- United States

- /

- Banks

- /

- NasdaqGS:TRST

TrustCo Bank (TRST) Margin Expansion Challenges Muted Growth Narrative

Reviewed by Simply Wall St

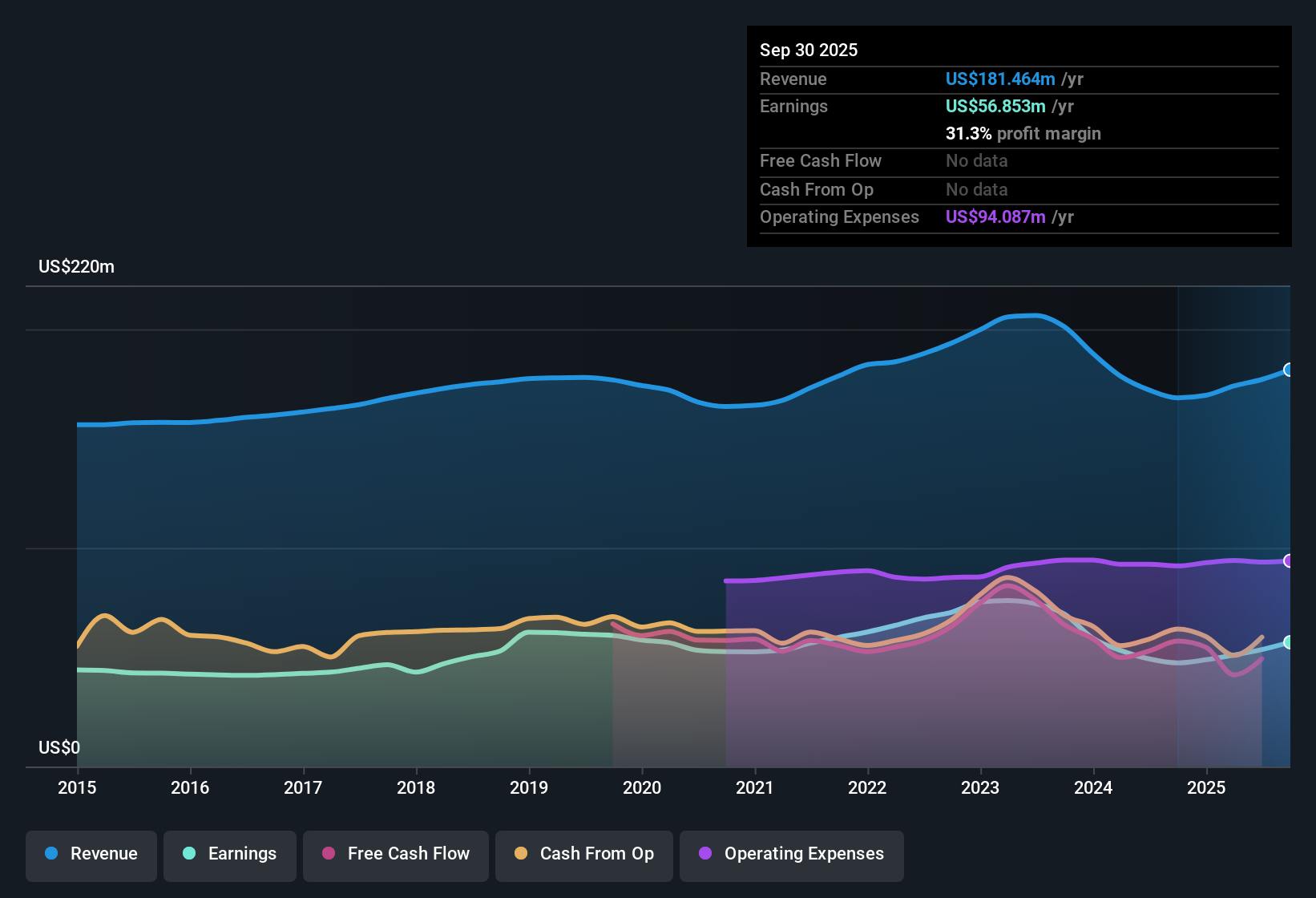

TrustCo Bank Corp NY (TRST) posted a net profit margin of 31.3%, up from 28.1% a year earlier, and delivered annual earnings growth of 19.9% despite a prior five-year average decline of 2% per year. Shares currently trade at $36.92, well below an estimated fair value of $52.42. TRST carries a P/E ratio of 12.2x, which is above both its peer group and the broader US Banks sector. Margin expansion and high-quality past earnings offer positive momentum for investors, even as risks around muted future growth and a relatively premium valuation temper the outlook.

See our full analysis for TrustCo Bank Corp NY.Next, we will see how these headline figures hold up when put side by side with the prevailing narratives followed by analysts and investors alike.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Backs Dividend Strength

- Net profit margin improved to 31.3%, marking a clear jump from the previous 28.1%. This signals ongoing profitability discipline.

- Recent margin growth heavily supports the case that TRST’s robust profitability underpins its attractive dividend profile, as highlighted:

- Margin improvement aligns with the view that the bank’s steady track record of profit expansion delivers confidence to income-focused investors.

- Compared to the average annual decline of 2% over five years, this year’s improved margin reinforces diligence in cost and lending controls. This adds credibility to the reward of a stable dividend payout.

No Growth Ahead Clouds Upside

- The EDGAR summary signals that analysts do not expect revenue or earnings to grow in the foreseeable future. This raises a material concern for forward returns despite the recent turnaround.

- This absence of anticipated growth creates tension for investors who see TRST as a reliable performer, but must weigh:

- Muted growth prospects against otherwise solid fundamentals, since high past earnings quality alone cannot offset a flatlining outlook.

- The risk that premium valuation may become harder to justify if the lack of growth persists beyond the current year’s improvement.

Premium P/E Ratio vs Peers, But Trades Below DCF Fair Value

- TRST’s P/E ratio stands at 12.2x, above the peer group (10.5x) and US Banks sector average (11.2x). The share price of $36.92 remains at a sizable discount to its DCF fair value of $52.42.

- Investors face a valuation dilemma:

- The market is assigning a premium on quality and earnings improvement, but the stock still trades well below modeled fair value by discounted cash flow. This creates a disconnect between headline multiples and intrinsic value.

- Analysts point out that, while premium multiples can limit near-term upside if sector sentiment softens, current pricing does offer a potential margin of safety when considering the DCF-based fair value gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TrustCo Bank Corp NY's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite recent profitability gains, TrustCo’s growth outlook remains muted. Analysts forecast flat revenues with limited prospects for meaningful earnings expansion.

If sustained growth matters more to you, target stable growth stocks screener (2093 results) and filter for companies delivering reliable gains year in and year out, whatever the cycle brings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TrustCo Bank Corp NY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRST

TrustCo Bank Corp NY

Operates as the holding company for Trustco Bank that provides personal and business banking services to individuals and businesses.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives