- United States

- /

- Banks

- /

- NasdaqGS:TCBI

What Texas Capital Bancshares (TCBI)'s Healthcare Loan Buy and Tech Upgrades Mean for Shareholders

Reviewed by Simply Wall St

- In recent days, Texas Capital Bancshares has advanced its strategy by acquiring a healthcare loan portfolio and investing in technology upgrades, moves that coincide with widespread anticipation of the Federal Reserve's first interest rate cut of the year. These actions are positioned to support enhanced efficiency, revenue diversification, and potentially expand lending opportunities for the bank as monetary policy shifts.

- Analysts note that such proactive initiatives, combined with broader market trends, may reinforce the bank's approach to building resilient earnings streams and achieving operational efficiencies in a competitive sector.

- We will examine how the expected interest rate cut and the healthcare loan portfolio acquisition could shift Texas Capital Bancshares' investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Texas Capital Bancshares Investment Narrative Recap

Being a shareholder in Texas Capital Bancshares means believing in the company’s ability to capitalize on Texas’s economic tailwinds, commercial loan growth, and digital platform investments, while balancing the potential volatility from interest rate changes. The anticipated Federal Reserve rate cut may serve as a short-term catalyst by supporting net interest income, though lending profitability remains closely tied to market cycles; the most pressing risk is the bank’s geographic concentration within Texas, which leaves it exposed to localized downturns. Overall, the disruption to catalysts or risks from the recent news appears moderate at this stage.

The acquisition of a healthcare loan portfolio stands out as particularly relevant following the rate cut expectations, given that it directly relates to revenue diversification and lending growth. As Texas Capital expands into healthcare financing, this move aligns with broader efforts to buffer earnings against interest margin swings and foster resilience amid rapidly changing market conditions.

Conversely, investors should be aware that geographic concentration in Texas means recurring credit and economic shocks in the state could ...

Read the full narrative on Texas Capital Bancshares (it's free!)

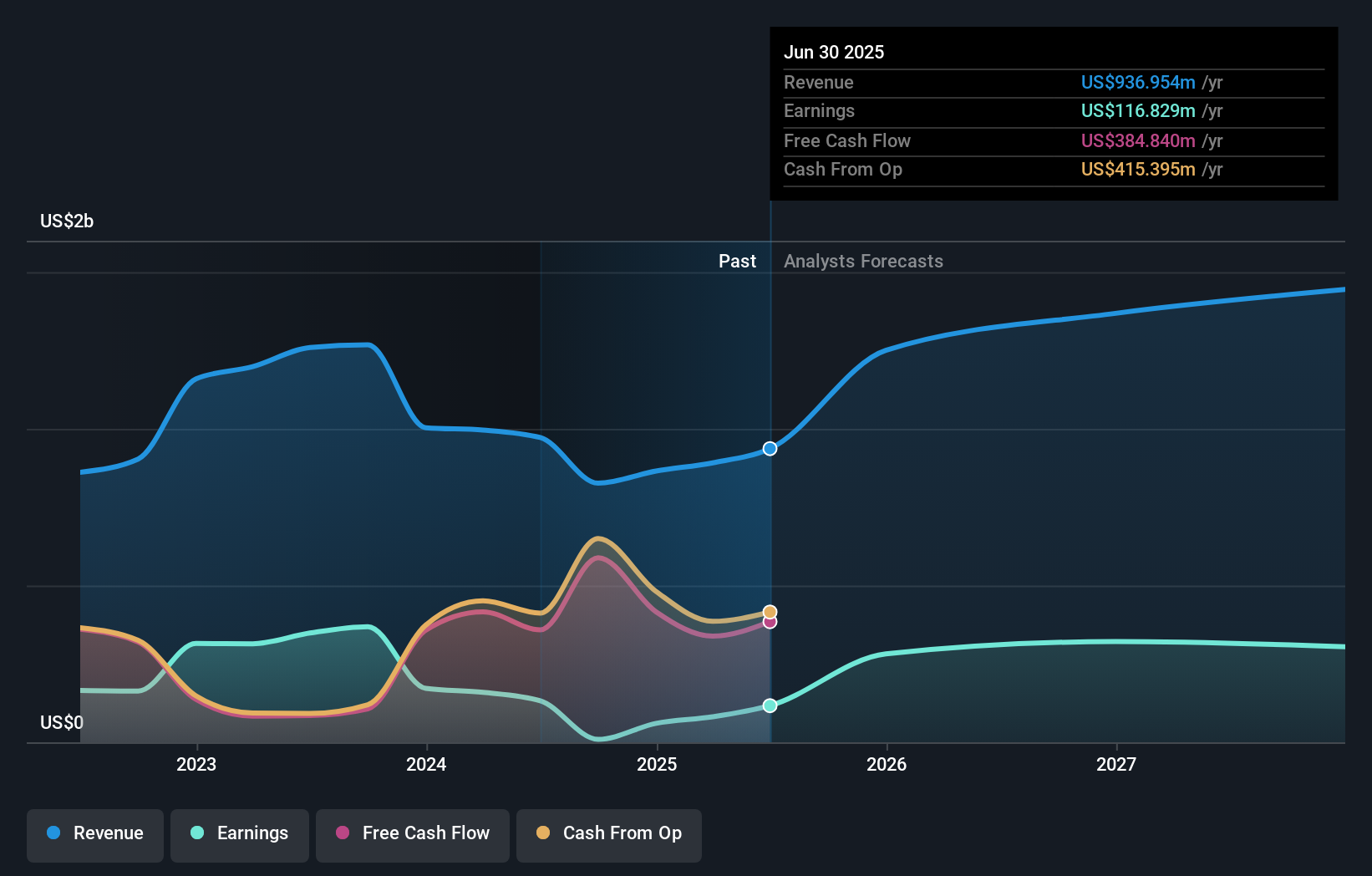

Texas Capital Bancshares' outlook points to $1.6 billion in revenue and $438.9 million in earnings by 2028. This is based on an expected 20.6% annual revenue growth rate and a $322.1 million increase in earnings from the current $116.8 million.

Uncover how Texas Capital Bancshares' forecasts yield a $92.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted one fair value estimate for Texas Capital Bancshares at US$92, showing a single-point perspective rather than a broad range. While some anticipate lending growth from interest rate relief, others may see the limited geographic footprint as a bigger factor for future stability, explore a variety of views to inform your approach.

Explore another fair value estimate on Texas Capital Bancshares - why the stock might be worth as much as 6% more than the current price!

Build Your Own Texas Capital Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Capital Bancshares research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Texas Capital Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Capital Bancshares' overall financial health at a glance.

No Opportunity In Texas Capital Bancshares?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives