- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Three High Growth US Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences gains fueled by optimism over potential interest rate cuts, investors are increasingly looking for opportunities in high-growth companies with strong insider ownership. In this environment, stocks that combine robust growth prospects with significant insider stakes can offer compelling investment opportunities due to the alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 24.7% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Duolingo (NasdaqGS:DUOL) | 15% | 47.9% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Here's a peek at a few of the choices from the screener.

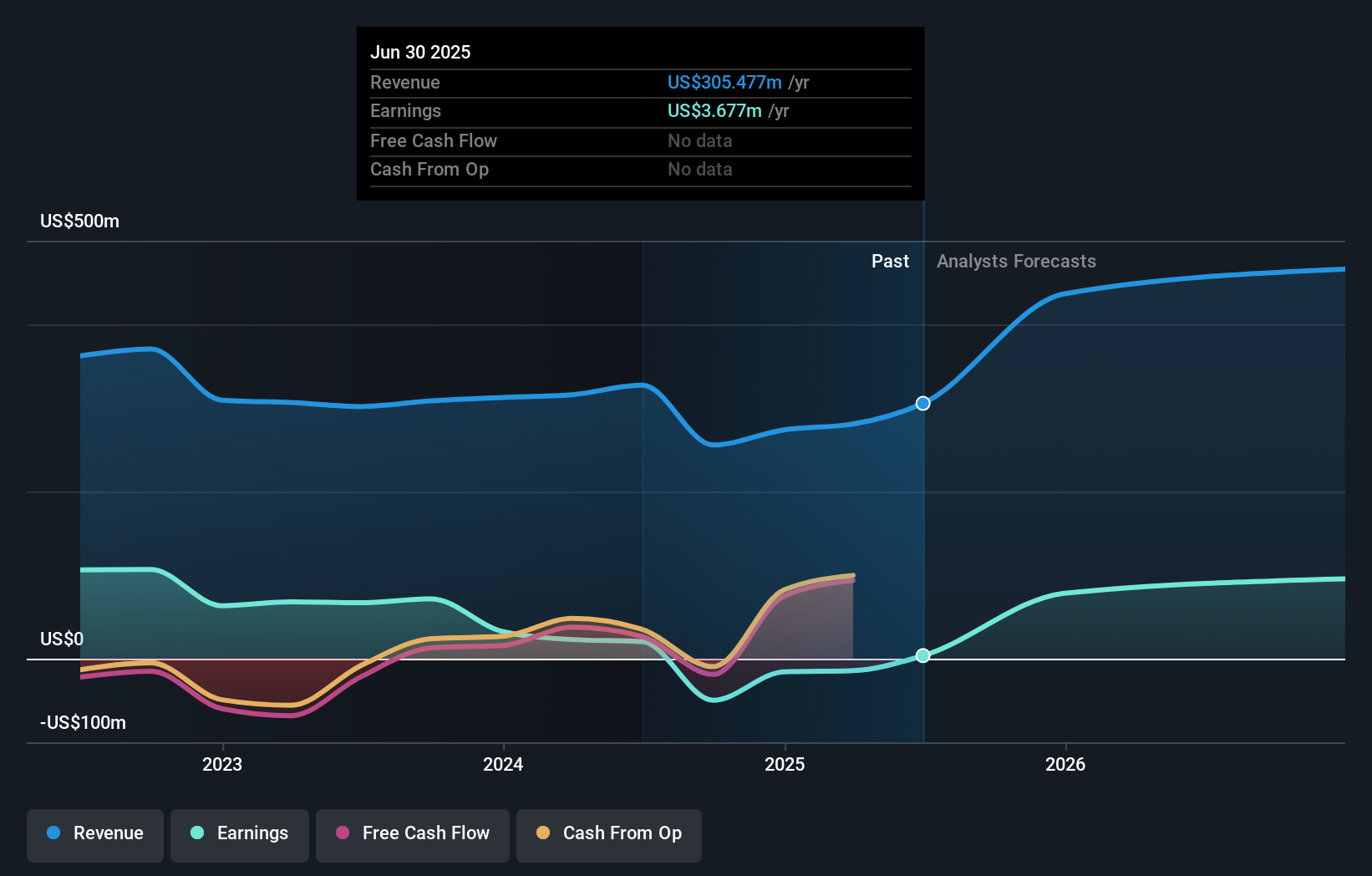

Lindblad Expeditions Holdings (NasdaqCM:LIND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings, Inc. offers marine expedition adventures and travel experiences globally and has a market cap of $472.70 million.

Operations: Lindblad generates revenue through its marine expedition adventures, which brought in $400.22 million, and its land experiences segment, contributing $179.55 million.

Insider Ownership: 31.6%

Lindblad Expeditions Holdings, known for its high insider ownership, recently expanded its fleet with two new Galápagos vessels and appointed experienced directors Annette Reavis and Andy Stuart. Despite a net loss of US$3.98 million in Q1 2024, the company forecasts significant earnings growth of 113.99% per year and expects to become profitable within three years. Insider activity has been positive with substantial buying over the past three months, indicating confidence in future prospects.

- Take a closer look at Lindblad Expeditions Holdings' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Lindblad Expeditions Holdings' share price might be too optimistic.

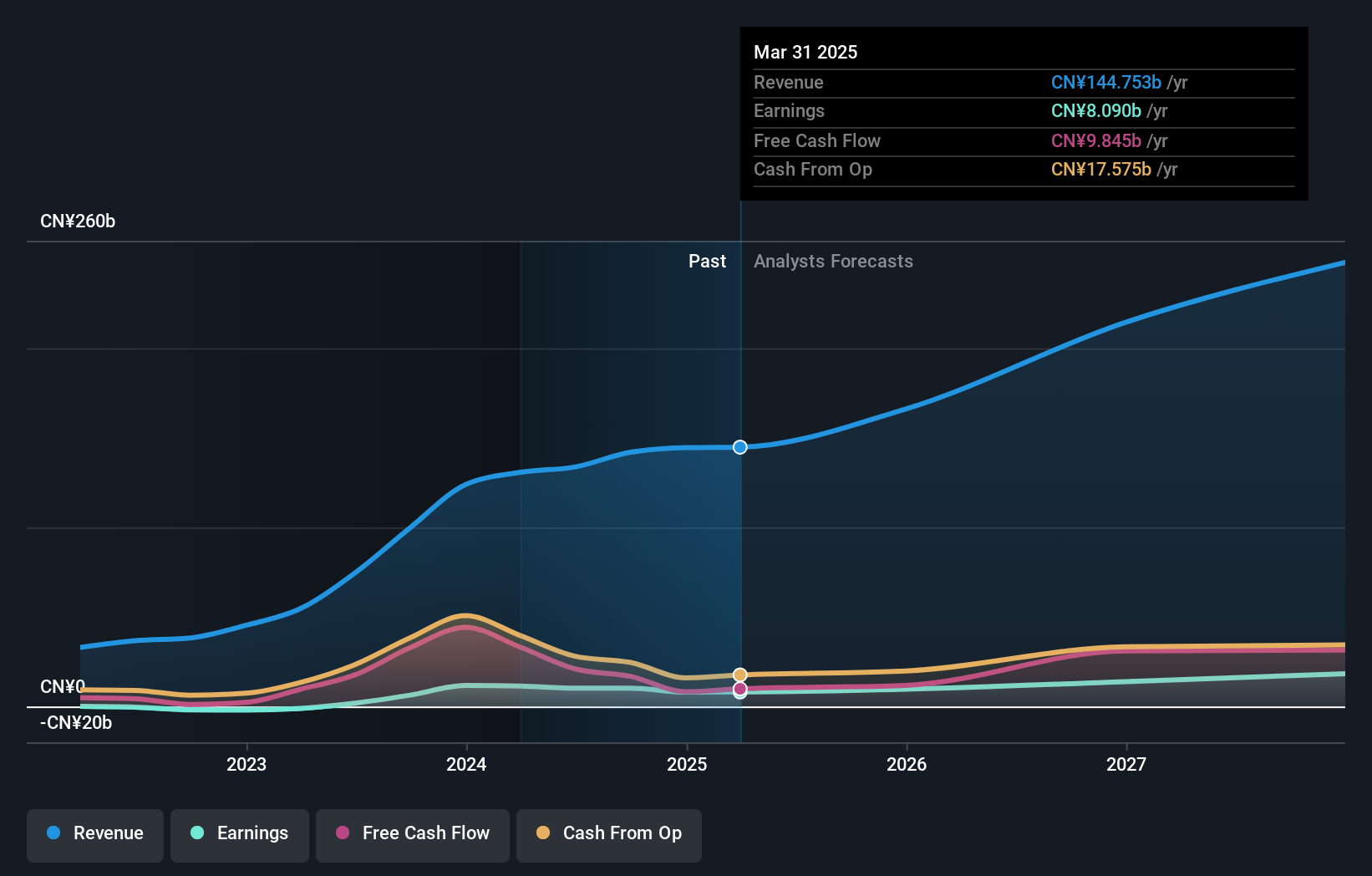

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China and has a market cap of approximately $20.47 billion.

Operations: The company generates revenue primarily from its auto manufacturing segment, which amounted to CN¥130.70 billion.

Insider Ownership: 29.3%

Li Auto, a growth company with high insider ownership, is forecast to achieve significant revenue and earnings growth, outpacing the US market. Despite recent legal challenges and a revised delivery outlook affecting its stock price, the company reported strong sales figures for June 2024 with 47,774 vehicles delivered. Li Auto's valuation appears attractive as it trades below fair value estimates. The company's return on equity is expected to remain low at 18.3% in three years.

- Click here to discover the nuances of Li Auto with our detailed analytical future growth report.

- Our valuation report here indicates Li Auto may be undervalued.

Amerant Bancorp (NYSE:AMTB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amerant Bancorp Inc., with a market cap of $730.04 million, operates as the bank holding company for Amerant Bank, N.A.

Operations: Amerant Bancorp generates $327.31 million from its banking segment.

Insider Ownership: 12.5%

Amerant Bancorp, with high insider ownership, is forecast to grow earnings at 72.67% per year, significantly outpacing the US market. Despite reporting a net income drop to US$4.96 million for Q2 2024 and impairments totaling nearly US$3.74 million, the company continues its share buyback program and declared a $0.09 per-share dividend payable in August 2024. However, profit margins have declined from last year’s figures and revenue growth is expected to be moderate at 12.9% annually.

- Unlock comprehensive insights into our analysis of Amerant Bancorp stock in this growth report.

- In light of our recent valuation report, it seems possible that Amerant Bancorp is trading beyond its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 184 Fast Growing US Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Reasonable growth potential and slightly overvalued.