- United States

- /

- Banks

- /

- NasdaqGM:VBTX

Broad Russell Index Exits Could Be a Game Changer for Veritex Holdings (VBTX)

Reviewed by Sasha Jovanovic

- On October 17, 2025, Veritex Holdings, Inc. was removed from multiple Russell indices, including the Russell 2000, Russell 3000, and several value and defensive benchmarks.

- This broad index exclusion can prompt adjustments by passive funds and ETFs, often amplifying market pressures on a company's shares, independent of its fundamental performance.

- We'll examine how Veritex Holdings' widespread index removals may affect its investment outlook, particularly amid heightened regional bank sector concerns.

Find companies with promising cash flow potential yet trading below their fair value.

Veritex Holdings Investment Narrative Recap

To own shares of Veritex Holdings today, you need confidence in the company's ability to manage credit quality and drive sustainable loan growth despite a challenging regional banking environment. While the mass removal of Veritex from Russell indices on October 17, 2025, can create some short-term volatility due to passive fund rebalancing, it does not materially alter the core catalysts, such as credit risk management, or the biggest near-term risk, which remains potential deterioration in loan performance and muted loan growth.

Amid these market disruptions, the most pertinent recent announcement was Veritex’s pending acquisition by Huntington Bancshares, set to close just days after the index exclusions. This all-stock transaction significantly outweighs the typical impact from index removals, as it means fundamental performance or sector pressures may soon be secondary to the merger dynamics and associated shareholder approvals.

In contrast, some risks remain, especially for investors watching for signs that loan quality could...

Read the full narrative on Veritex Holdings (it's free!)

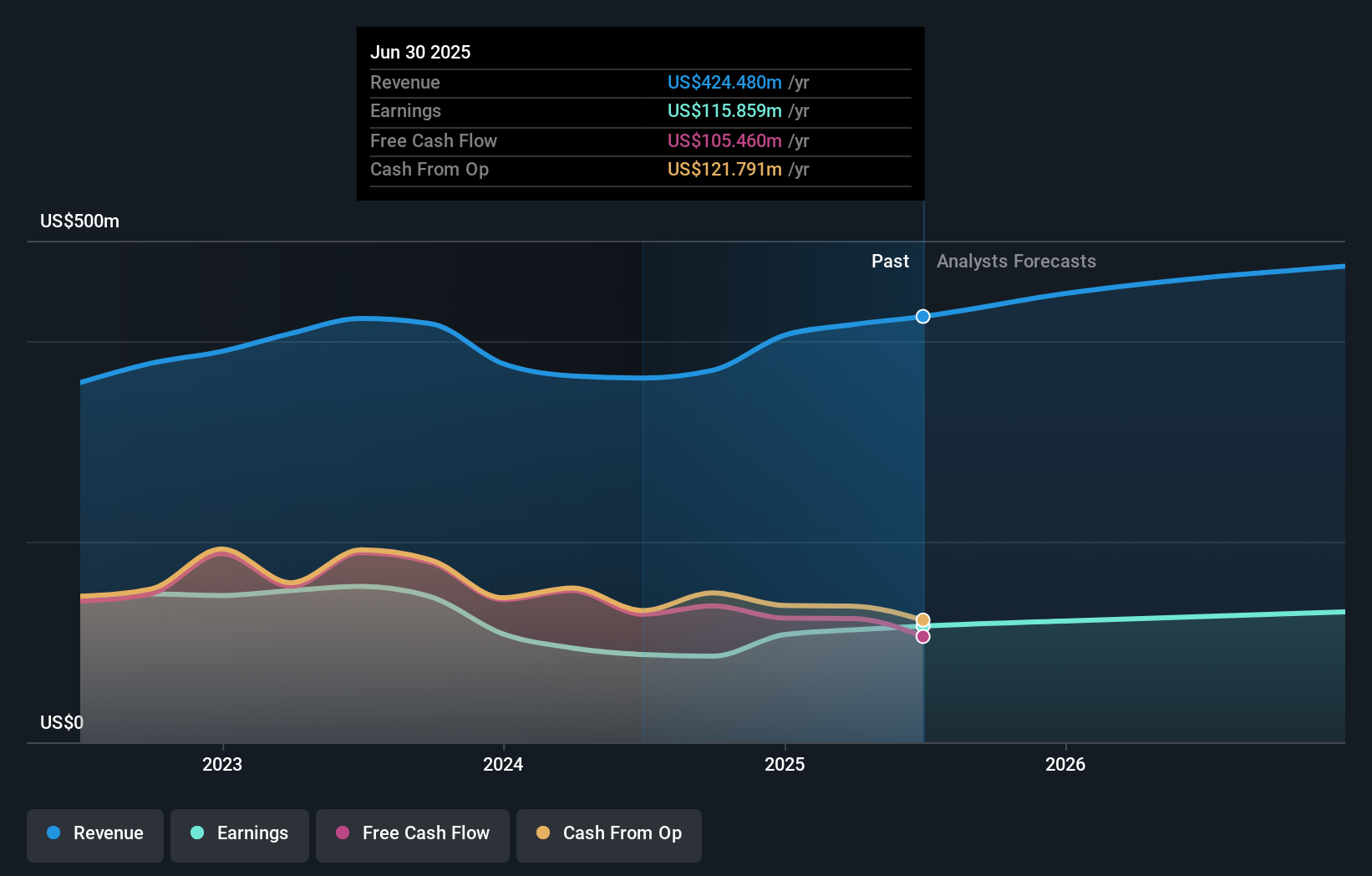

Veritex Holdings' outlook forecasts $525.4 million in revenue and $146.9 million in earnings by 2028. This assumes a 7.4% annual revenue growth rate and a $31.0 million earnings increase from current earnings of $115.9 million.

Uncover how Veritex Holdings' forecasts yield a $31.75 fair value, a 5% upside to its current price.

Exploring Other Perspectives

All fair value estimates from the Simply Wall St Community peg Veritex at US$31.75, providing a single viewpoint from one contributor. With index exclusion effects now in play, the risk of further loan performance issues may weigh more heavily on future estimates; explore the Community for additional perspectives and opinions.

Explore another fair value estimate on Veritex Holdings - why the stock might be worth just $31.75!

Build Your Own Veritex Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veritex Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Veritex Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veritex Holdings' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VBTX

Veritex Holdings

Operates as the bank holding company for Veritex Community Bank that provides various commercial banking products and services to small and medium-sized businesses and professionals in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives