- United States

- /

- Banks

- /

- NYSE:AUB

Did Janney’s Analyst Endorsement Just Shift Atlantic Union Bankshares’ (AUB) Investment Narrative?

Reviewed by Sasha Jovanovic

- Janney Montgomery Scott recently initiated coverage on Atlantic Union Bankshares, assigning a Buy rating and pointing to the company’s consistent profitability, credit quality, and potential to expand its market presence in the Mid-Atlantic region.

- This new coverage aligns with positive opinions from other analysts, indicating growing confidence in Atlantic Union Bankshares’ ability to compete with larger regional institutions.

- We'll explore how this analyst endorsement, focusing on market share gains, could influence the current investment narrative for Atlantic Union Bankshares.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Atlantic Union Bankshares Investment Narrative Recap

To be a shareholder in Atlantic Union Bankshares, you need conviction in the company’s ability to leverage its market presence in the Mid-Atlantic, integrate past acquisitions, and sustain profitable growth, even as the industry faces ongoing digital transformation and regional economic uncertainties. The recent analyst endorsement by Janney Montgomery Scott reinforces the market share expansion narrative; however, it does not materially reduce the biggest short-term risk: integration challenges and cost controls associated with growth after major mergers like Sandy Spring. Among recent company announcements, the appointment of Bradley S. Haun as Chief Risk Officer, following the Sandy Spring and American National acquisitions, stands out. This move arrives as Atlantic Union focuses on risk management and integration success, key factors underpinning the bank's largest near-term catalyst, extracting value and cost synergies from its expanding footprint while maintaining credit quality. By contrast, investors should be aware of the distinct risks from possible regional economic shocks, which could...

Read the full narrative on Atlantic Union Bankshares (it's free!)

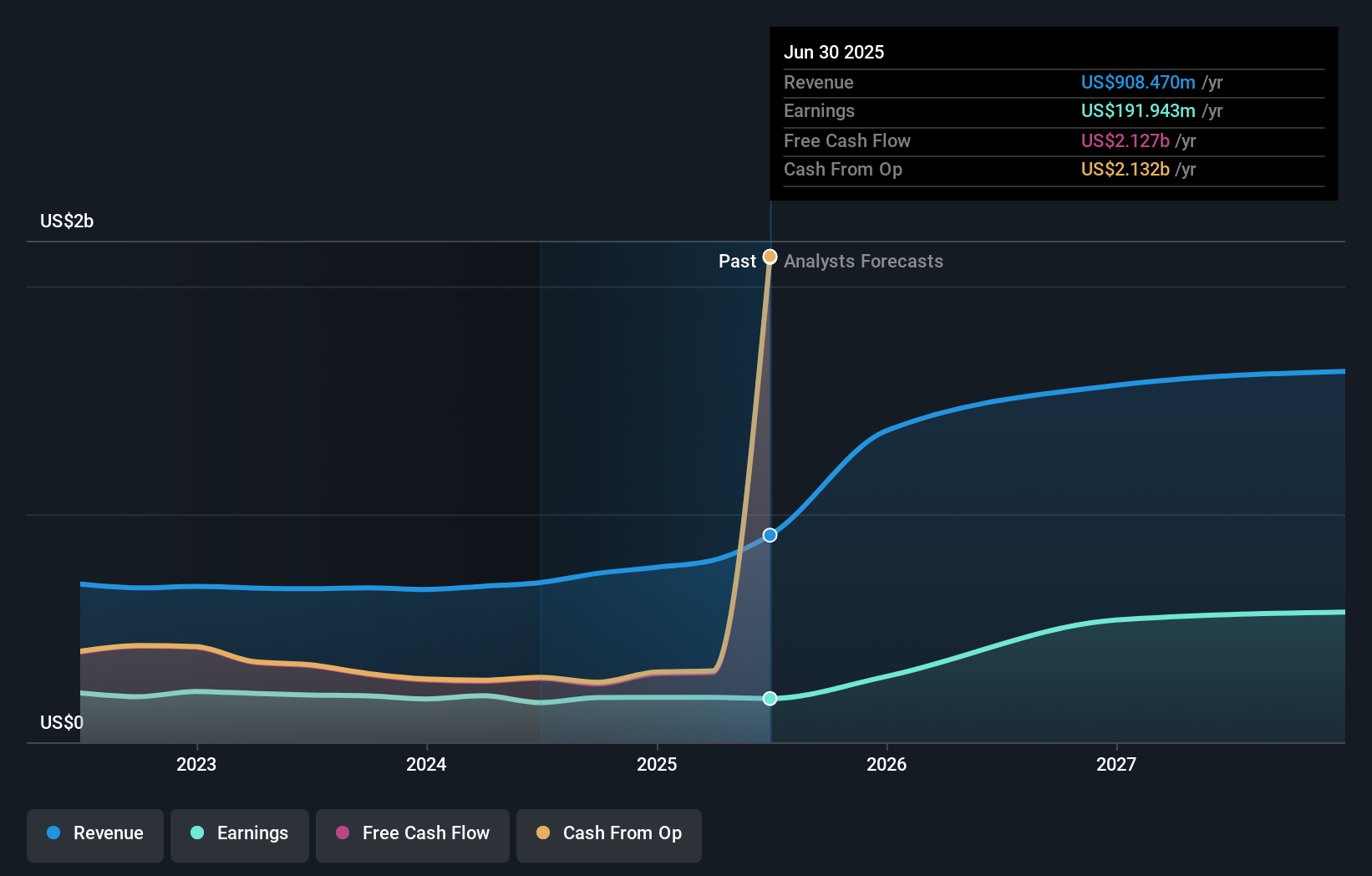

Atlantic Union Bankshares' narrative projects $1.9 billion in revenue and $806.7 million in earnings by 2028. This requires 28.7% yearly revenue growth and a $614.8 million earnings increase from the current $191.9 million.

Uncover how Atlantic Union Bankshares' forecasts yield a $40.62 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five different fair value views from the Simply Wall St Community range from US$25.40 to over US$45.41 per share. These diverse outlooks come as Atlantic Union's ability to execute its post-merger integration will play a critical role in shaping future results, explore more perspectives to inform your own view.

Explore 5 other fair value estimates on Atlantic Union Bankshares - why the stock might be worth 30% less than the current price!

Build Your Own Atlantic Union Bankshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atlantic Union Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlantic Union Bankshares' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AUB

Atlantic Union Bankshares

Operates as the bank holding company for Atlantic Union Bank that provides banking and related financial products and services to consumers and businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives