- United States

- /

- Banks

- /

- NasdaqGS:TFSL

Does Rising Profitability and Buybacks Reinforce Long-Term Value Creation at TFS Financial (TFSL)?

Reviewed by Sasha Jovanovic

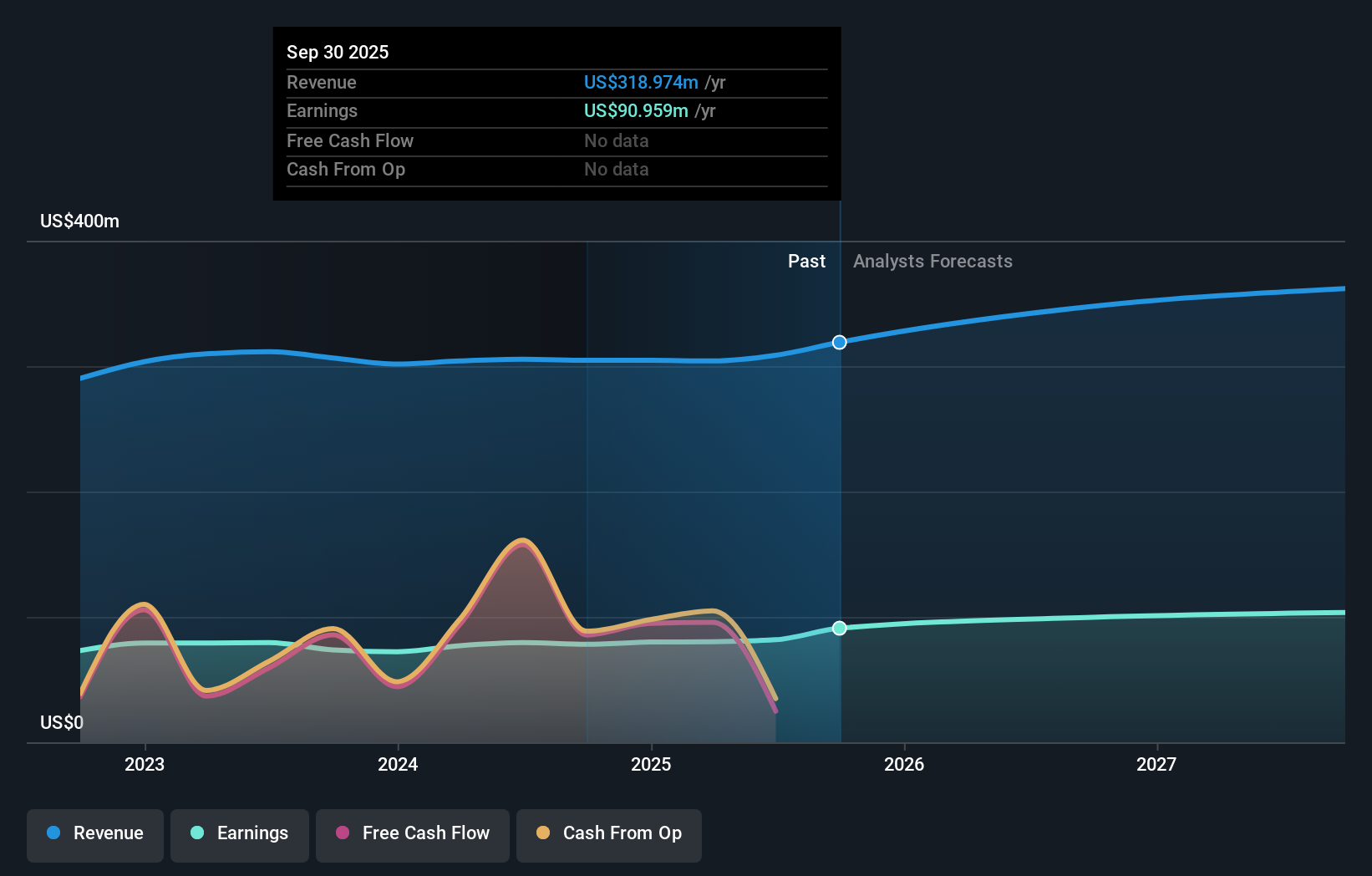

- TFS Financial Corporation recently reported fourth quarter and full-year earnings for the period ended September 30, 2025, with net interest income rising to US$77.32 million and net income reaching US$26 million for the quarter, both up from the previous year.

- In addition to improved profitability, the company highlighted progress on its share repurchase program, signaling ongoing commitment to return value to shareholders.

- With a strong increase in both net interest income and net income, we’ll consider how these results impact TFS Financial’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is TFS Financial's Investment Narrative?

To be a shareholder in TFS Financial, you generally have to believe in its steady, dividend-focused business model despite sector underperformance and a premium valuation to peers. The recent jump in net interest income and net income reinforces confidence in the bank’s earnings quality and management’s intent to reward shareholders, backed by ongoing share repurchases. While these developments improve the short-term outlook and may temper concerns about sluggish revenue and profit growth versus broader markets, key challenges remain: the stock’s high price-to-earnings ratio outpaces industry benchmarks, and its generous dividend is not fully covered by earnings or projected to be sustainable long term. Additionally, new executive leadership and recent insider selling might prompt some to question the stability of future performance. For the moment, improved quarterly and annual results may act as a positive catalyst, but they do little to resolve bigger questions around valuation, sustainable payout, and growth relative to sector peers.

However, that eye-catching dividend is not without its potential pitfalls for shareholders.

Exploring Other Perspectives

Explore 3 other fair value estimates on TFS Financial - why the stock might be worth as much as $13.59!

Build Your Own TFS Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFS Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TFS Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFS Financial's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives