- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

3 Companies That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As the United States stock market navigates uncertainties such as potential government shutdowns and fluctuating commodity prices, major indices like the Dow Jones, Nasdaq, and S&P 500 have shown resilience with recent gains. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer value beyond current market perceptions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (TTD) | $49.64 | $96.49 | 48.6% |

| Phibro Animal Health (PAHC) | $39.15 | $77.67 | 49.6% |

| Northwest Bancshares (NWBI) | $12.43 | $24.41 | 49.1% |

| NeuroPace (NPCE) | $10.24 | $20.04 | 48.9% |

| Metropolitan Bank Holding (MCB) | $75.44 | $150.26 | 49.8% |

| Investar Holding (ISTR) | $23.13 | $44.89 | 48.5% |

| Horizon Bancorp (HBNC) | $16.13 | $31.76 | 49.2% |

| Glaukos (GKOS) | $81.28 | $161.55 | 49.7% |

| Customers Bancorp (CUBI) | $65.60 | $131.16 | 50% |

| AbbVie (ABBV) | $223.16 | $438.05 | 49.1% |

Let's dive into some prime choices out of the screener.

Phibro Animal Health (PAHC)

Overview: Phibro Animal Health Corporation is an animal health and mineral nutrition company with operations across the United States, Latin America and Canada, Europe, the Middle East, Africa and the Asia Pacific, with a market cap of approximately $1.57 billion.

Operations: Phibro Animal Health's revenue is primarily derived from its Animal Health segment at $962.80 million, followed by Mineral Nutrition at $253.24 million and Performance Products at $80.18 million.

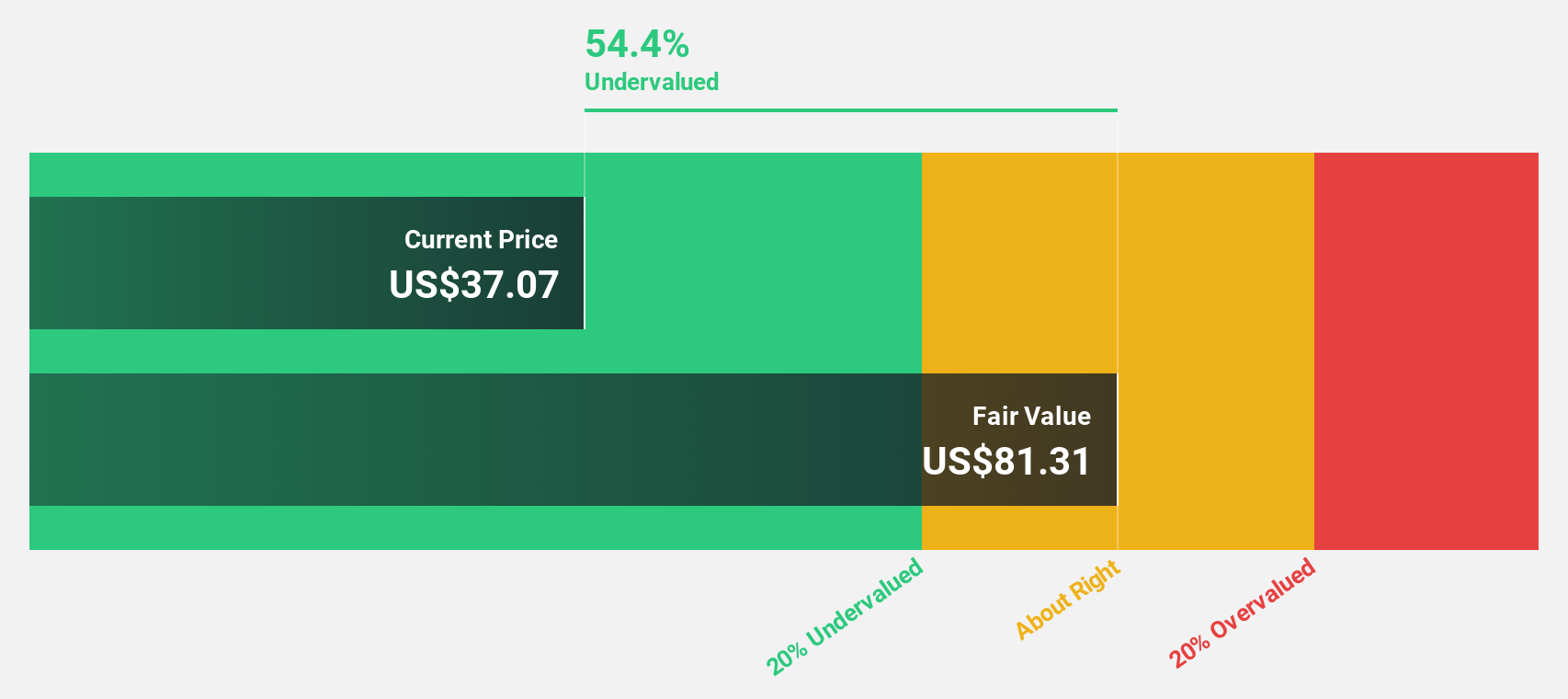

Estimated Discount To Fair Value: 49.6%

Phibro Animal Health appears undervalued, trading at $39.15, significantly below its estimated fair value of $77.67. Despite revenue growth forecasts of 5.6% annually—below the US market average—earnings are expected to grow robustly at 26.6% per year, outpacing the market's 15.4%. Recent earnings reports show a substantial increase in net income and EPS compared to last year, indicating strong cash flow potential despite debt coverage concerns by operating cash flow.

