- United States

- /

- Banks

- /

- NYSE:BAC

BofA (BAC): Margin Expansion Challenges Concerns About Profitability Momentum This Earnings Season

Reviewed by Simply Wall St

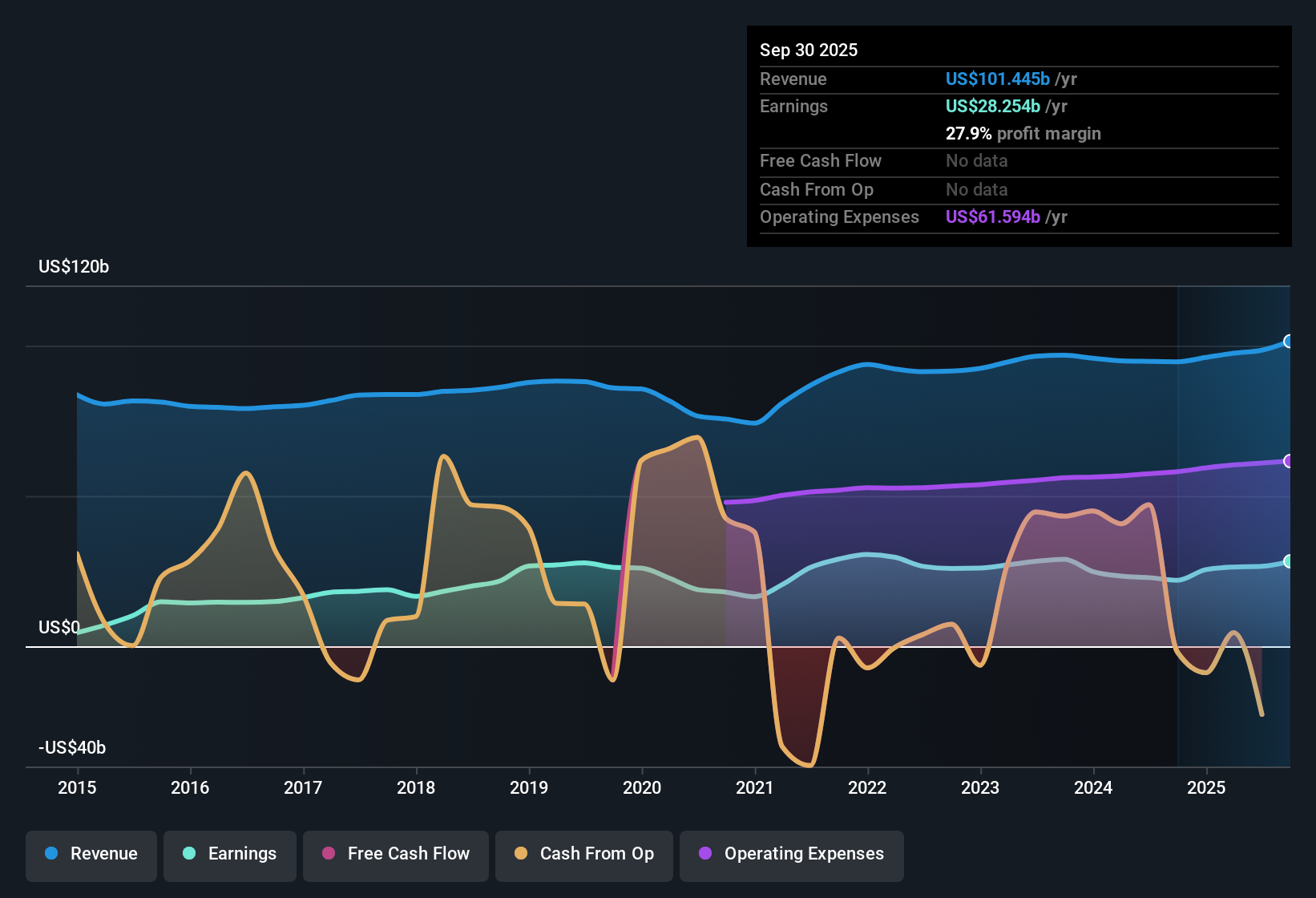

Bank of America (BAC) reported annual earnings growth of 28.8% in the most recent year, far outpacing its five-year average increase of 2.7%. Net profit margin climbed to 27.9% from last year’s 23.2%, with revenue forecast to rise 5.9% per year but still trailing the broader US market and peer averages. Investors are likely to see these healthy margins, high earnings quality, and solid profit growth as key strengths driving sentiment for the stock’s current valuation.

See our full analysis for Bank of America.Next up, we will see how these headline results compare to the bigger narratives shaping opinion on Bank of America. This includes examining which stories hold up and which might fall short.

See what the community is saying about Bank of America

Analyst Forecasts Signal Slower Revenue Growth Than Peers

- Analysts project Bank of America's top line to grow 5.9% per year going forward, which trails both broader US market and peer averages. This puts Bank of America on the lower end of growth expectations despite the latest profit acceleration.

- According to the analysts' consensus view, while investments in digital engagement and AI may help lift customer retention and unlock new revenue streams over time,

- the reality is that forecast revenue growth lags the sector. This suggests the bank’s future advantage may depend more on operational efficiency and cost management rather than outright top-line gains.

- Consensus also acknowledges that, with profit margins expected to marginally contract from 27.0% to 26.9% by 2028, realizing outsized gains will require strategic execution alongside technological investment.

- Curious how the bank’s digital transformation could impact its future? Dive into the full narrative and see what else analysts are saying. 📊 Read the full Bank of America Consensus Narrative.

Valuation Premium Persists Despite Slim Upside

- At a share price of $52.28, Bank of America is trading below its DCF fair value of $61.25 but still commands a higher price-to-earnings ratio (14.0x) than the US Banks industry average (11.9x) and peers. The consensus price target is just 7.8% above current levels at $56.35.

- Analysts' consensus view points out that, even with supportive earnings quality and sound capital levels,

- the modest gap between current pricing and consensus target suggests investors see the stock as fairly valued given these industry headwinds and tempered future growth.

- Share repurchases, forecast to shrink the share count by 3.47% per year over three years, provide some potential uplift. However, valuation multiples remain at a premium relative to most peers.

No Major Risks Flagged but Litigation and Competition Loom

- EDGAR filings and risks data reveal that while there are currently no major red-flag risks or signs of substantial insider selling, increased litigation costs and heightened deposit competition are expected to put pressure on margins and noninterest expenses in the coming years.

- Analysts' consensus narrative calls out concerns that economic fluctuations, such as slower GDP growth and stagnant policy rates, could heighten these pressures,

- with litigation specifically spotlighted for its potential to drive up noninterest expenses and reduce net income if recent trends persist.

- Rising competition for deposits may also necessitate higher rates paid to customers, which could curb net interest income and impact future profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of America on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Share your perspective and shape a personalized narrative in just a few minutes. Do it your way

A great starting point for your Bank of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Bank of America boasts strong recent earnings, its revenue growth lags peers and valuation remains stretched. Analysts currently forecast limited upside.

If you would rather target opportunities with more attractive pricing and greater upside potential, use these 870 undervalued stocks based on cash flows to discover companies that may be trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives