- United States

- /

- Banks

- /

- NasdaqGS:ZION

Does the Recent 6.9% Rally Signal New Upside for Zions Bancorporation in 2025?

Reviewed by Bailey Pemberton

If you’re looking at Zions Bancorporation National Association’s stock and wondering, “Should I get in now, hold tight, or move on?” you’re not alone. The stock has been anything but dull this year, swinging up 6.9% in the past week after a sluggish period that saw it drop 6.7% over the last month. Longer-term holders have been rewarded, with the share price climbing 95.2% over five years, showing that patience has certainly paid off in the past.

What’s behind these moves? Investors are reacting to a steady stream of news highlighting the company’s strategic operational shifts and sector-wide banking stability improvements. Concerns from earlier in the year about regional banking risks and their impact on valuations have started to fade, replaced by optimism about Zions Bancorporation’s resilience and measured growth strategy. That renewed confidence is reflected in how investors are reevaluating the potential of the stock, especially given its robust track record during periods of financial sector turbulence.

With a value score of 5 out of 6, Zions Bancorporation passes almost every undervaluation check we look for, marking it as a stock that’s frequently overlooked by value hunters. But traditional valuation methods, while helpful, only tell part of the story. Next, we’ll break down how Zions Bancorporation stacks up under commonly used valuation frameworks and hint at an even sharper way to spot opportunity that experienced investors won’t want to miss.

Why Zions Bancorporation National Association is lagging behind its peers

Approach 1: Zions Bancorporation National Association Excess Returns Analysis

The Excess Returns model centers on evaluating how effectively a company generates returns on its invested capital over and above its cost of capital. In other words, it gauges whether Zions Bancorporation is creating real value for shareholders, not just earning a return but exceeding what it costs to finance that investment.

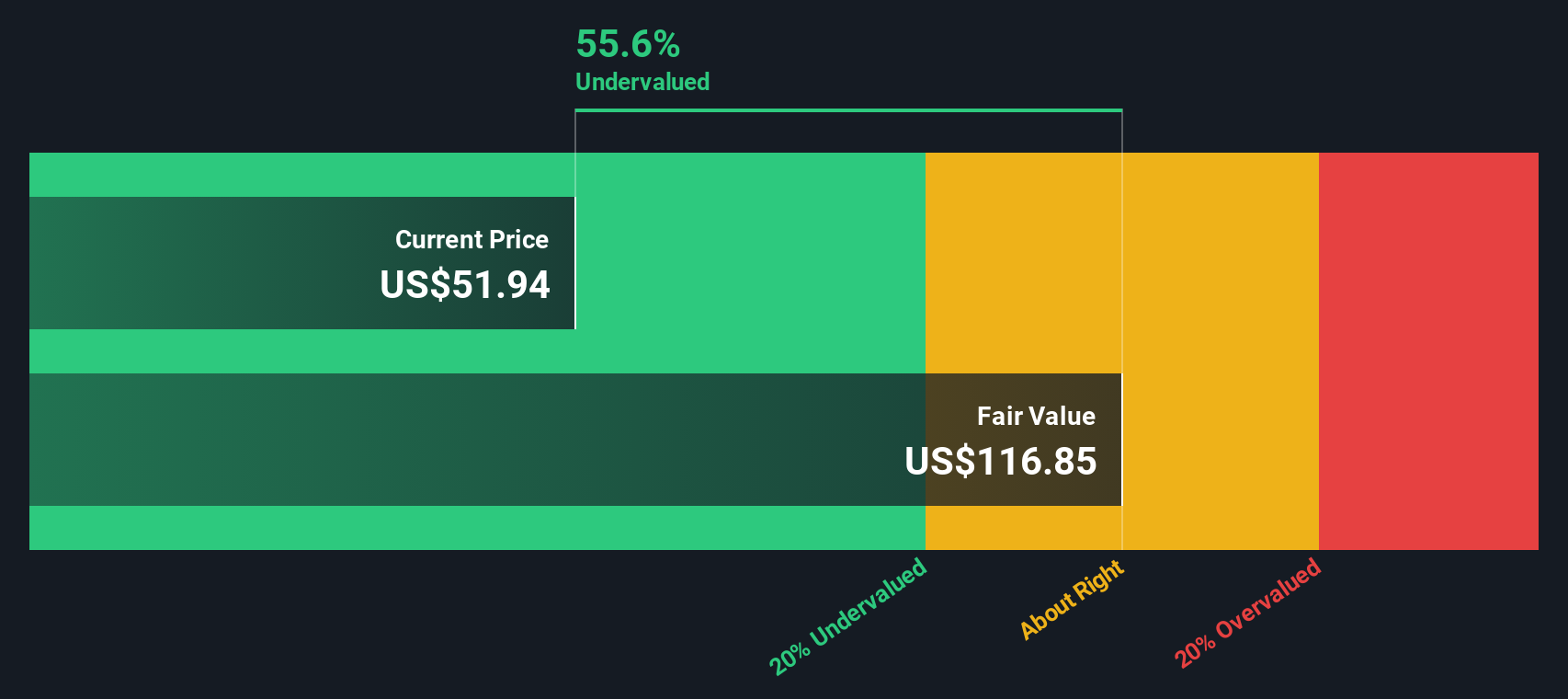

For Zions Bancorporation National Association, the numbers tell a compelling story. The company shows a Book Value of $46.05 per share and a Stable Earnings Per Share (EPS) of $6.45, drawn from analyst estimates of future Return on Equity from 17 experts. With a Cost of Equity at $3.81 per share, Zions is producing an Excess Return of $2.64 per share, underscoring its ability to generate value above its financing costs. The average Return on Equity sits at an impressive 12.20%, while the forecasted Stable Book Value rises to $52.87 per share based on 13 analysts’ future predictions.

Calculating from these metrics, the Excess Returns model estimates an intrinsic value of $117.07 per share. This implies the stock is trading at a 54.6% discount to fair value. This substantial margin means Zions Bancorporation National Association is significantly undervalued compared to its calculated worth.

Result: UNDERVALUED

Our Excess Returns analysis suggests Zions Bancorporation National Association is undervalued by 54.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zions Bancorporation National Association Price vs Earnings

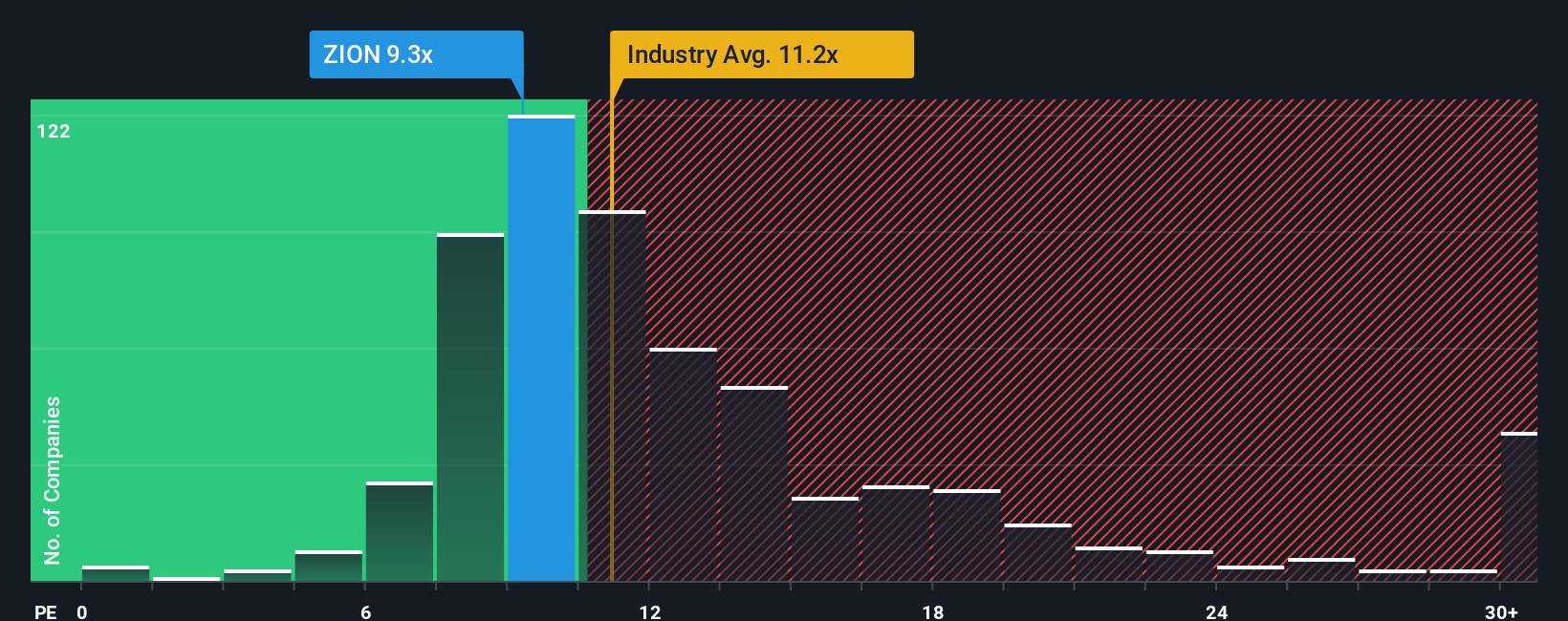

The price-to-earnings (PE) ratio is a favored valuation metric for profitable companies like Zions Bancorporation National Association because it directly links a company's share price to its current and expected future earnings power. For investors, the PE ratio offers a quick way to gauge how much the market is willing to pay for each dollar of a company’s earnings, helping to compare profitability across firms and industries.

What constitutes a "normal" or "fair" PE ratio is shaped by several factors, including growth expectations, profitability, and risk. Fast-growing banks with predictable earnings typically command higher PE ratios, while those facing more risks or slower growth usually trade at a discount.

Currently, Zions Bancorporation trades at a PE ratio of 9.51x. For context, the average PE ratio among its direct peers stands at 12.09x, while the broader banking industry averages 11.24x. This suggests that Zions stock is trading below both its peer group and the industry.

Simply Wall St’s proprietary “Fair Ratio” goes a step further by estimating an ideal PE ratio for Zions based on unique characteristics like its earnings growth outlook, risk profile, market cap, and profitability. This provides a more tailored view than simply comparing it to peers or the industry, as it accounts for the specific details that matter most for this company.

Zions Bancorporation’s Fair Ratio is calculated at 12.62x, which is substantially higher than its current PE of 9.51x. This meaningful gap underscores that, when taking all key factors into account, the market could be undervaluing Zions Bancorporation today.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

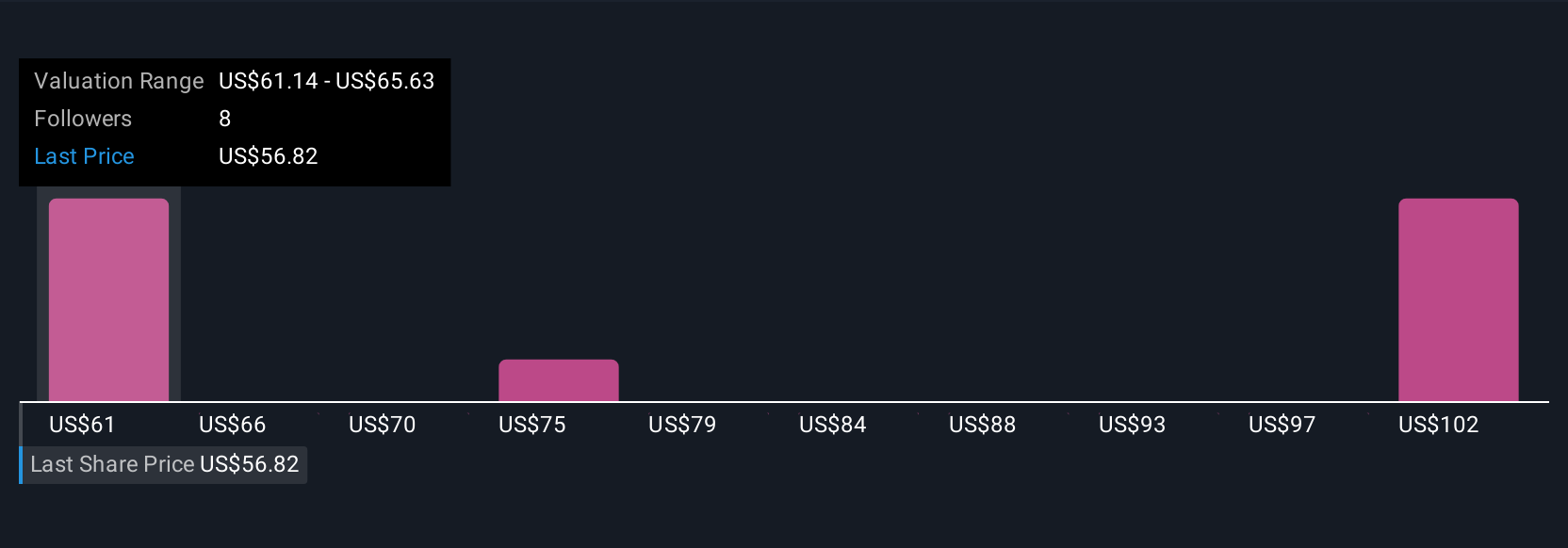

Upgrade Your Decision Making: Choose your Zions Bancorporation National Association Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just a number; it is your story or perspective on a company, built around your assumptions for its future revenue growth, earnings, margins, and fair value.

Using Narratives, investors connect the company's real-world story and market outlook to assumptions and forecasts, and ultimately to a calculated fair value, making each investment decision more personal and grounded. Narratives are accessible and easy to use, available directly on the Simply Wall St platform’s Community page, where millions of investors update and share their views.

With Narratives, you can clearly see whether it is time to buy or sell by comparing your fair value to the current price. They also update automatically as new news or earnings come out, keeping your view current and actionable.

For example, some investors tracking Zions Bancorporation expect earnings to climb as digital banking and fee-based services grow, driving price targets up to $69.00. Others, wary of regional or regulatory risks, see fair value closer to $57.00. With Narratives, you control the story and the numbers behind your investment decisions.

Do you think there's more to the story for Zions Bancorporation National Association? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zions Bancorporation National Association might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZION

Zions Bancorporation National Association

Provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives