- United States

- /

- Banks

- /

- NasdaqGS:WSBC

How WesBanco’s (WSBC) Latest Dividend Increase Reflects Its Evolving Capital Allocation Strategy

Reviewed by Sasha Jovanovic

- WesBanco, Inc. recently announced that its Board of Directors approved a 2.7% increase in the quarterly cash dividend to US$0.38 per common share, and declared a quarterly cash dividend of US$0.5326 per depositary share on its 7.375% Non-Cumulative Perpetual Preferred Stock, Series B, both payable in early January 2026 to shareholders of record in December 2025.

- This marks the nineteenth increase in the quarterly dividend since 2010, reflecting the company's ongoing focus on providing consistent returns to common shareholders.

- We'll examine how WesBanco's latest dividend increase signals ongoing capital return priorities and may influence its long-term investment appeal.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

WesBanco Investment Narrative Recap

To be a WesBanco shareholder, you need to trust in the bank’s ability to generate loan and deposit growth from expanding into new markets while managing the risks of geographic concentration and exposure to commercial real estate refinancing. The recent dividend hike reflects stability in capital returns, but it does not materially affect the most immediate risk: pressure on fee and noninterest income from fintech and regulatory changes.

The October 2025 opening of a new loan production office and retail banking center in Knoxville is especially relevant, as it highlights WesBanco’s drive to access high-growth regions, a catalyst that may offset ongoing challenges in its core Midwest and Appalachian markets.

However, what’s less obvious is how, despite the positive signals of dividend increases, investors should be aware that...

Read the full narrative on WesBanco (it's free!)

WesBanco's outlook anticipates $1.7 billion in revenue and $821.3 million in earnings by 2028. This would require 35.2% annual revenue growth and a $696.1 million increase in earnings from the current $125.2 million.

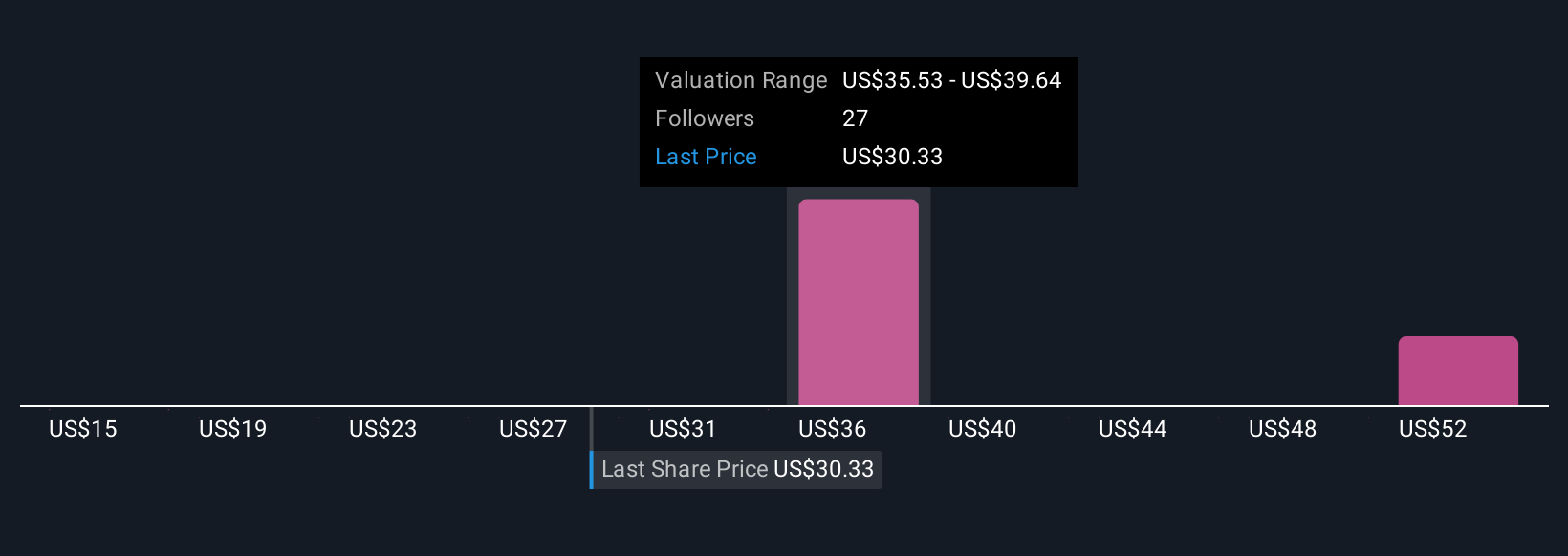

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided five separate fair value estimates for WesBanco, ranging widely from US$14.98 to US$56.25 per share. These diverse viewpoints contrast with the baseline outlook that growth into new markets could support future performance, inviting you to explore the varied investor expectations driving the stock today.

Explore 5 other fair value estimates on WesBanco - why the stock might be worth less than half the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.