- Upon reviewing our latest growth report, Phibro Animal Health's projected financial performance appears quite optimistic.

- Take a closer look at Phibro Animal Health's balance sheet health here in our report.

Northwest Bancshares (NWBI)

Overview: Northwest Bancshares, Inc. is the bank holding company for Northwest Bank, offering personal and business banking solutions in the United States, with a market cap of approximately $1.83 billion.

Operations: The company generates revenue of $561.86 million from its banking segment, providing a range of financial services in the United States.

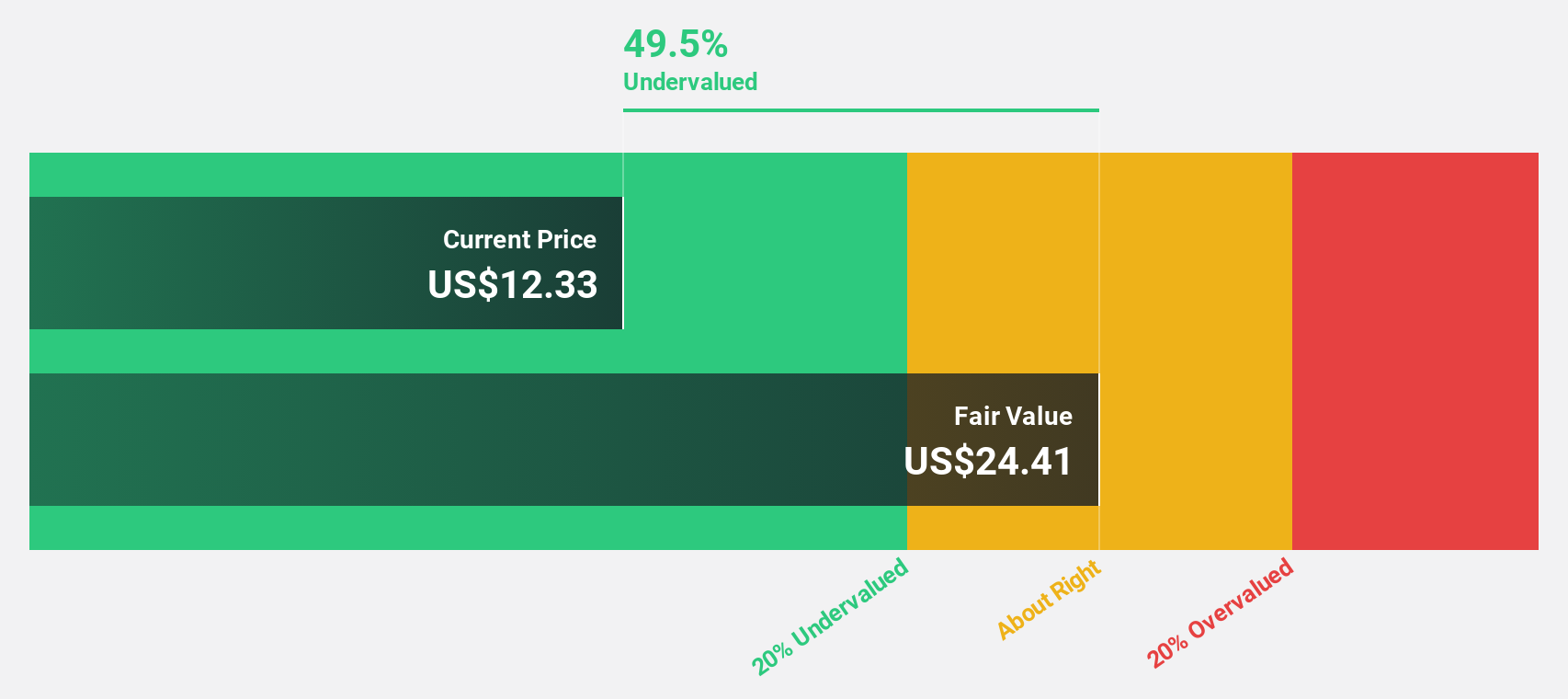

Estimated Discount To Fair Value: 49.1%

Northwest Bancshares is trading at US$12.43, significantly below its estimated fair value of US$24.41, suggesting it may be undervalued based on cash flows. Recent earnings reports highlight a substantial increase in net income and EPS compared to last year, reflecting strong cash flow potential. However, the dividend track record remains unstable despite positive growth forecasts for revenue and earnings that exceed the broader market's expectations over the next few years.

- According our earnings growth report, there's an indication that Northwest Bancshares might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Northwest Bancshares.

Associated Banc-Corp (ASB)

Overview: Associated Banc-Corp is a bank holding company offering a range of banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota with a market cap of approximately $4.26 billion.

Operations: The company's revenue segments include Community, Consumer, and Business with $991.89 million, Corporate and Commercial Specialty with $532.26 million, and Risk Management and Shared Services with -$488.18 million.

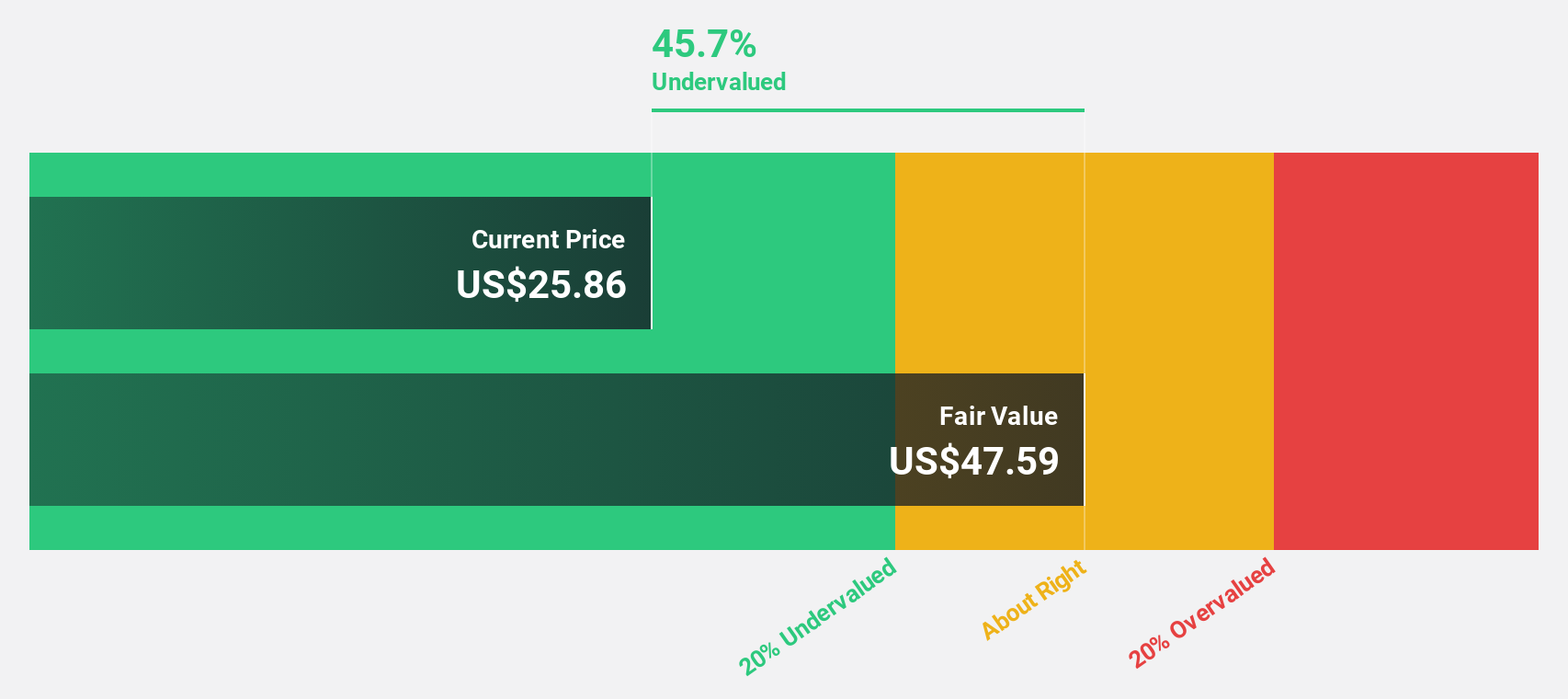

Estimated Discount To Fair Value: 35.8%

Associated Banc-Corp is trading at US$25.94, well below its estimated fair value of US$40.39, which highlights potential undervaluation based on cash flows. Despite a decline in profit margins from 17.7% to 12.3%, earnings are forecast to grow significantly at 43.7% annually, surpassing market expectations of 15.4%. However, recent insider selling and a dividend that may not be fully covered by earnings present risks for investors seeking stability amidst strong growth prospects in net interest income and overall earnings.

- Insights from our recent growth report point to a promising forecast for Associated Banc-Corp's business outlook.

- Get an in-depth perspective on Associated Banc-Corp's balance sheet by reading our health report here.

Taking Advantage

- Delve into our full catalog of 196 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives