- United States

- /

- Banks

- /

- NYSE:ASB

Associated Banc-Corp (ASB): Valuation Review After Prime Rate Cut and Earnings Surprise

Reviewed by Kshitija Bhandaru

If you are watching Associated Banc-Corp (NYSE:ASB), this week brought some news that could shake up your view of the stock. The company just announced a reduction in its prime lending rate from 7.50% to 7.25%, an operational move that may make borrowing more attractive for customers. Alongside the rate cut, Associated Banc-Corp released quarterly earnings that beat analyst expectations on both revenue and earnings per share. These decisions are meaningful for investors trying to gauge both near-term profitability and the bank’s long-term growth path.

These events land at a time of positive momentum for the stock. Over the past year, shares are up 26% and have gained 11% year-to-date, outpacing many peers in the regional banking sector. While earnings and revenue growth have both seen strong results recently, periods of insider selling and ongoing pressures on revenue growth have kept some investors cautious. Still, the overall trajectory, boosted by a solid three-year return, suggests the market is watching carefully for signs of sustained improvement.

After the latest move and robust results, is the market accurately pricing in growth for Associated Banc-Corp, or is there more value yet to be tapped?

Most Popular Narrative: 8.1% Undervalued

The most widely followed valuation narrative suggests Associated Banc-Corp is trading below fair value, with analysts projecting an 8.1% discount compared to their modeled price target.

The company's strategic pivot toward growing commercial and industrial (C&I) lending, replacing lower-yielding residential balances with higher-yielding, relationship-focused assets, is driving record net interest income and margin expansion. This positions the balance sheet for sustained profitability growth and is likely to positively impact revenue and net margins.

Want to uncover what lies behind this bullish valuation? The secret is a handful of aggressive financial forecasts, along with some surprising assumptions about future margins and growth. Curious which banking metric has analysts this optimistic? The full narrative lifts the curtain on these bold projections.

Result: Fair Value of $28.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges remain if deposit growth falters or commercial lending faces economic headwinds. Either of these factors could quickly undermine the bullish outlook.

Find out about the key risks to this Associated Banc-Corp narrative.Another View: Multiples Tell a Different Story

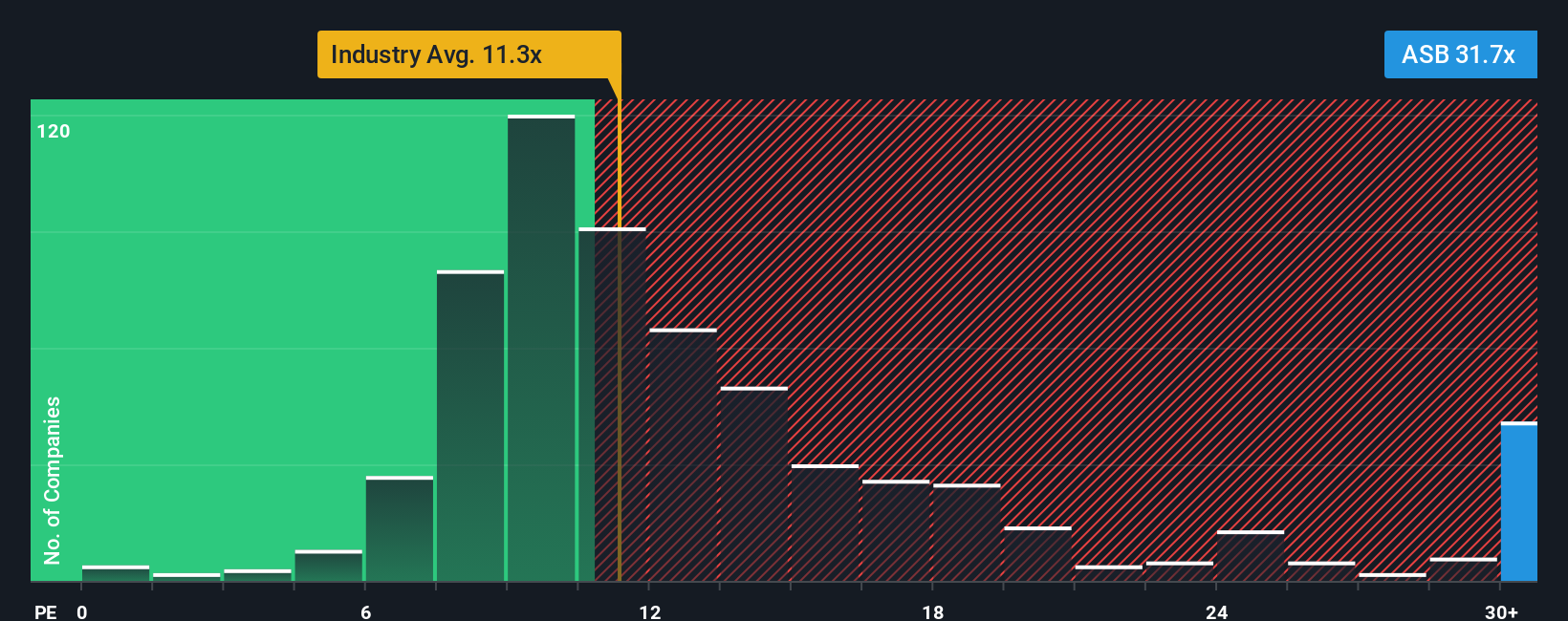

While one narrative sees Associated Banc-Corp as undervalued, comparing its price-to-earnings ratio with the industry suggests the shares are actually expensive versus regional bank peers. Are investors willing to pay up for future growth, or does this signal overheated optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Associated Banc-Corp Narrative

If you see things differently or want a deeper dive into the numbers, you can craft a personalized view in just a few minutes. Do it your way

A great starting point for your Associated Banc-Corp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your watchlist with stocks that match your investing priorities using our tailored screeners on Simply Wall St.

- Target reliable income streams by checking out companies offering steady payouts through our dividend stocks with yields > 3%.

- Uncover future disruptors shaping finance and technology by exploring innovative picks via our AI penny stocks.

- Chase value opportunities and identify businesses trading below their true worth thanks to the power of our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives