- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Does WesBanco’s Dividend Hike And Preferred Swap Reshape The Capital Story For WSBC?

Reviewed by Sasha Jovanovic

- WesBanco recently increased its quarterly cash dividend by 2.7% to US$0.38 per common share and, on November 15, 2025, redeemed all outstanding Series A preferred stock using proceeds from a new Series B preferred stock offering, while director Nelson F. Eric Jr. sold 752 common shares on December 3, 2025.

- Together, the higher dividend and preferred stock redemption highlight management’s current focus on returning capital to common shareholders and reshaping WesBanco’s funding mix.

- We’ll now examine how the dividend increase and preferred stock redemption influence WesBanco’s investment narrative and outlook for investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WesBanco Investment Narrative Recap

To own WesBanco, you need to believe it can keep turning its regional footprint and fee businesses into steady earnings and dividend income, despite concentration in specific Midwestern and Appalachian markets. The latest dividend increase and reshuffling of preferred stock do not appear to materially change the key near term catalyst, which remains execution on growth in higher potential markets and digital banking, nor the main risk from its exposure to commercial real estate and acquired loan portfolios.

The move to redeem Series A preferred stock using proceeds from a new Series B preferred offering is most relevant here, because it directly affects WesBanco’s capital structure and cost of funding. While this action by itself does not alter the core growth drivers in newer markets or fee businesses, it sits in the background of how effectively WesBanco can support loan growth and digital investments without adding pressure to margins or earnings quality.

But investors should also be aware that WesBanco’s reliance on commercial real estate and acquired loan portfolios leaves it exposed to...

Read the full narrative on WesBanco (it's free!)

WesBanco's narrative projects $1.7 billion revenue and $821.3 million earnings by 2028. This requires 35.2% yearly revenue growth and a roughly $696 million earnings increase from $125.2 million today.

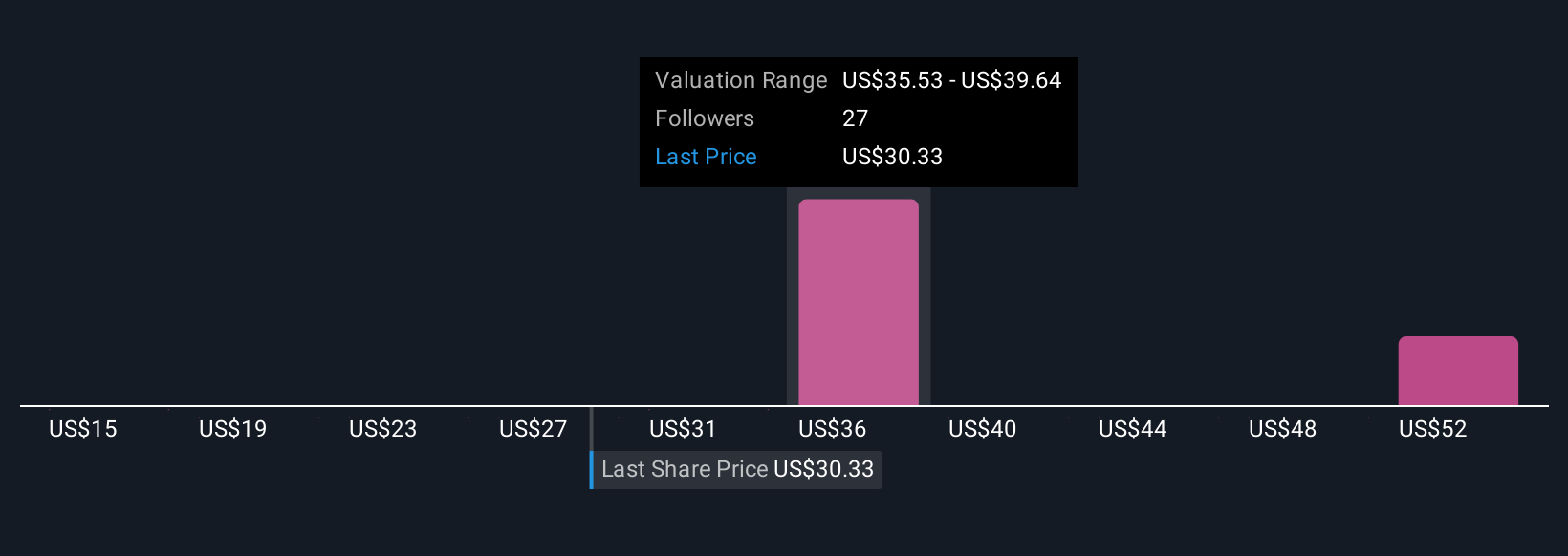

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see WesBanco’s fair value anywhere between US$14.98 and about US$56.27, underscoring very different expectations. As you weigh those views, keep in mind how much of the story still depends on WesBanco growing in newer, higher growth markets while managing concentration in its core regions.

Explore 5 other fair value estimates on WesBanco - why the stock might be worth less than half the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

No Opportunity In WesBanco?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026