- United States

- /

- Banks

- /

- NYSE:ASB

Associated Banc-Corp (ASB) Forecasts 33% EPS Growth, Challenging Skepticism Over Past Earnings Declines

Reviewed by Simply Wall St

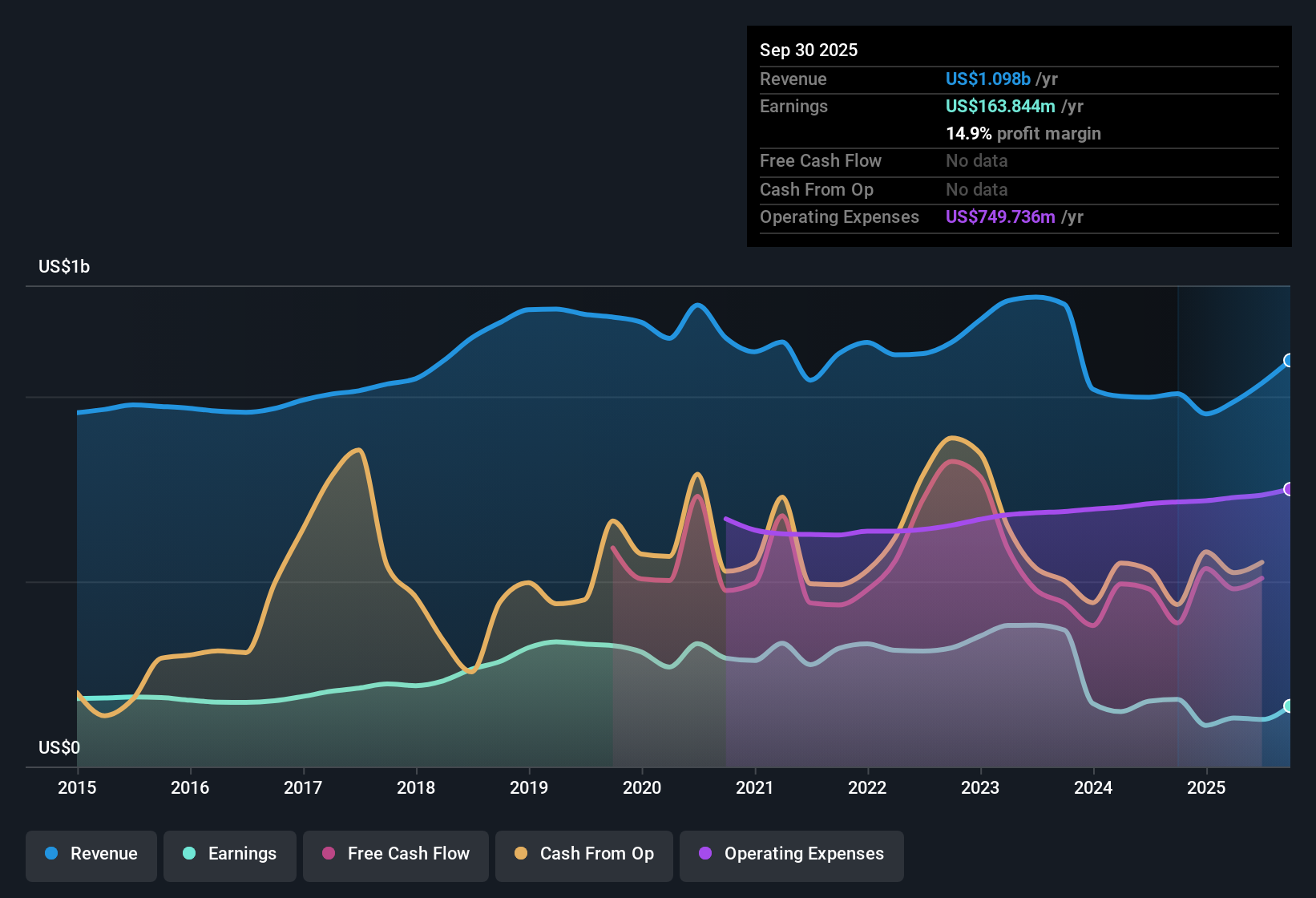

Associated Banc-Corp (ASB) is set for an earnings comeback, with forecasts pointing to 33.2% annual EPS growth and 14.9% annual revenue growth over the next three years. This is notably ahead of the US market’s 10% revenue pace. Despite this upbeat outlook, the company’s earnings have actually declined by 16% per year over the past five years, and profit margins have narrowed to 14.9% from 18% a year ago. While investors may be drawn to the attractive dividend and improving growth narrative, the premium price-to-earnings ratio and compressed margins provide reasons for both optimism and caution.

See our full analysis for Associated Banc-Corp.Next up, we’ll see how these results stack up against the latest narratives. Sometimes the numbers reinforce the story; other times they bring a fresh perspective.

See what the community is saying about Associated Banc-Corp

Efficiency Ratio Holds Firm at 56%

- The company’s efficiency ratio is below 56%, signifying that operating costs remain tightly managed relative to revenue generation.

- Analysts’ consensus view highlights that ongoing investment in digital technology and focus on disciplined expense management are streamlining costs and boosting margins.

- Improved digital platforms are driving customer satisfaction while supporting cost control, laying groundwork for sustained operating leverage.

- Return on equity benefits as management channels resources toward technology and incremental buybacks, directly reflected in the improved efficiency ratio.

What’s driving profitability surprises and risk discipline? See how they play into the full consensus narrative below. 📊 Read the full Associated Banc-Corp Consensus Narrative.

PE Multiple Sits at 25.5x, Above Peers

- Associated Banc-Corp’s price-to-earnings ratio stands at 25.5x, placing it meaningfully above both the peer group and broader US Banks industry averages.

- Analysts’ consensus view notes that the premium multiple reflects expectations for robust earnings rebound and high quality of profits, but also signals caution:

- The share price of $25.59 remains below DCF fair value ($43.81), creating a valuation gap that could close if projected growth and margins materialize.

- While investors may be reassured by the attractive dividend and forward revenue growth, premium valuation heightens sensitivity to future margin or growth disappointments.

Deposit Growth Fuels Margin Expansion

- Record inflows into core deposits are supporting lower funding costs, shoring up net interest margins amidst commercial and industrial lending expansion.

- Analysts’ consensus view points to strong Midwest market dynamics alongside organic customer acquisition as primary catalysts:

- These trends are expected to generate long-term fee income and position the bank for sustained revenue growth, even as competition for deposits and regulatory pressures require ongoing vigilance.

- The consensus narrative underscores that strategic pivot to higher-yielding assets is already producing margin improvements, but future risks around funding stability and sector competition remain in focus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Associated Banc-Corp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the numbers? In just a few minutes, you can craft and share your own perspective. Do it your way

A great starting point for your Associated Banc-Corp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Although Associated Banc-Corp is positioned for profit recovery, its premium valuation and shrinking margins highlight both vulnerability to disappointments and uncertainty about the future.

Look for better value and greater upside by checking out these 877 undervalued stocks based on cash flows where companies trade below fair value and offer a stronger margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)