- United States

- /

- Banks

- /

- NasdaqGS:UBSI

Assessing United Bankshares (UBSI) Valuation After New Buyback and Dividend Increase

Reviewed by Simply Wall St

United Bankshares (UBSI) just unveiled a fresh buyback plan to repurchase up to 5 million shares, and the company is also increasing its quarterly dividend. These shareholder-focused decisions arrive as the company’s fundamentals show recent improvement.

See our latest analysis for United Bankshares.

Momentum is picking up for United Bankshares following the new buyback plan and dividend hike. The 30-day share price return of 5.1% suggests renewed optimism. However, with a 1-year total shareholder return of -9.5% and only a modest gain since the start of the year, investors appear cautiously encouraged by management's recent moves and are waiting to see if the longer-term story improves from here.

If announcements like these have you thinking bigger picture, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

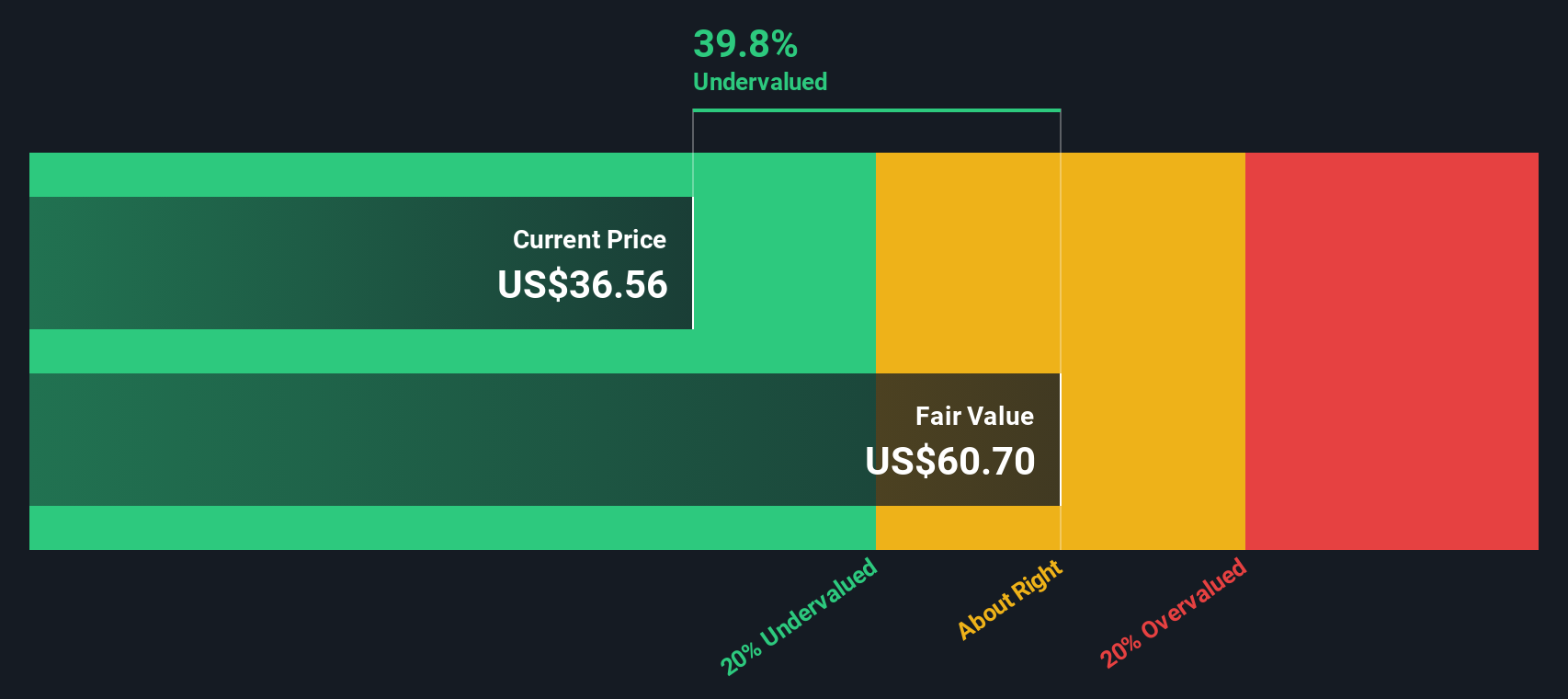

But with United Bankshares trading at a notable discount to its intrinsic value even after this recent momentum, is the market overlooking a potential bargain? Alternatively, have expectations for future growth already been priced in?

Price-to-Earnings of 12.2x: Is it justified?

United Bankshares trades at a price-to-earnings ratio of 12.2, just above the US Banks industry average of 11. This suggests the stock is priced at a premium compared to many direct peers, raising questions about whether this valuation is earned given the company's recent performance and outlook.

The price-to-earnings ratio compares the company’s share price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. For banks, it reflects not only current profitability but also expectations for future growth as well as confidence in the stability of those earnings.

At 12.2 times earnings, United Bankshares appears expensive relative to the broader sector. This may signal that the market values its consistent dividend and recent margin improvements, or it may reflect some uncertainty about how long these positives can continue. Compared to the estimated fair price-to-earnings ratio of 11.1, the current multiple stands above what might be expected based on its fundamentals, suggesting a potential for reversion toward sector norms.

Explore the SWS fair ratio for United Bankshares

Result: Price-to-Earnings of 12.2x (OVERVALUED)

However, persistent underperformance over one and three years, along with uncertainty around sustaining recent growth, could quickly shift market sentiment back to caution.

Find out about the key risks to this United Bankshares narrative.

Another View: SWS DCF Model Points to Deep Value

While the price-to-earnings ratio suggests United Bankshares could be expensive, our DCF model presents a very different perspective. According to its SWS DCF valuation, United Bankshares is trading at a substantial 36.7% discount to its estimated fair value of $58.82 per share. This notable gap suggests the market might be underestimating UBSI’s longer-term potential. The key question is which viewpoint will ultimately prove accurate.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United Bankshares Narrative

If you want to challenge this perspective or would rather dig into the numbers firsthand, it takes less than three minutes to build your own view, so why not Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Bankshares.

Looking for more investment ideas?

Give yourself the edge by expanding your watchlist and seizing opportunities with handpicked stock screens focused on today’s hottest investment trends and sectors.

- Tap into untapped growth by checking out these 3604 penny stocks with strong financials offering surprising financial strength despite their affordable share prices.

- Ride the wave of innovation and shape your portfolio with these 25 AI penny stocks powering breakthroughs in artificial intelligence.

- Boost your income stream with these 17 dividend stocks with yields > 3% that consistently pay attractive dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UBSI

United Bankshares

Through its subsidiaries, provides commercial and retail banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives