- United States

- /

- Banks

- /

- NasdaqGS:TCBK

How Rising Net Interest Income and Charge-Offs at TriCo Bancshares (TCBK) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

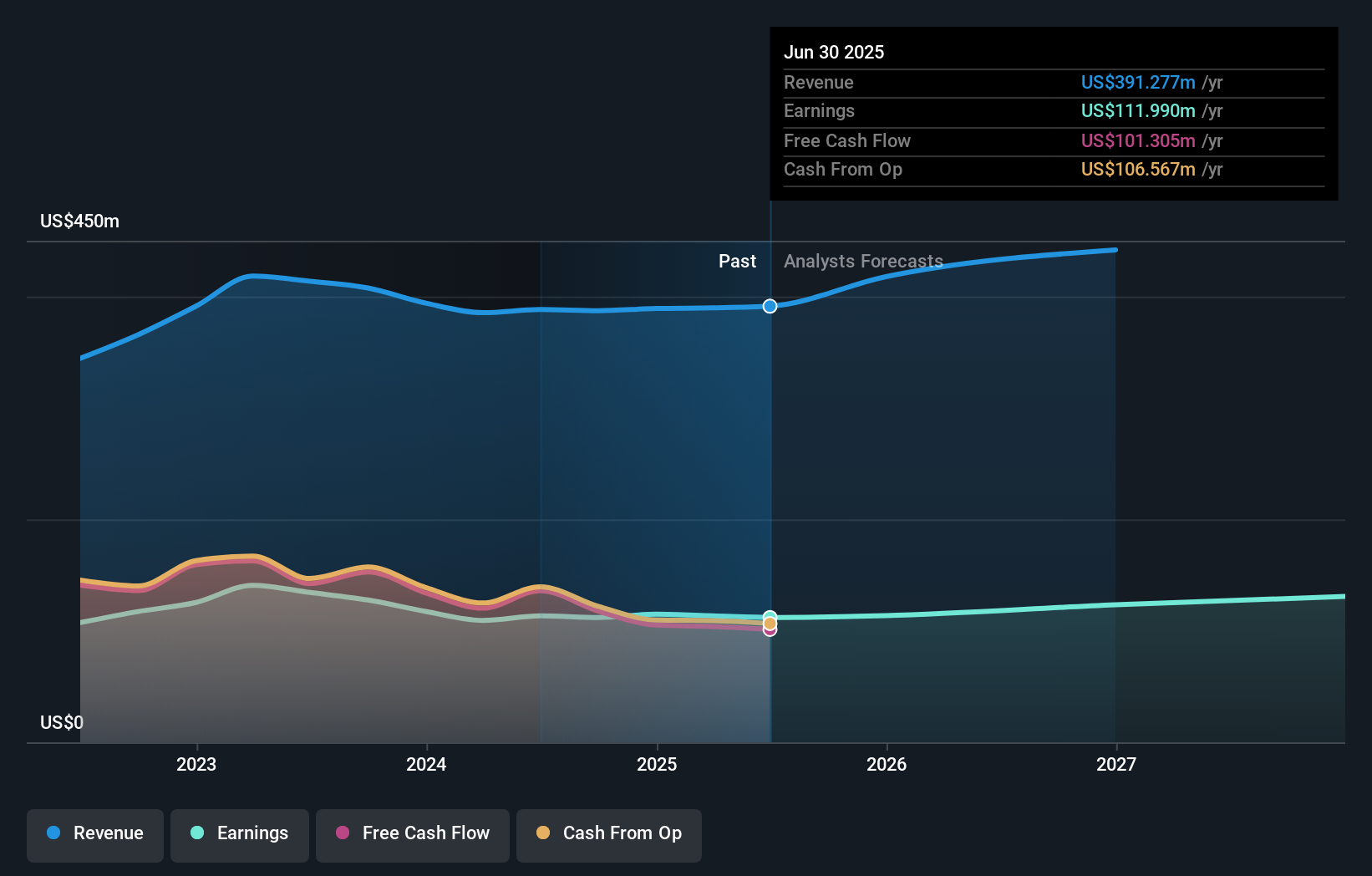

- TriCo Bancshares recently announced its third quarter 2025 results, reporting net interest income of US$89.56 million and net income of US$34.02 million, both higher than the same period last year, while net charge-offs rose to US$737,000 from US$444,000 a year ago.

- This simultaneous increase in both earnings and loan charge-offs highlights the company’s ability to grow profitability amid a period of increased credit costs.

- We'll now explore how TriCo Bancshares’ higher net interest income shapes its investment narrative despite an uptick in charge-offs.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is TriCo Bancshares' Investment Narrative?

Owning a stake in TriCo Bancshares means believing in the bank's steady performance and its ability to grow value through disciplined lending and a consistent, growing dividend. The most recent quarter showed higher net interest income and net income, despite a noticeable rise in loan charge-offs. So far, the scale of charge-offs remains modest relative to overall profitability and hasn’t caused alarm in the market, with the share price only edging down slightly in the days after the announcement. The key catalysts ahead remain stable or improving net interest margins, prudent cost management, and solid dividend payments. However, the upward tick in credit losses does sharpen focus on credit quality and the risk of further increases if economic conditions weaken. The current news signals vigilance is warranted on asset quality, though it does not fundamentally alter the short-term investment story for now.

But higher charge-offs could be an early sign of changing credit conditions worth paying attention to.

Exploring Other Perspectives

Explore 2 other fair value estimates on TriCo Bancshares - why the stock might be worth as much as 14% more than the current price!

Build Your Own TriCo Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriCo Bancshares research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TriCo Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriCo Bancshares' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives