- United States

- /

- Banks

- /

- NasdaqGS:TFSL

How Investors May Respond To TFS Financial (TFSL) Affirming Dividend Amid Capital Stability Focus

Reviewed by Sasha Jovanovic

- On November 20, 2025, TFS Financial Corporation announced that its Board of Directors declared a quarterly cash dividend of $0.2825 per share, set to be paid on December 16 to shareholders of record on December 2.

- This dividend affirmation, paired with ongoing waivers by its mutual holding company, strengthened coverage for minority shareholders and reinforced TFS Financial's capital stability during ongoing sector challenges.

- We’ll explore how TFS Financial’s reliable dividend policy shapes its investment narrative amid evolving interest rate expectations.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is TFS Financial's Investment Narrative?

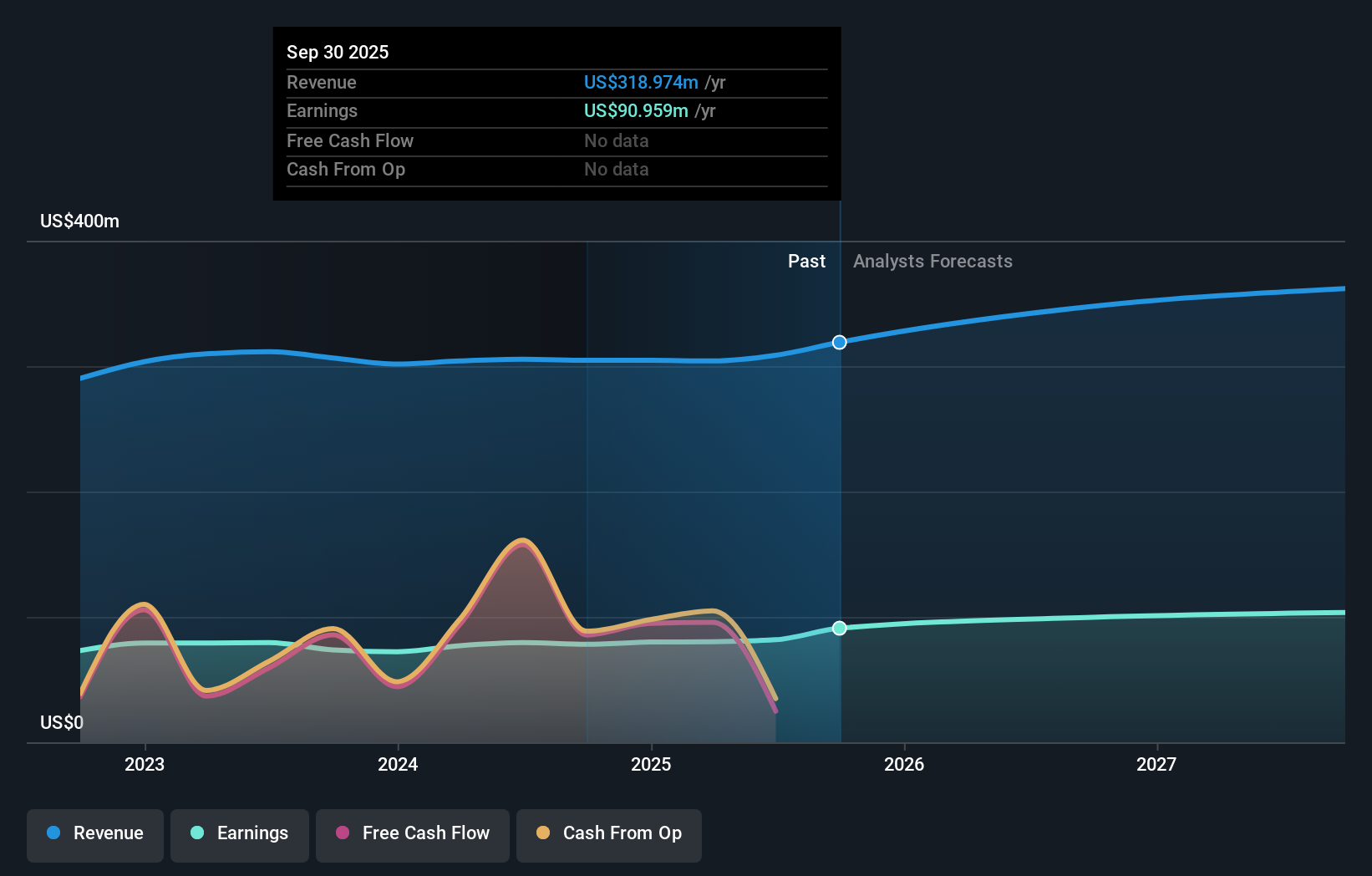

Anyone interested in TFS Financial right now needs to believe in the appeal of consistent income, solid capital ratios, and resilience through sector headwinds, not rapid growth or deep value. The company’s steady dividend policy, reaffirmed by the November announcement, reinforces a narrative of stability, even as the sector faces uncertainty around interest rates and credit quality. The recent positive price reaction, driven by optimism about potential near-term central bank rate cuts, adds some support to the investment case by easing immediate pressure on net interest income and funding costs. However, this does little to address longer-term concerns such as elevated valuations, relatively low return on equity, or the ongoing risk tied to commercial real estate exposure. The dividend is generous, but sustainability questions remain given current earnings growth rates and coverage metrics. For now, the latest news speaks to reliability rather than any fundamental shift in risk or catalysts, the core questions for investors persist.

But valuation risk isn’t going away just because rates might move lower. TFS Financial's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on TFS Financial - why the stock might be worth as much as $13.59!

Build Your Own TFS Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFS Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TFS Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFS Financial's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives