- United States

- /

- Banks

- /

- NYSE:AX

We Ran A Stock Scan For Earnings Growth And Axos Financial (NYSE:AX) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Axos Financial (NYSE:AX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Axos Financial with the means to add long-term value to shareholders.

See our latest analysis for Axos Financial

How Quickly Is Axos Financial Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Axos Financial has grown EPS by 21% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

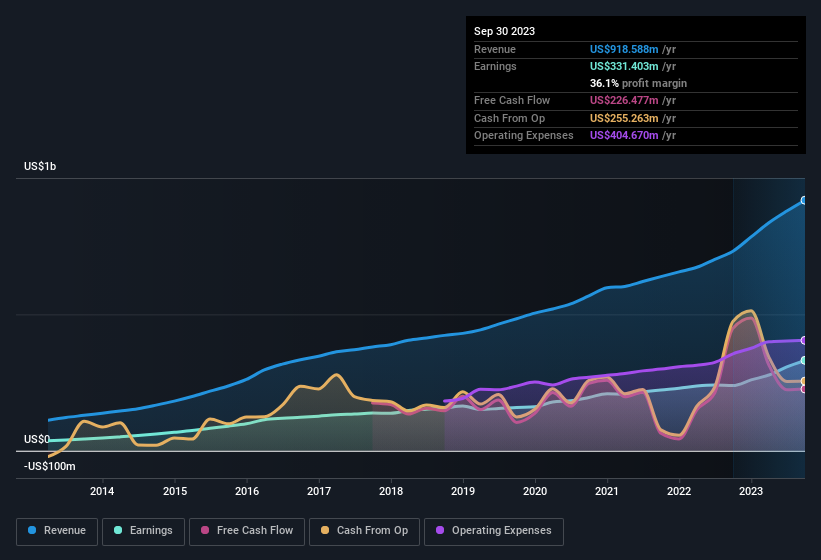

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Axos Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Axos Financial achieved similar EBIT margins to last year, revenue grew by a solid 26% to US$919m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Axos Financial's future profits.

Are Axos Financial Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Axos Financial insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$296m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is Axos Financial Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Axos Financial's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Even so, be aware that Axos Financial is showing 1 warning sign in our investment analysis , you should know about...

Although Axos Financial certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AX

Axos Financial

Operates as a consumer and business banking provider in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026