The board of WVS Financial Corp. (NASDAQ:WVFC) has announced that it will pay a dividend on the 19th of August, with investors receiving US$0.10 per share. Including this payment, the dividend yield on the stock will be 2.4%, which is a modest boost for shareholders' returns.

Check out our latest analysis for WVS Financial

WVS Financial's Earnings Easily Cover the Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Based on the last payment, WVS Financial was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

If the trend of the last few years continues, EPS will grow by 1.3% over the next 12 months. If the dividend continues on this path, the payout ratio could be 63% by next year, which we think can be pretty sustainable going forward.

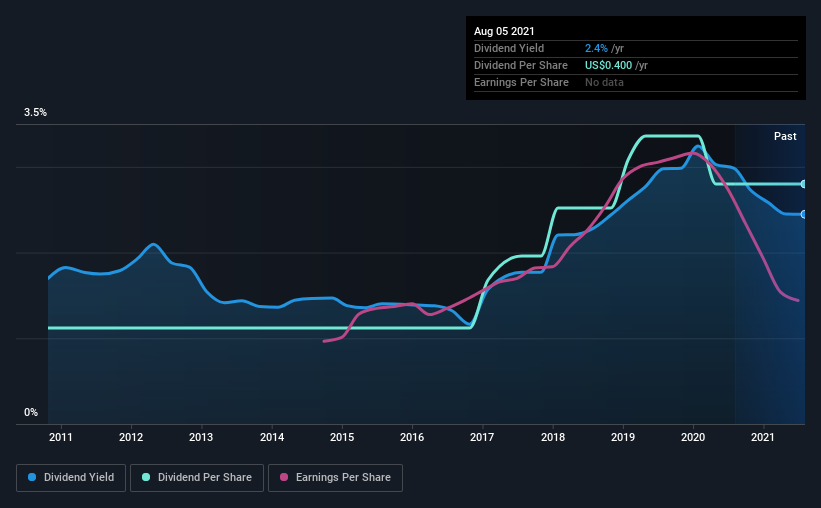

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the first annual payment was US$0.16, compared to the most recent full-year payment of US$0.40. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. WVS Financial hasn't seen much change in its earnings per share over the last five years. The company has been growing at a pretty soft 1.3% per annum, and is paying out quite a lot of its earnings to shareholders. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

In Summary

Overall, we think WVS Financial is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for WVS Financial that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade WVS Financial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WVS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:WVFC

WVS Financial

Operates as the bank holding company for West View Savings Bank that provides various banking products and services in the United States.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives