- United States

- /

- Banks

- /

- NasdaqGS:UMBF

A Closer Look at UMB Financial’s (UMBF) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

UMB Financial (UMBF) stock has gained over 8% in the past 3 months, catching the attention of investors curious about the drivers behind this positive momentum. Despite the absence of headline news, these moves have prompted a closer look at how shares are valued at this time.

See our latest analysis for UMB Financial.

Momentum has definitely been building for UMB Financial, with shares climbing over the past quarter and the one-year total shareholder return now at a solid 16.7%. That long-term strength, combined with this recent uptick, has made the story more interesting for investors watching for signals of either growth potential or shifting risk perceptions.

If you’re curious to see which companies are also catching attention for their pace of growth, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given UMB Financial’s strong track record and a continued rise in share price, investors are left wondering whether the current valuation presents a rare opportunity to buy into further growth or if every bit of future upside is already reflected.

Most Popular Narrative: 12.9% Undervalued

UMB Financial’s most-followed narrative sees the fair value at $137.75, well above the last close of $119.99. This perspective is based on high conviction growth drivers and improved efficiency expectations in the years ahead.

The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This should materially improve operating leverage and expand net margins.

Curious what’s fueling the big price gap? The narrative is based on pivotal earnings catalysts, sharper margins, and a multi-year profit surge. Want to see which bold projections underpin this bullish view? Find out what could propel UMB’s value far beyond current levels.

Result: Fair Value of $137.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration risks and heavy regional exposure could still challenge UMB Financial's ability to fully deliver on bullish growth projections.

Find out about the key risks to this UMB Financial narrative.

Another View: A Look at Valuation Ratios

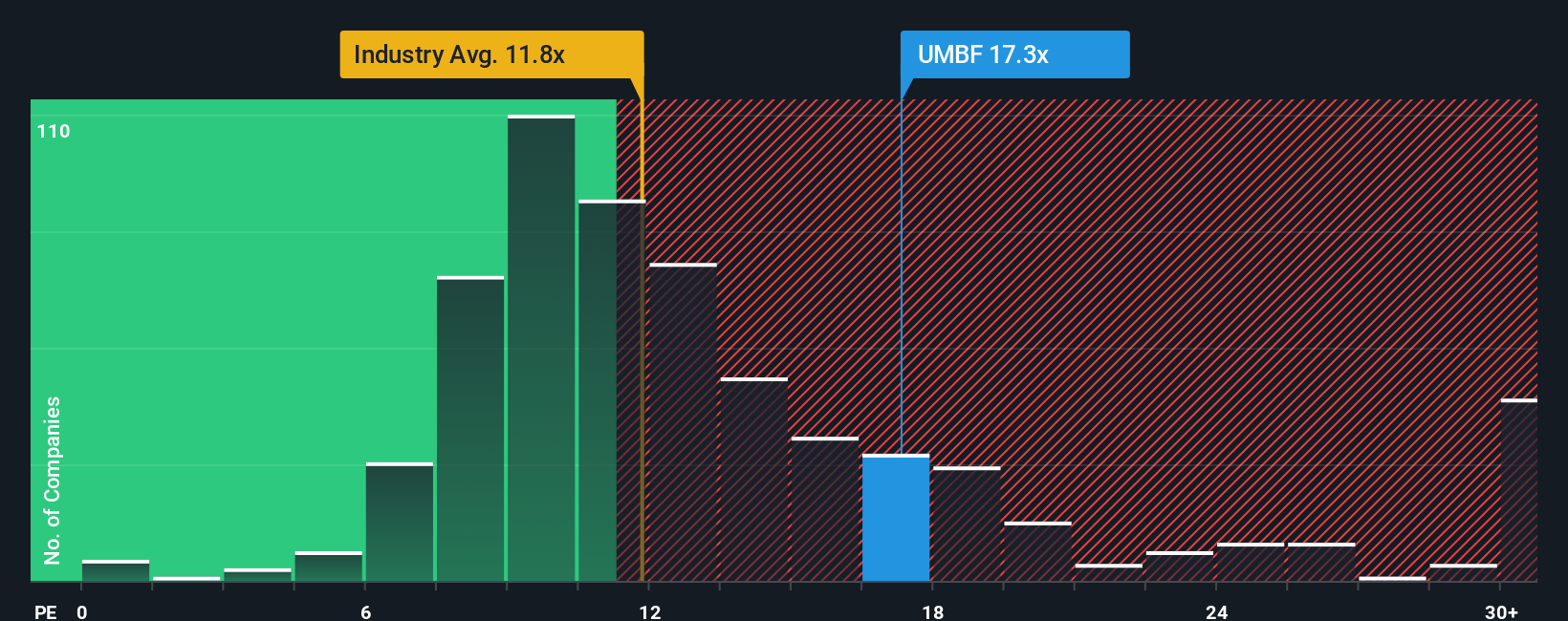

While some see UMB Financial as undervalued, a closer look at its price-to-earnings ratio tells a different story. At 17.4x, UMB Financial is trading higher than the US Banks industry average of 11.8x and peer average of 13.1x. It is also above its own fair ratio of 17x. This signals a potential valuation risk if future growth falls short. Do these higher ratios signal genuine strength, or could they limit further upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMB Financial Narrative

If you see things differently or want to dive into the details yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your UMB Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. Expand your portfolio and get ahead of the market with unique stock picks available through the Simply Wall Street Screener. Here are three powerful starting points:

- Accelerate your search for hidden market gems by checking out these 3573 penny stocks with strong financials offering strong financials and impressive growth stories.

- Secure steady income streams when you consider these 19 dividend stocks with yields > 3% featuring yields above 3% from companies with proven track records.

- Position yourself at the forefront of technology by selecting these 25 AI penny stocks making breakthroughs in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives