- United States

- /

- Banks

- /

- NasdaqGS:TFSL

TFS Financial (TFSL): Valuation Check After Record Earnings and 14% Revenue Growth

Reviewed by Simply Wall St

TFS Financial (TFSL) just wrapped up a strong Q3, with revenue up 14% year on year and record annual earnings that met expectations, giving investors fresh insight into its mortgage driven growth story.

See our latest analysis for TFS Financial.

Investors have been steadily warming to that story. The share price is now at $14.31 after a solid year-to-date share price return of 15.31 percent and a 1-year total shareholder return of 22.84 percent, suggesting momentum is quietly building rather than fading.

If this kind of steady banking performance appeals, it could be worth exploring fast growing stocks with high insider ownership for other financially solid names that might be earlier in their growth story.

But with the share price hovering near analyst targets after record earnings, is TFS Financial still flying under the radar for value focused investors, or is the market already pricing in the next leg of its mortgage led growth?

Price to Earnings of 44.6x, is it justified?

TFS Financial trades at $14.31, a level that equates to a 44.6 times price to earnings multiple, far richer than typical bank peers and broader market benchmarks.

The price to earnings ratio compares the current share price to per share earnings. It captures how much investors are willing to pay for each dollar of profit in a steady, regulated sector like US retail banking.

With TFSL's multiple standing at 44.6 times versus a peer average of 14.9 times and an estimated fair price to earnings of 11.6 times, the market appears to be paying a premium that implies either sustained profit momentum or a structurally safer earnings profile than the numbers alone suggest.

That premium looks even more stretched against the wider US banks industry, where the average price to earnings ratio is just 11.9 times. This reinforces the sense that TFSL now sits in a significantly higher expectations bracket than its sector rivals and may have further to fall if sentiment normalises toward the estimated fair ratio level.

Explore the SWS fair ratio for TFS Financial

Result: Price to Earnings of 44.6x (OVERVALUED)

However, risks remain, including a potential pullback if earnings growth slows or if higher funding costs start to squeeze its mortgage focused margins.

Find out about the key risks to this TFS Financial narrative.

Another View, What Does Our DCF Say?

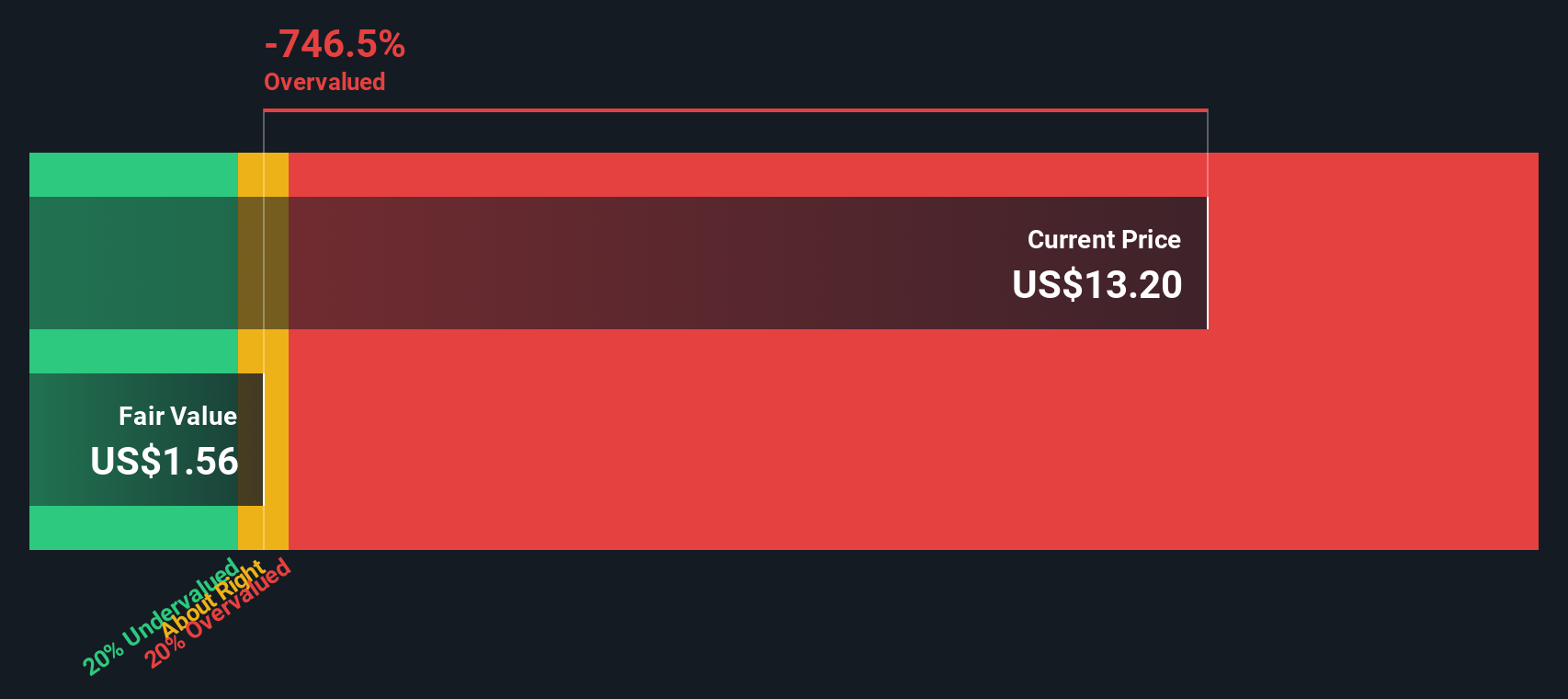

Our DCF model paints an even starker picture, suggesting fair value closer to $1.39, which makes the current $14.31 share price look heavily overvalued. If both earnings multiples and cash flow estimates are this stretched, how much room is left for mistakes?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TFS Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TFS Financial Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can quickly build a personalised view in just a few minutes: Do it your way.

A great starting point for your TFS Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Take the momentum from your TFS Financial research and put it to work by hunting for fresh opportunities with the Simply Wall Street Screener before the crowd catches on.

- Capture early stage potential by targeting quality businesses trading at compelling valuations through these 910 undervalued stocks based on cash flows before sentiment fully turns in their favor.

- Ride powerful megatrends by focusing on innovation leaders in automation and machine learning using these 24 AI penny stocks while they are still building long runways for growth.

- Lock in dependable income streams by filtering for consistent payers and robust payout histories with these 12 dividend stocks with yields > 3% before yields compress and prices move higher.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion