- United States

- /

- Diversified Financial

- /

- NasdaqGS:WSBF

Waterstone Financial, Inc. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

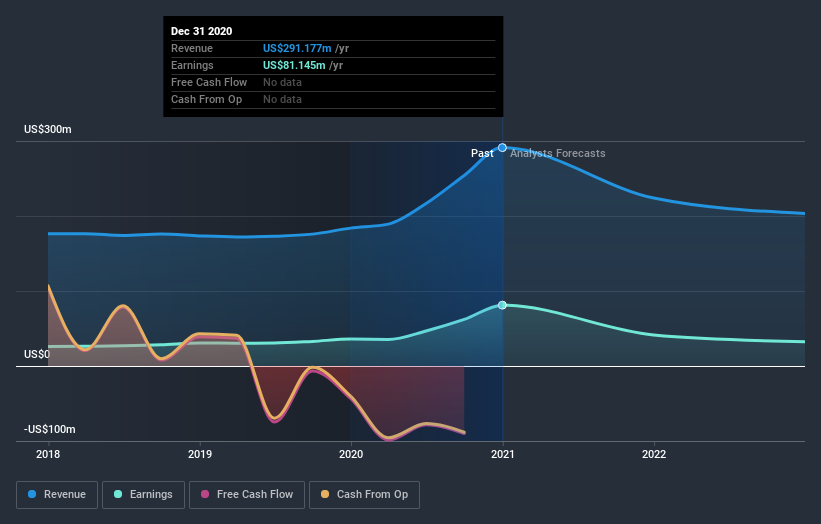

Shareholders might have noticed that Waterstone Financial, Inc. (NASDAQ:WSBF) filed its yearly result this time last week. The early response was not positive, with shares down 4.2% to US$18.47 in the past week. Revenues were US$291m, approximately in line with expectations, although statutory earnings per share (EPS) performed substantially better. EPS of US$3.30 were also better than expected, beating analyst predictions by 13%. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

See our latest analysis for Waterstone Financial

Following the recent earnings report, the consensus from one analyst covering Waterstone Financial is for revenues of US$224.0m in 2021, implying a painful 23% decline in sales compared to the last 12 months. Statutory earnings per share are forecast to dive 47% to US$1.75 in the same period. Yet prior to the latest earnings, the analyst had been anticipated revenues of US$215.0m and earnings per share (EPS) of US$1.39 in 2021. So it seems there's been a definite increase in optimism about Waterstone Financial's future following the latest results, with a great increase in the earnings per share forecasts in particular.

It will come as no surprise to learn that the analyst has increased their price target for Waterstone Financial 11% to US$20.50on the back of these upgrades.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Waterstone Financial's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 23%, a significant reduction from annual growth of 9.4% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 2.9% annually for the foreseeable future. The forecasts do look bearish for Waterstone Financial, since they're expecting it to shrink faster than the industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Waterstone Financial's earnings potential next year. They also upgraded their revenue estimates, with sales apparently performing well, although revenues are expected to lag the wider industry this year. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Waterstone Financial going out as far as 2022, and you can see them free on our platform here.

You still need to take note of risks, for example - Waterstone Financial has 3 warning signs (and 1 which is significant) we think you should know about.

If you decide to trade Waterstone Financial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Waterstone Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WSBF

Waterstone Financial

Operates as a bank holding company for WaterStone Bank SSB that provides various financial services to customers in southeastern Wisconsin, the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives