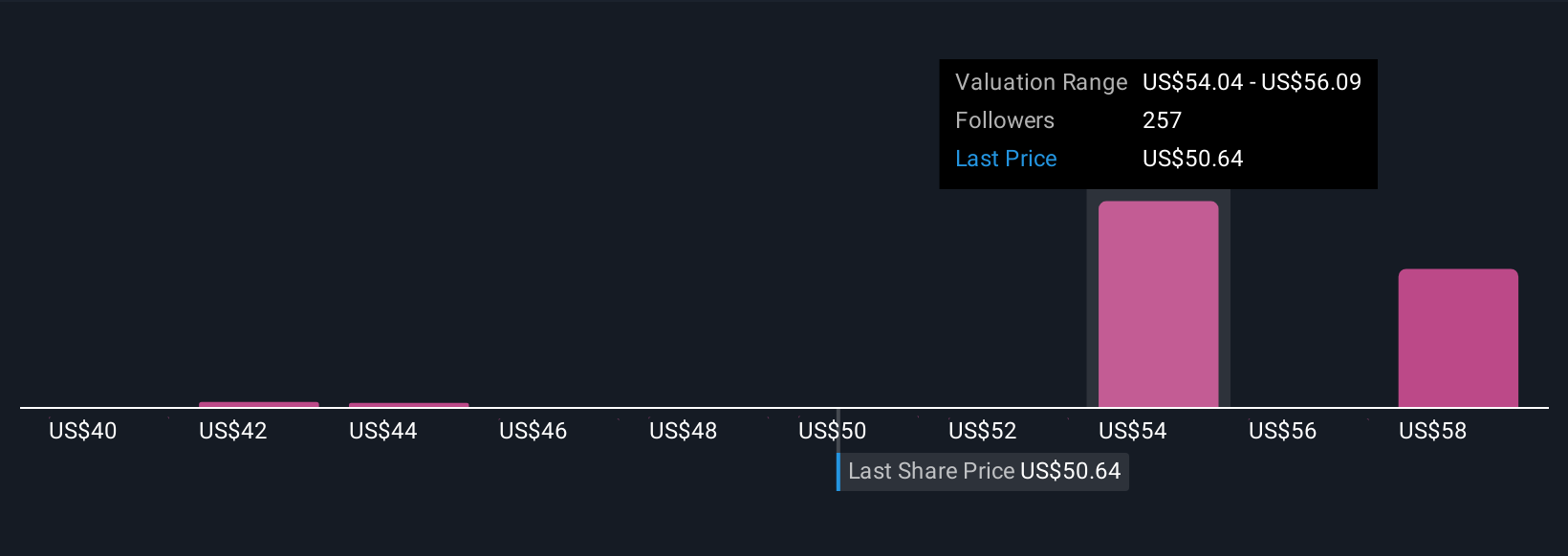

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, what you think Bank of America will achieve, why it will succeed or face challenges, and how numbers like future earnings, revenue growth, and profit margins support your view. Narratives link your personal perspective on what is likely for the business to a financial forecast and then to a fair value for the stock, making your reasoning concrete and actionable.

On Simply Wall St's platform, millions of investors use Narratives within the Community page, turning complex financials into understandable, customizable stories. By building or finding a Narrative, you can instantly see a fair value calculation and discover if it signals the stock is under- or over-valued compared to the current price, empowering you to decide when to buy or sell. Narratives update automatically when new information arrives, including company news, earnings releases, or industry shifts, so your perspective stays up to date with the latest facts. For example, for Bank of America, some investors’ Narratives are bullish, assuming rapid revenue growth and a fair value near $59, while others are more cautious, highlighting risks for a lower fair value close to $43.

For Bank of America, we'll make it really easy for you with previews of two leading Bank of America Narratives:

Fair Value: $55.23

Undervalued by 12.0%

Revenue Growth Rate: 7.4%

- Investment in digital engagement and AI is expected to drive higher customer retention, new client growth, and improved revenue over time.

- Strong capital position supports earnings per share growth. Continued share buybacks and strategic asset management enhance future profitability.

- Main risks include litigation costs, economic and policy uncertainties, and rising competition for deposits. Analysts see shares as fairly priced with modest upside.

Fair Value: $43.34

Overvalued by 12.3%

Revenue Growth Rate: 10.6%

- While Bank of America remains resilient with a strong loan portfolio and increased digital engagement, its sector faces headwinds from interest rate swings and potential regulatory changes.

- Berkshire Hathaway’s reduced stake has led to questions about future profitability and market confidence, adding uncertainty to the outlook.

- Although net interest income is strong for now, any aggressive rate cuts or economic downturn could pressure margins and compress earnings. Fair value estimates are now below the current market price.

Do you think there's more to the story for Bank of America? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives