- United States

- /

- Banks

- /

- NasdaqGS:TOWN

Should You Reconsider TowneBank After Shares Fall Nearly 10% This Month?

Reviewed by Bailey Pemberton

If you’ve had TowneBank on your watchlist lately, you’re probably wondering if it’s time to make a move, sit tight, or steer clear until calmer waters return. After a stellar long-term run that saw shares gain more than 110% over the past five years, things have taken a choppier turn in the short run. The stock has lost 5.7% in the last week alone, down nearly 9.5% over the past month, and is modestly negative year-to-date. Still, when you zoom out, even with a slight dip of 2.0% over the past year, that multi-year strength is hard to ignore.

Some of the recent volatility ties back to broader shifts in the market. Investors have been recalibrating their risk appetite, leading to swings in financial stocks like TowneBank. Even in the face of these jitters, loyal shareholders remember the kind of compounding performance this bank has delivered before, and new investors are starting to debate if these discounted prices signal renewed opportunity or simply reflect new uncertainties.

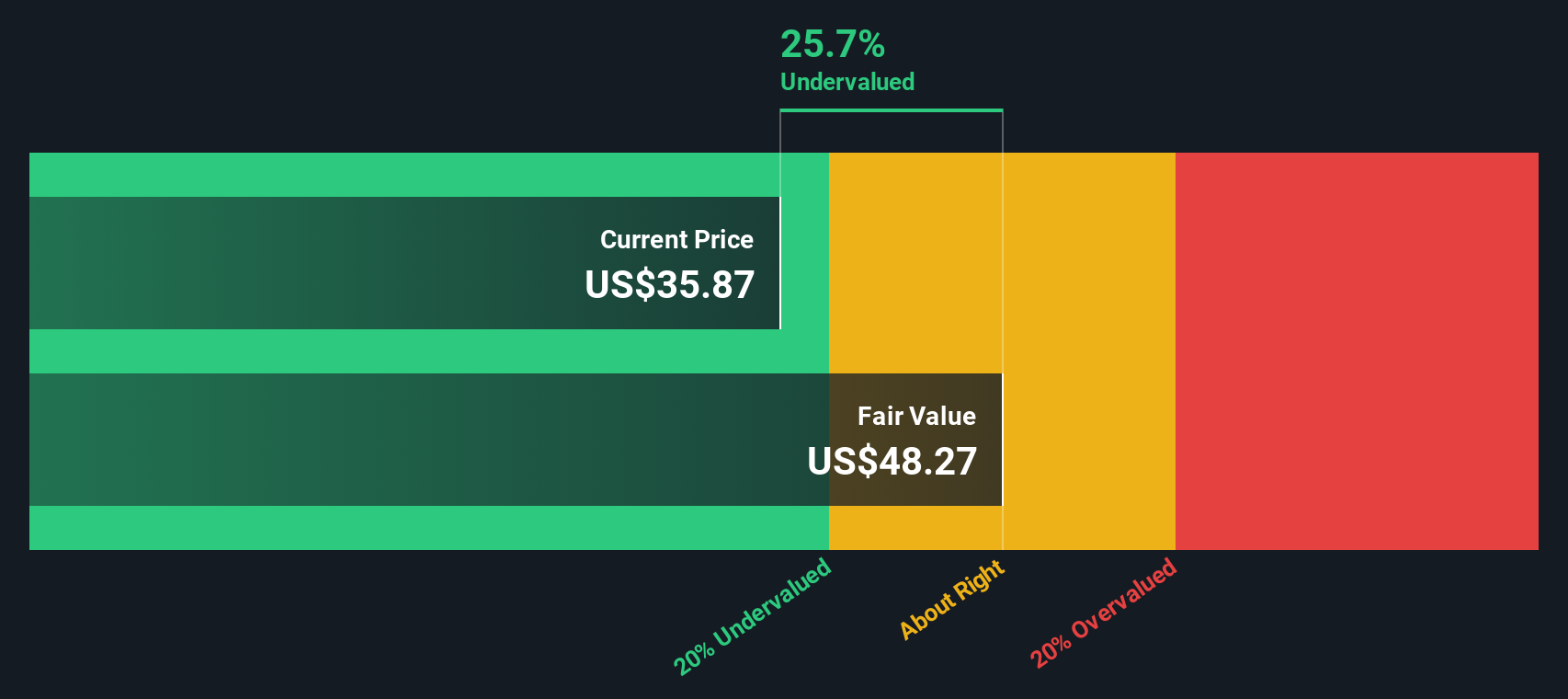

Of course, before rushing in, it’s smart to look beneath the surface, especially at valuation. Using a set of six common valuation checks, TowneBank scores a 4, which means it comes out as undervalued in four areas. That’s enough to catch the eye of savvy investors, though it raises as many questions as it answers.

So how do these different valuation measures stack up, and which ones should you trust the most? Let’s break down the main methods for assessing what TowneBank is really worth, and stick around for a more insightful way to think about valuation altogether.

Why TowneBank is lagging behind its peers

Approach 1: TowneBank Excess Returns Analysis

The Excess Returns model examines how efficiently a company generates profits above its cost of equity, providing insight into the true value created for shareholders over time. This approach assesses the value TowneBank produces relative to the capital its investors have put at risk.

For TowneBank, the numbers tell a compelling story. The company's Book Value currently stands at $30.03 per share, while the Stable Earnings Per Share (EPS) is projected at $3.33 (drawn from future Return on Equity forecasts by four analysts). Factoring in a Cost of Equity of $2.22 per share, this results in an Excess Return of $1.12 per share, highlighting TowneBank's ability to consistently generate returns above what shareholders require. The bank also maintains an impressive average Return on Equity of 10.18%, with its Stable Book Value expected to reach $32.76 per share in the coming years.

According to this model, TowneBank’s estimated intrinsic value is $62.93 per share. Based on current prices, the stock is trading at a significant 48.4% discount to its intrinsic worth. This suggests investors may be overlooking the company’s ability to deliver value far above its cost of capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests TowneBank is undervalued by 48.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

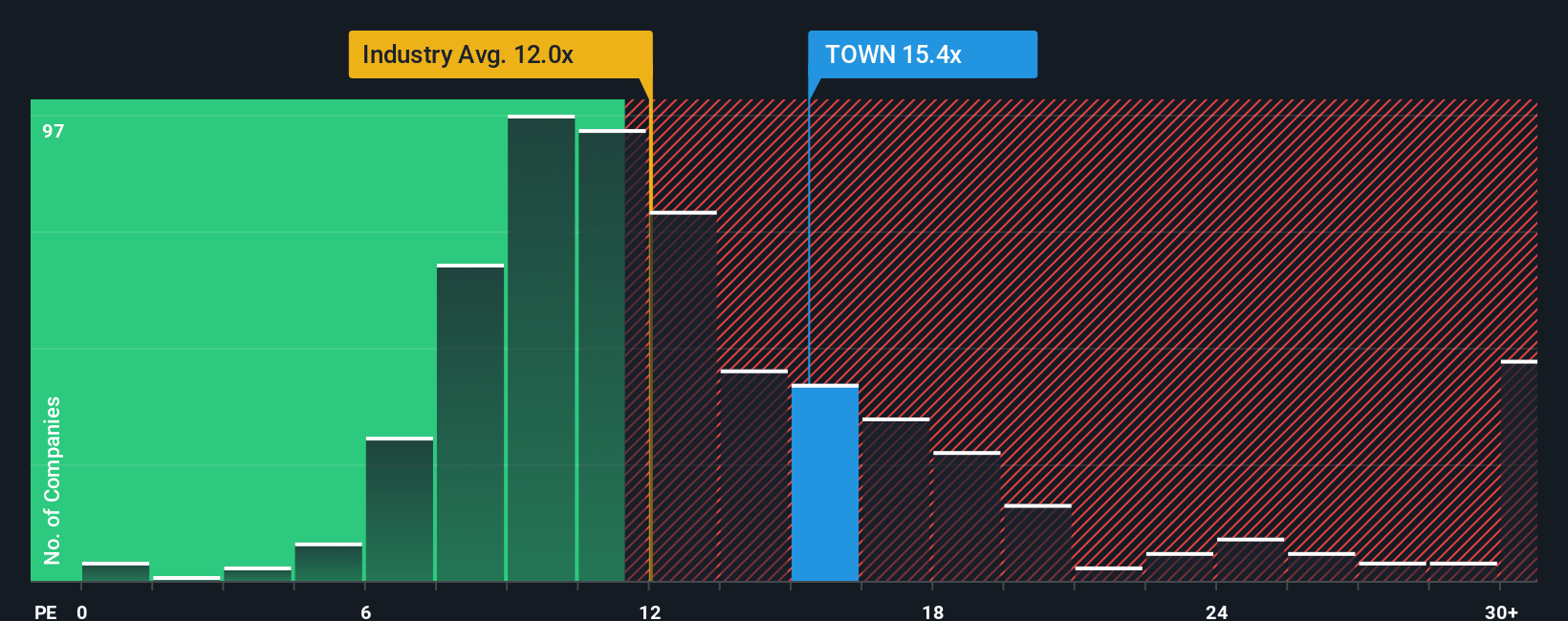

Approach 2: TowneBank Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies like TowneBank because it directly ties a company’s stock price to its actual earnings performance. When a business generates steady profits, the PE ratio offers a straightforward way to gauge how much investors are willing to pay for each dollar of earnings.

"Fair" PE ratios are shaped by a mix of factors, including growth expectations and perceived risk. Companies with brighter growth prospects or more stable earnings can command higher PE multiples, while those in slower growth or riskier environments tend to trade at lower ones.

TowneBank is currently trading at a PE ratio of 15.0x. This sits above the Banks industry average of 11.3x and the peer average of 11.9x. To get a truer sense of value, Simply Wall St’s proprietary "Fair Ratio" builds in TowneBank’s individual characteristics, such as earnings growth, industry context, profit margins, company size, and risk factors. This yields a tailored fair PE ratio of 17.2x. Unlike simple peer or industry comparisons, the Fair Ratio looks at the whole picture to provide a more meaningful benchmark.

Comparing TowneBank’s actual PE (15.0x) to its Fair Ratio (17.2x), the stock currently trades at a discount to its fair multiple, suggesting undervaluation in the context of its potential and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

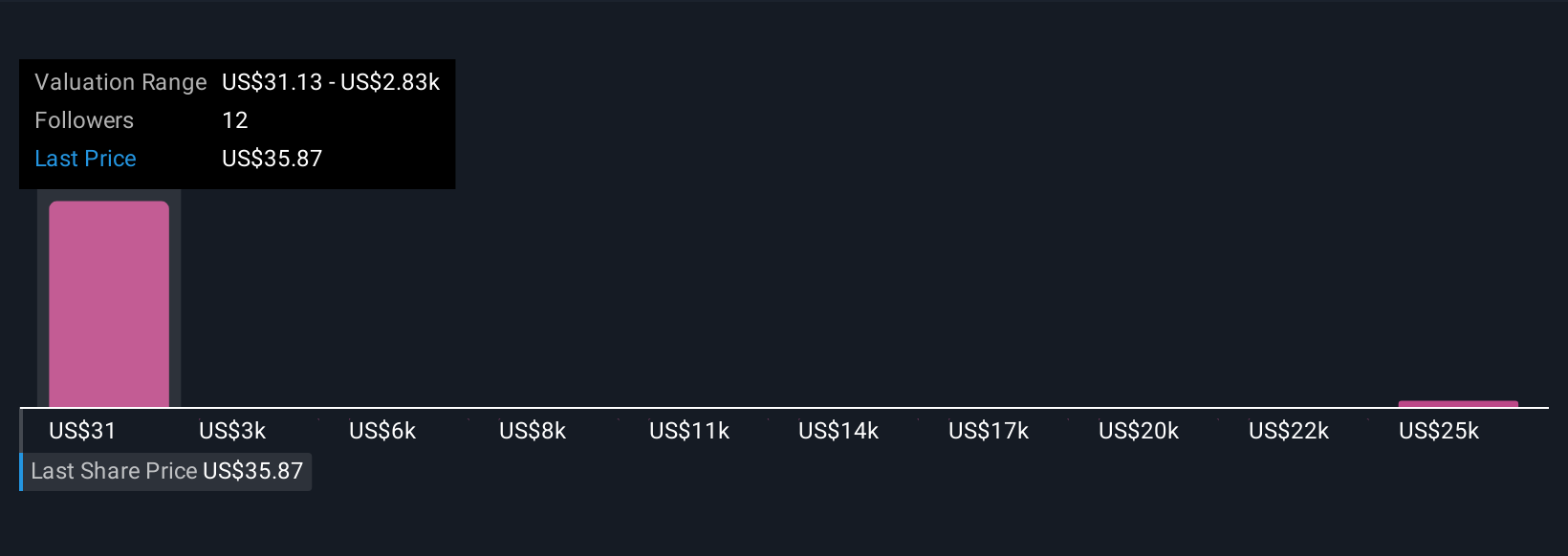

Upgrade Your Decision Making: Choose your TowneBank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you tell the story behind the numbers, bringing together your perspective on a company’s fair value, future revenue growth, earnings, and margins. This approach connects TowneBank’s story to your financial forecast and then directly to a calculated fair value.

These Narratives are accessible and easy to use right on Simply Wall St’s Community page, where millions of investors share and refine their views. By comparing fair value estimates from Narratives to the current stock price, you can quickly see if today is the right time to buy or sell. As new information like news or earnings is released, Narratives update in real time, ensuring your outlook always reflects the latest developments.

For example, with TowneBank, some investors in the Community see significant upside based on projected growth, while others set more conservative fair values based on slower profit outlooks. Narratives make it simple to track these different perspectives and empower you to act confidently on your own view.

Do you think there's more to the story for TowneBank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives