- United States

- /

- Banks

- /

- NasdaqGS:WSBC

WesBanco (WSBC): Assessing Valuation After a 16% Monthly Share Price Climb

Reviewed by Simply Wall St

WesBanco (WSBC) has quietly put together a solid run, with the stock up roughly 16% over the past month. That climb comes alongside double digit revenue and earnings growth and is drawing fresh attention to its valuation.

See our latest analysis for WesBanco.

Zooming out, WesBanco’s 30 day share price return of about 16% has helped lift year to date gains and sits alongside a five year total shareholder return of roughly 47%. This suggests momentum is building as investors warm to its growth profile and valuation reset.

If WesBanco’s recent move has you thinking more broadly about financials, it could be a good time to explore solid balance sheet and fundamentals stocks screener (None results) for other banks with sturdier balance sheets and consistent fundamentals.

With WesBanco trading below analyst targets and our intrinsic estimates, yet already enjoying a strong multi year run, investors face a key question: is this a fresh buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.5% Undervalued

With WesBanco last closing at $35, the most followed narrative pegs fair value modestly higher, hinting at upside without calling the stock deeply mispriced.

Analysts expect earnings to reach $821.3 million (and earnings per share of $7.52) by about September 2028, up from $125.2 million today. The analysts are largely in agreement about this estimate.

Curious what kind of revenue surge, margin lift, and future earnings multiple are baked into that outlook? The narrative describes a surprisingly bold profit trajectory, grounded in very specific growth assumptions and a discount rate that quietly does a lot of heavy lifting.

Result: Fair Value of $37.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavier than expected commercial real estate payoffs or a regional downturn across its Midwest and Appalachian footprint could undermine those optimistic growth assumptions.

Find out about the key risks to this WesBanco narrative.

Another Take On Valuation

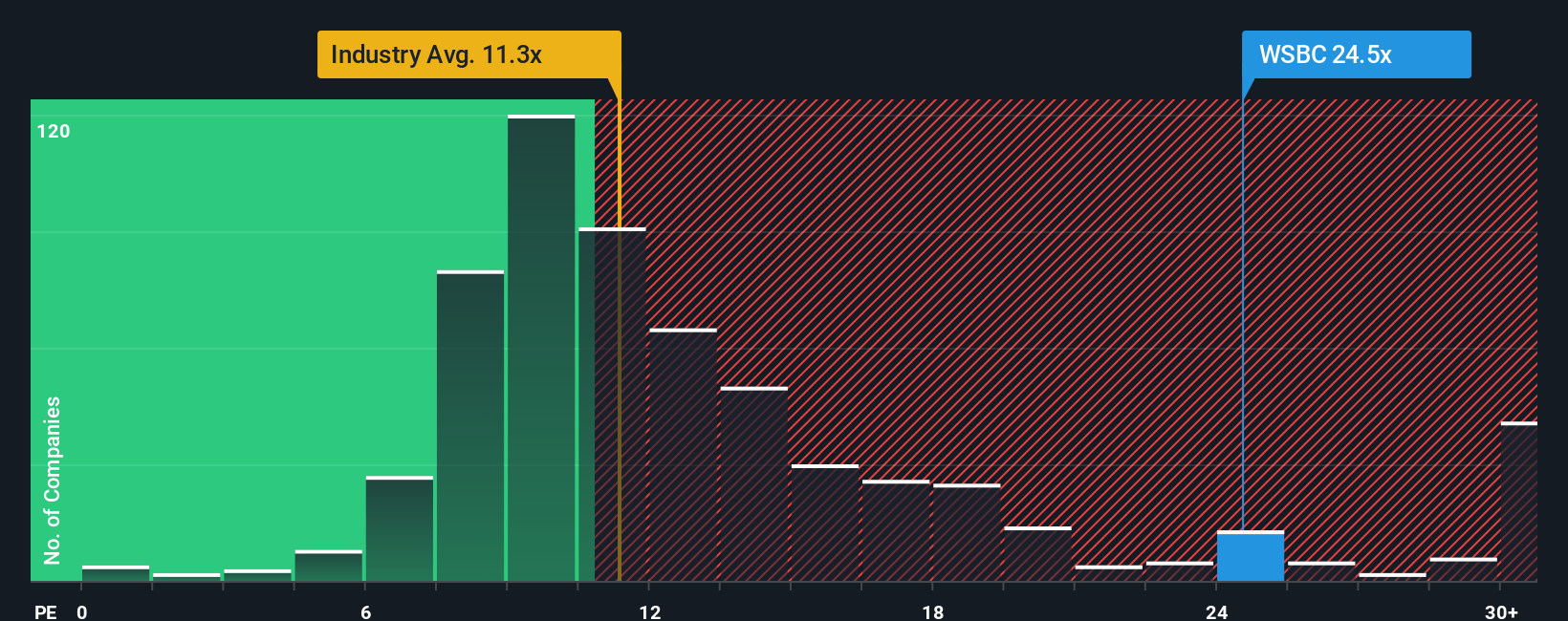

While our intrinsic work sees WesBanco trading about 40% below fair value, its 19.6x price to earnings ratio looks rich versus peers at 16x and a fair ratio of 19.5x. That leaves little valuation cushion if growth or margins fall short of the story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WesBanco Narrative

If you are not sold on this framing or would rather lean on your own due diligence, you can build a personalized view in minutes: Do it your way.

A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with WesBanco. Use the Simply Wall St Screener to pinpoint fresh, data-backed opportunities that could strengthen your portfolio before others notice.

- Capture early stage potential by targeting these 3636 penny stocks with strong financials that pair smaller market caps with surprisingly resilient fundamentals.

- Ride structural trends in automation and data by focusing on these 24 AI penny stocks positioned at the heart of AI driven transformation.

- Lock in value-oriented opportunities using these 913 undervalued stocks based on cash flows that highlight companies trading below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion