- United States

- /

- Banks

- /

- NasdaqGS:WTFC

Could Wintrust Financial's (WTFC) Credit Discipline Prove Resilient Amid Peers' Loan Quality Concerns?

Reviewed by Sasha Jovanovic

- In the past week, disclosures from Zions Bancorp and Western Alliance Bancorp about deteriorating loan quality heightened concerns across the regional banking sector, impacting sentiment toward peers like Wintrust Financial.

- These developments renewed attention on broader credit risks and commercial real estate exposure within regional banks, despite Wintrust itself not reporting specific loan issues.

- We'll examine how renewed caution over loan quality could influence the bank's outlook for disciplined credit management and earnings resilience.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wintrust Financial Investment Narrative Recap

To be a shareholder in Wintrust Financial, you need to believe in its ability to deliver steady loan and deposit growth within its Midwest footprint, while maintaining high-quality credit underwriting and expanding its specialized lending portfolios. While the recent loan quality issues at Zions and Western Alliance have affected sentiment across regional banks, no specific deterioration has been reported at Wintrust, so the immediate impact on the company’s most important short-term catalyst, steady loan growth and disciplined credit management, appears limited. The biggest risk remains the possibility that concerns around commercial real estate exposure could escalate, influencing earnings quality if sector stress spreads further.

Among Wintrust’s recent announcements, the appointment of two new independent directors to the board, one to its Risk Management and IT Security Committees, stands out as the most relevant to renewed industry focus on credit risk. This move could support ongoing discipline in loan oversight and help sustain confidence in risk controls at a time when market attention is squarely on asset quality in the banking sector.

Yet, in contrast to the stable picture painted by management, there is still the lingering question for investors about how exposed Wintrust is to future …

Read the full narrative on Wintrust Financial (it's free!)

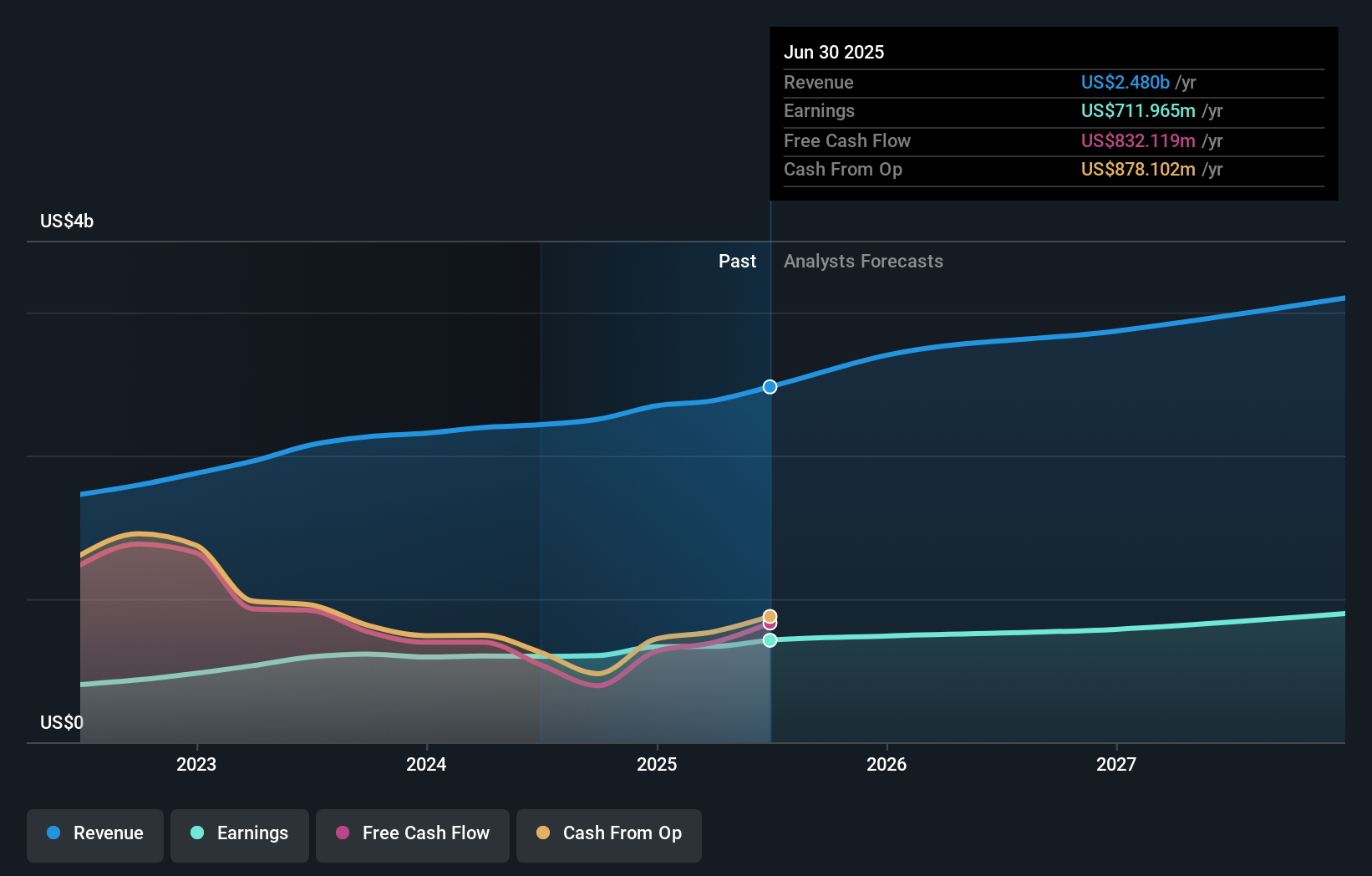

Wintrust Financial's outlook anticipates $3.2 billion in revenue and $898.5 million in earnings by 2028. This projection is based on a 9.0% annual revenue growth rate and reflects a $186.5 million increase in earnings from the current $712.0 million.

Uncover how Wintrust Financial's forecasts yield a $156.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range between US$77 and US$231.93, with three different viewpoints represented. While many believe in further earnings growth, the renewed concerns around commercial real estate exposure could be a deciding factor as you weigh these different perspectives.

Explore 3 other fair value estimates on Wintrust Financial - why the stock might be worth as much as 93% more than the current price!

Build Your Own Wintrust Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wintrust Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wintrust Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wintrust Financial's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wintrust Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTFC

Wintrust Financial

A financial holding company, provides community-oriented, personal, and commercial banking services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives