- United States

- /

- Banks

- /

- NasdaqCM:ACNB

3 Dividend Stocks To Consider With Yields Up To 3.8%

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months, it has risen by 14% with earnings expected to grow by 15% per annum in the coming years. In this context of steady growth and positive earnings outlooks, dividend stocks with yields up to 3.8% present an attractive option for investors seeking income alongside potential capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.97% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.65% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.20% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.16% | ★★★★★★ |

| Ennis (EBF) | 5.63% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.12% | ★★★★★☆ |

| Dillard's (DDS) | 5.60% | ★★★★★★ |

| CompX International (CIX) | 4.85% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.95% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.70% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

ACNB (ACNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACNB Corporation is a financial holding company providing banking, insurance, and financial services to individual, business, and government customers in the United States with a market cap of $450.68 million.

Operations: ACNB Corporation generates its revenue primarily through its Banking segment, which accounts for $104.94 million, and its Insurance segment, contributing $9.79 million.

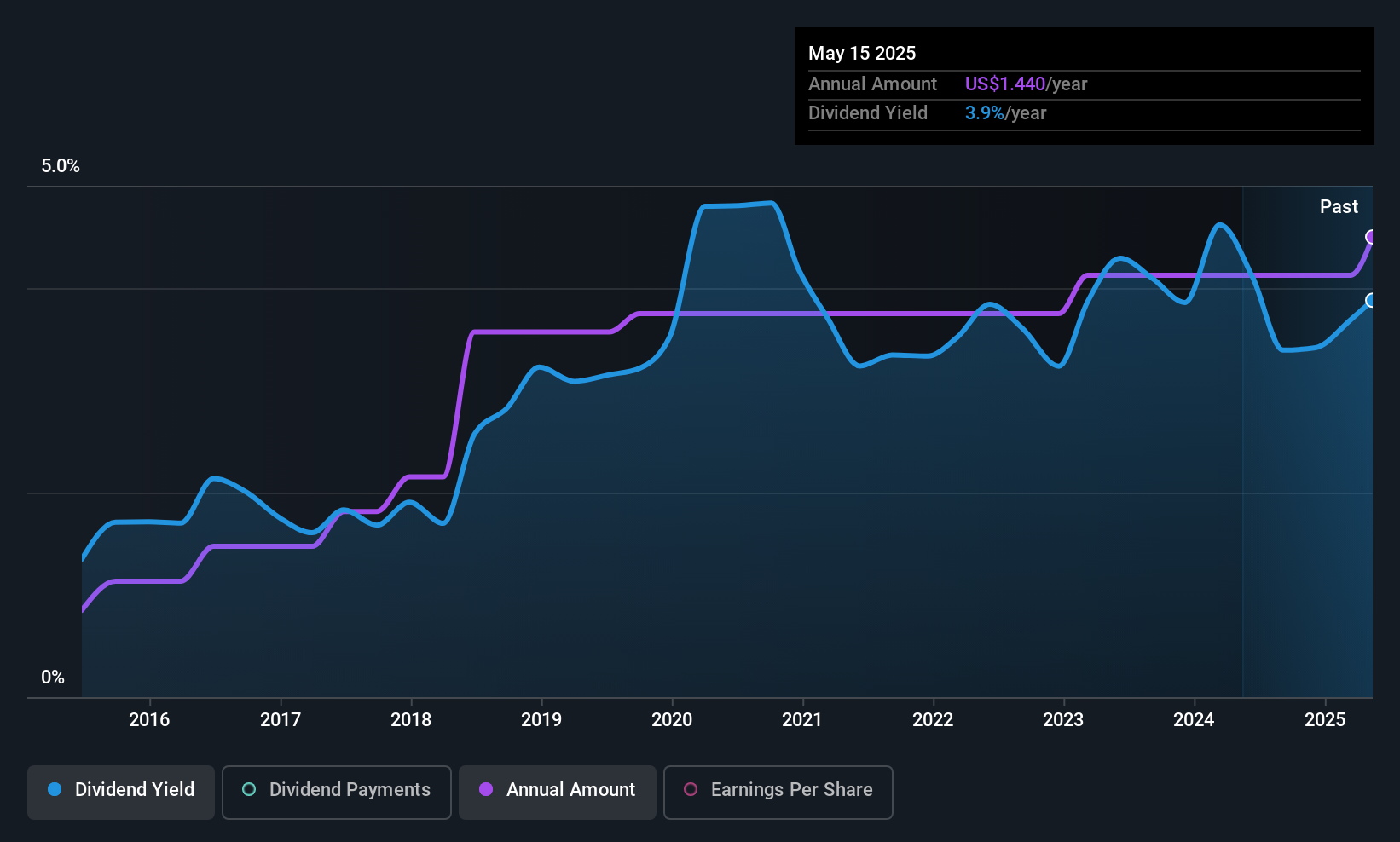

Dividend Yield: 3.1%

ACNB has maintained stable and growing dividends over the past decade, with a current yield of 3.14% and a payout ratio of 45.6%, indicating well-covered payments by earnings. Despite recent financial challenges, including a net loss in Q1 2025 and being dropped from the Russell 2000 Dynamic Index, ACNB continues its dividend reliability with an announced increase to US$0.34 per share for June 2025. The stock trades below estimated fair value but experienced shareholder dilution last year.

- Navigate through the intricacies of ACNB with our comprehensive dividend report here.

- According our valuation report, there's an indication that ACNB's share price might be on the cheaper side.

Northeast Community Bancorp (NECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northeast Community Bancorp, Inc. is the holding company for NorthEast Community Bank, offering financial services to individuals and businesses, with a market cap of $270.32 million.

Operations: Northeast Community Bancorp, Inc. generates revenue primarily from its Thrift / Savings and Loan Institutions segment, amounting to $104.39 million.

Dividend Yield: 3.4%

Northeast Community Bancorp has consistently increased its dividends over the past decade, maintaining stability with a current yield of 3.4%. Despite earnings forecasted to decline by 3.4% annually over the next three years, its low payout ratio of 17.1% ensures dividend coverage by earnings. Recent announcements confirm a quarterly dividend of US$0.20 per share for August 2025, reflecting ongoing commitment to shareholder returns while trading at significant value below estimated fair value.

- Click to explore a detailed breakdown of our findings in Northeast Community Bancorp's dividend report.

- Our comprehensive valuation report raises the possibility that Northeast Community Bancorp is priced lower than what may be justified by its financials.

Virginia National Bankshares (VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $198.26 million, serves as the holding company for Virginia National Bank, offering a variety of commercial and retail banking products and services in Virginia.

Operations: Virginia National Bankshares Corporation generates its revenue primarily through its banking operations, contributing $54 million, and VNB Trust & Estate Services, which adds $0.95 million.

Dividend Yield: 3.8%

Virginia National Bankshares has a history of reliable and stable dividend payments, recently increasing its quarterly dividend to US$0.36 per share, marking a 9.1% rise from the previous quarter. The current yield is approximately 4.09%, slightly below top-tier US dividend payers but supported by a low payout ratio of 39.8%. Recent earnings growth supports this stability, with first-quarter net income rising to US$4.49 million from the previous year's US$3.65 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Virginia National Bankshares.

- Our valuation report unveils the possibility Virginia National Bankshares' shares may be trading at a discount.

Make It Happen

- Unlock our comprehensive list of 142 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives