- United States

- /

- Banks

- /

- NasdaqGS:VLY

Leadership Shift and Consumer Focus Might Change The Case For Investing In Valley National Bancorp (VLY)

Reviewed by Sasha Jovanovic

- In recent weeks, Valley National Bancorp has attracted interest due to its discounted valuation and leadership changes focusing on consumer banking improvements.

- Analyst attention on Valley National Bancorp stems from expectations of significant future earnings growth and management steps to strengthen its consumer banking strategy, factors likely to shape investor sentiment and operational outlook.

- We'll examine how recent leadership changes aimed at revitalizing consumer banking could impact Valley National Bancorp's overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Valley National Bancorp Investment Narrative Recap

To be a shareholder in Valley National Bancorp today, you need to believe in the company's ability to reinvigorate its consumer banking segment and deliver on long-term earnings forecasts amid ongoing challenges in the banking sector. The latest news highlighting valuation discounts and leadership changes does not meaningfully shift the most important near-term catalyst, management's push for consumer banking improvements, nor does it materially reduce the dominant risk: persistent credit quality concerns linked to commercial real estate and regional economic exposure.

The appointment of Patrick Smith as Senior Executive Vice President and President of Consumer Banking is especially relevant, given the company's renewed attention to optimizing the consumer side of its business. This leadership update is intended to support Valley National's focus on potentially expanding core deposit growth, a key area for operational improvement and margin stabilization.

However, in contrast, investors should be aware that ongoing credit quality issues and regional economic risks could...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's narrative projects $2.5 billion in revenue and $807.5 million in earnings by 2028. This requires 16.6% yearly revenue growth and an earnings increase of $381.8 million from the current $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $11.96 fair value, a 10% upside to its current price.

Exploring Other Perspectives

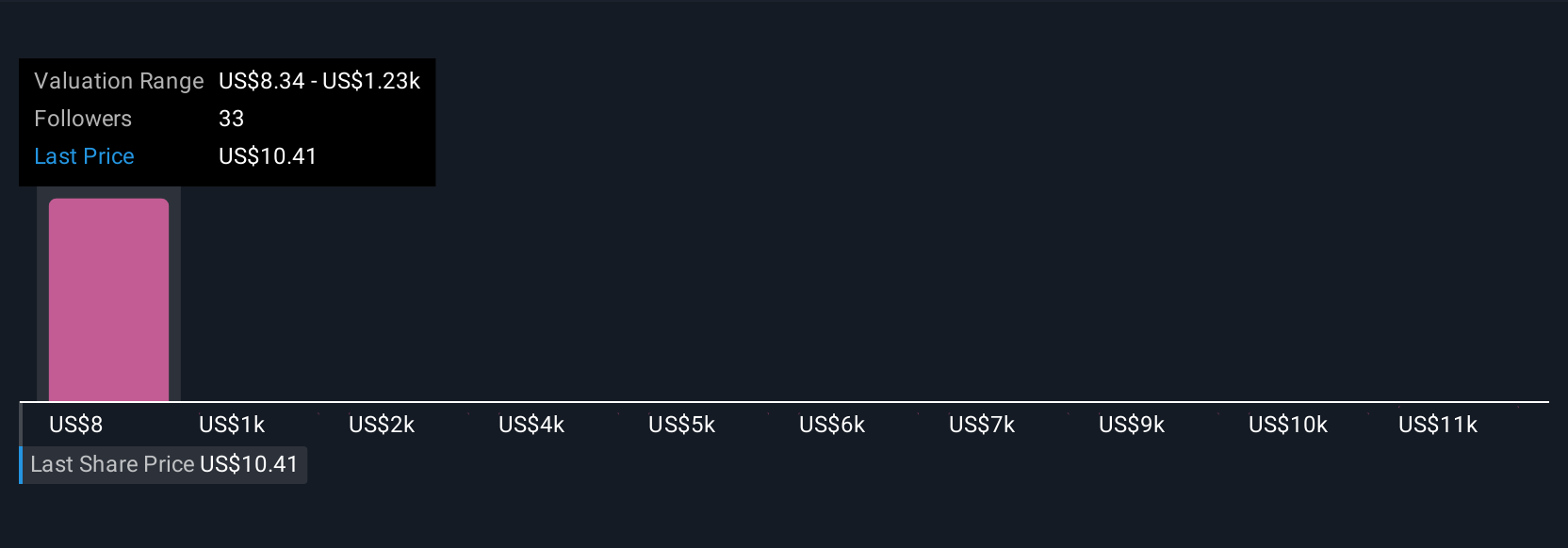

Five Simply Wall St Community members place Valley National Bancorp’s fair value between US$8.34 and US$12,190.04, signaling strong differences of opinion. Against this backdrop, ongoing credit quality risks remain a focal concern for anyone considering these broad valuation perspectives.

Explore 5 other fair value estimates on Valley National Bancorp - why the stock might be worth 23% less than the current price!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives