- United States

- /

- Commercial Services

- /

- NYSE:MEG

Exploring July 2025's Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has shown a robust 17% increase over the past year with earnings forecasted to grow by 15% annually. In this environment, identifying stocks that are potentially undervalued with notable insider activity can provide investors with intriguing opportunities for growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 30.25% | ★★★★★★ |

| Columbus McKinnon | NA | 0.5x | 36.93% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 35.19% | ★★★★★☆ |

| Citizens & Northern | 11.1x | 2.7x | 48.44% | ★★★★☆☆ |

| Southside Bancshares | 10.8x | 3.6x | 41.69% | ★★★★☆☆ |

| S&T Bancorp | 11.0x | 3.7x | 44.59% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 34.00% | ★★★★☆☆ |

| Farmland Partners | 7.0x | 8.5x | -35.02% | ★★★☆☆☆ |

| BlueLinx Holdings | 15.8x | 0.2x | -146.12% | ★★★☆☆☆ |

| MVB Financial | 17.1x | 2.0x | 15.93% | ★★☆☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

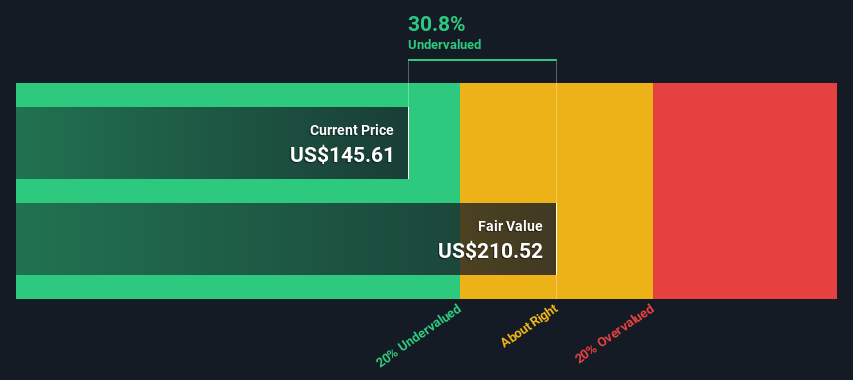

Diamond Hill Investment Group (DHIL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Diamond Hill Investment Group is a company that specializes in providing investment advisory and fund administration services, with a market capitalization of approximately $0.48 billion.

Operations: The company's primary revenue stream is from investment advisory and fund administration services, generating $151.92 million. Gross profit margin has shown variability, with recent figures around 48.04%. Operating expenses include significant allocations to general and administrative costs, which were approximately $16.69 million in the latest period.

PE: 10.1x

Diamond Hill Investment Group, a smaller company in the U.S., shows potential for value with recent insider confidence. Jo Quinif acquired 2,750 shares worth US$396,028. Despite earnings declining by 2.2% annually over five years and reliance on external borrowing, the company posted improved Q2 results with net income rising to US$15.57 million from US$8.13 million last year. The board affirmed a quarterly dividend of $1.50 per share, reflecting steady shareholder returns amidst these dynamics.

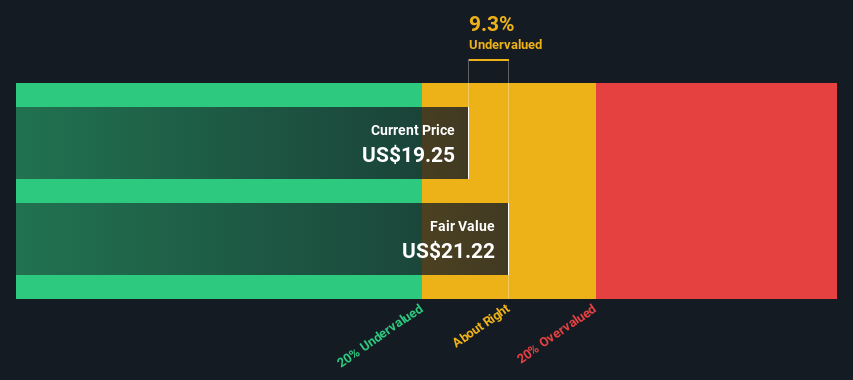

Amerant Bancorp (AMTB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Amerant Bancorp operates as a bank holding company providing a range of financial services primarily through its banking segment, with a market capitalization of approximately $0.78 billion.

Operations: The primary revenue stream for AMTB is derived from banking activities, amounting to $305.48 million. The company experiences a gross profit margin of 100%, indicating all revenues translate directly into gross profit due to the absence of cost of goods sold data. Operating expenses, primarily driven by general and administrative costs, significantly impact net income margins which have shown fluctuations over time, most notably reaching -19.46% in Q3 2024 before improving slightly in subsequent periods.

PE: 227.6x

Amerant Bancorp, a company in the financial sector, has shown promising signs of growth and potential value. The company reported significant improvements in net income to US$23 million for Q2 2025 from US$4.96 million the previous year, alongside an increase in net interest income to US$90.48 million. Insider confidence is evident as they increased their stake recently, reflecting belief in future prospects. Amerant's inclusion into multiple Russell indices underscores its growing market presence and strategic positioning for expansion.

- Navigate through the intricacies of Amerant Bancorp with our comprehensive valuation report here.

Understand Amerant Bancorp's track record by examining our Past report.

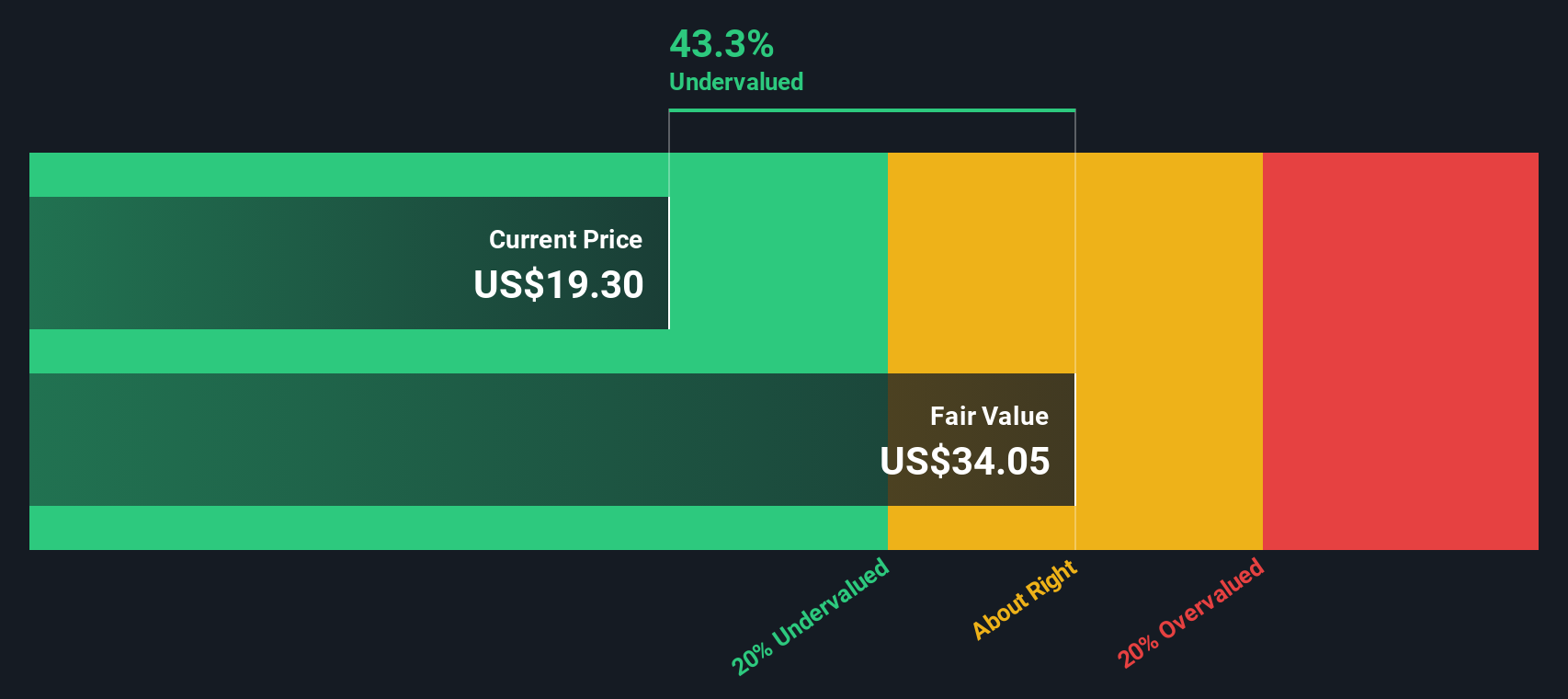

Montrose Environmental Group (MEG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Montrose Environmental Group operates in environmental services, focusing on remediation and reuse, measurement and analysis, and assessment, permitting, and response with a market capitalization of $1.60 billion.

Operations: The company's revenue streams are primarily derived from three segments: Remediation and Reuse, Measurement and Analysis, and Assessment, Permitting, and Response. Over recent periods, the gross profit margin has shown an upward trend, reaching 40.18% as of March 2025. Operating expenses have consistently increased with a notable portion allocated to General & Administrative expenses. Despite rising revenues, the company continues to report net losses due to substantial operating and non-operating expenses.

PE: -9.7x

Montrose Environmental Group, a player in environmental solutions, recently redeemed US$62.2 million of Series A-2 Preferred Stock using cash and borrowings, freeing itself from Oaktree Capital's board influence. Despite being unprofitable with reliance on external borrowing, its addition to the Russell 2000 Value Index highlights potential for growth. The company is tackling PFAS contamination with innovative solutions and has launched a US$40 million share repurchase program, signaling insider confidence in its future trajectory.

- Delve into the full analysis valuation report here for a deeper understanding of Montrose Environmental Group.

Gain insights into Montrose Environmental Group's past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 74 Undervalued US Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MEG

Montrose Environmental Group

Operates as an environmental services company in the United States, Canada, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives