- United States

- /

- Banks

- /

- NasdaqGS:WAFD

Will WaFd’s (WAFD) Projected Earnings Growth Shift Investor Perceptions Ahead of Results?

Reviewed by Sasha Jovanovic

- WaFd (WAFD) is set to announce its quarterly earnings after market close on October 15th, with analyst forecasts projecting $0.75 in earnings per share and US$190.22 million in revenue, both representing year-over-year growth.

- Recent shifts in institutional holdings and a single insider sale over the past six months add further context to investor sentiment as earnings approach.

- With analysts predicting higher earnings per share this quarter, we’ll explore how these expectations are shaping WaFd’s investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is WaFd's Investment Narrative?

To believe in WaFd as an investment, you need to have confidence in their ability to generate consistent earnings and offer shareholder-friendly policies like regular dividends and ongoing share buybacks. While recent analyst forecasts suggest a slight year-over-year increase in both earnings per share and revenue, the impact from the upcoming quarterly release seems broadly in line with recent trends rather than a major shift. Institutional investors have adjusted their positions and there's been some insider selling, which could weigh on short-term sentiment, but with only a single insider sale in six months, there's no obvious sign of major internal concern. The key catalysts remain stable earnings, disciplined capital returns, and steady credit quality. However, risks linger: the company’s net interest income has fluctuated, and recent price weakness signals investors may still be cautious about revenue growth and asset quality as rates and economic outlook evolve. The upcoming results, while not transformative, may refine, but not fundamentally change, the risk and reward balance for shareholders.

However, don't overlook the sensitivity to revenue growth trends in coming quarters.

Exploring Other Perspectives

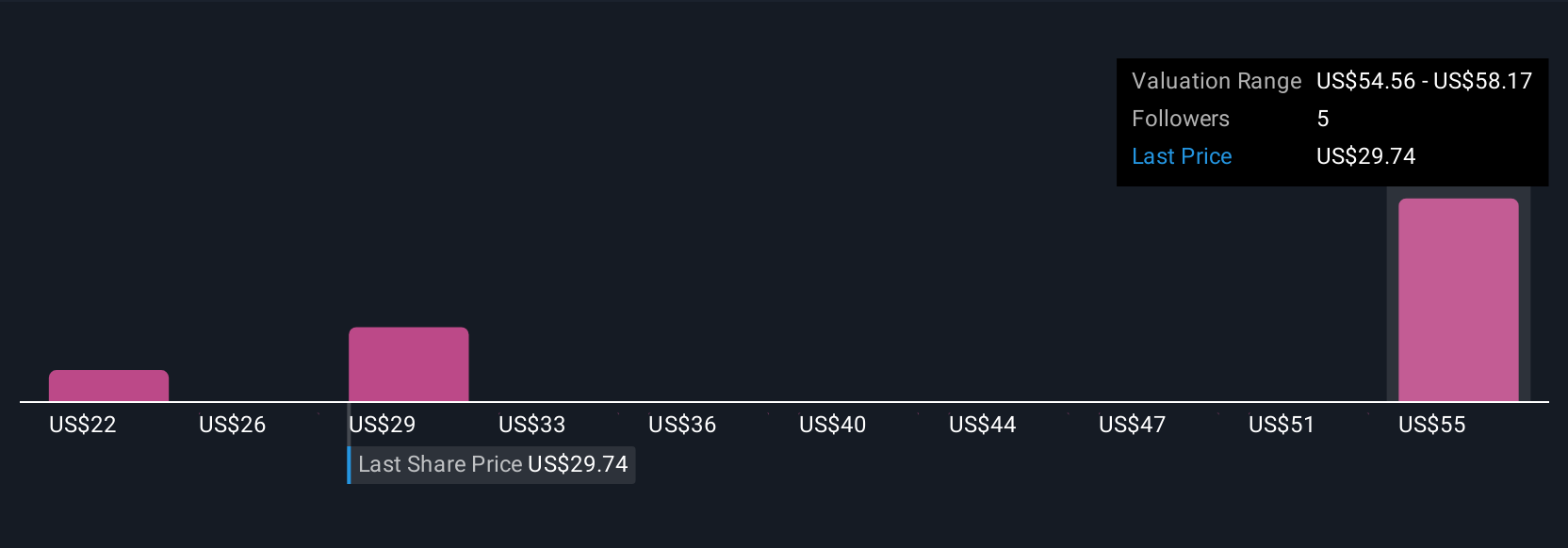

Explore 3 other fair value estimates on WaFd - why the stock might be worth as much as 78% more than the current price!

Build Your Own WaFd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WaFd research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free WaFd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WaFd's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives